If you’re an American taxpayer, the IRS has a file on you. The IRS tracks tax payments, income, deductions, and other important tax information. If you ever find yourself in need of this information, you can ask the IRS to send you a tax transcript that details all the information they have on file. If you’re applying for a mortgage, student loan, or starting a new business venture, you will likely need to present a tax transcript at some point during the application process. However, it’s good to keep your tax transcripts on file even if you don’t immediately need them. These reports can help you defend yourself if you’re ever audited, and they’re a useful reference for tax planning.

The IRS revamped its website a few years ago, and now it’s easier than ever to get your IRS transcript online. However, you need to know what you need to get started, so let’s start with the basics. What exactly is an IRS tax transcript?

What is a Tax Transcript?

Tax transcripts are IRS documents that provide details about your recent income and tax activity. Oftentimes, taxpayers use these documents as a reference for calculating their taxes. Sometimes, you need to present a recent tax transcript to apply for a loan or mortgage. These documents come directly for the IRS, so they hold a lot of weight with lenders and other interested parties.

There are several different types of transcripts, and each one focuses on different areas of your tax data. Before you request your tax transcript, you need to know which type of

Types of IRS Transcripts

There are several types of IRS transcripts, and each one lists different types of tax information.

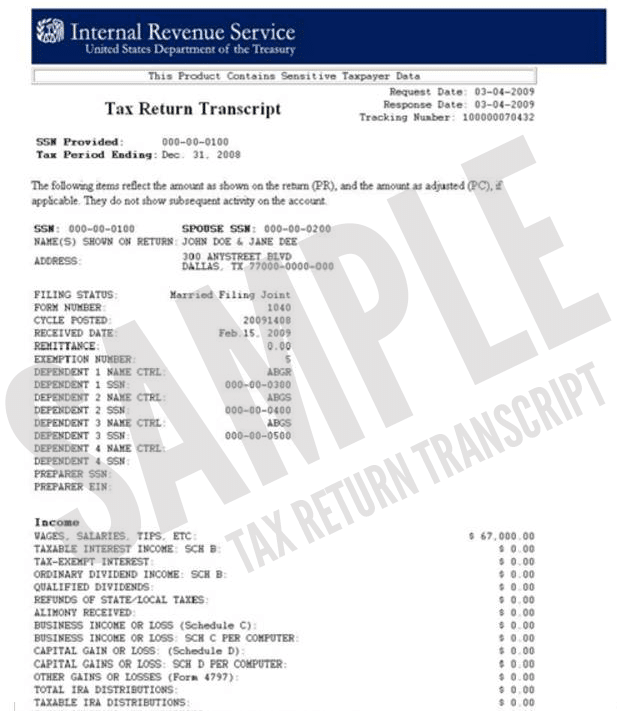

Tax Return Transcript

This report summarizes your filed tax returns. It includes an account of every tax form you’ve filed. However, the report won’t reflect any changes that were made after the return was filed. Click here to see our detailed post on tax return transcripts

Tax Account Transcript

This report provides an overview of your IRS account. It lists your marital status and the type of return you filed. Plus, it has an account of your adjusted gross and taxable income. This report will also show changes that were made after the tax return was filed.

Wage and Income Transcript

This transcript includes a record of all the income that the IRS has on file. It includes reported W2’s, 1099’s, and 1098’s.

How to Obtain IRS tax transcripts

It’s easy to get your IRS tax transcript. You can obtain reports going back as far as three years. All transcripts are free, and you have several options for requesting a copy. The IRS2Go mobile app allows users to easily access their tax transcripts. If the IRS can verify your identity online, you can instantly access your transcripts through IRS2Go or the Get Transcript feature on IRS.com.

Unfortunately, you have to request a transcript by mail if you can’t prove your identity online. You can request a tax transcript by mail using the IRS website and mobile app too. However, if you’re not technically inclined, you can request a tax transcript the old fashioned way using an IRS form. You can use Form 4506-T to request your tax return transcript through the mail.

You can also use your phone to request your IRS tax transcripts. The IRS has a toll-free phone line that handles these requests, and you can call it at +1-800-908-9946.

If you order your transcript online or via phone, it typically takes about 15 days to arrive. It can take up to 30 days to receive a transcript with a mailed request.

Reviewing Before the End of the Year

You should always review your IRS tax transcript at the end of the fiscal year to ensure your numbers line up. This information can help you ensure that your tax filings are correct. Sometimes, you can even find information that will help you reduce your tax bill. If you’re unfamiliar with proper tax planning procedures, you should speak to a professional. A tax advisor can help you review your tax transcript and ensure that your filings match up with the data the IRS has on file. This can help you avoid the mistake that could result in expensive IRS penalties. Plus, a certified tax pro can help you find every available discount so you can minimize your tax bill.

Shared Economy Tax specializes in taxes for self-employed workers and small business owners, and we’d be happy to take a look at your IRS tax transcripts. Our experienced team has been serving the Sharing Economy community for years, so we can provide detailed insights that other firms just can’t match. Get started today with a free one-on-one strategy session with a certified tax pro from Shared Economy Tax. You can also sign up for our free newsletter using the form below.