Financial statements are at the heart of every business. They enable you to keep track of your expenses and make decisions about your business’s future. But having accurate books starts with having good data to work with, which is why bookkeeping is an essential function for any business. Allow us to show you the best monthly bookkeeping services for 2023.

Though you may initially be hesitant to outsource this important function, outsourcing bookkeeping tasks to professional services can save time and improve accuracy. We will provide an overview of the best monthly bookkeeping services for 2023, highlighting their features, benefits, and customer reviews.

Criteria for Evaluating Bookkeeping Services

There are several key factors you should consider when evaluating bookkeeping services.

Expertise and Qualifications: Consider the expertise and qualifications of the bookkeeping service provider. You should look for professionals with relevant experience and certifications in bookkeeping or accounting. Their expertise ensures accurate financial record-keeping and compliance with regulations.

Range of Services Offered: Evaluate the range of services the bookkeeping service provides. Besides basic tasks like recording transactions and preparing financial statements, check if they offer additional services such as payroll processing, tax preparation, or financial analysis. Having multiple services through a single provider can simplify your accounting process.

Technology and Software Integration: Assess the technology and software used by the bookkeeping service. Look for providers that utilize modern accounting software, such as QuickBooks, Xero, or Wave. Integration with these tools streamlines processes improves accuracy, and enables seamless collaboration with your team.

Customer Reviews and Testimonials: Read customer reviews and testimonials to gauge the reputation and reliability of the bookkeeping service. Feedback from existing or previous clients provides insight into professionalism, responsiveness, and overall satisfaction.

Pricing and Value for Money: Consider the pricing structure of different bookkeeping services and assess the value they offer. Compare the pricing packages and what is included in each plan. It’s important to strike a balance between cost and quality. Look for transparent pricing and evaluate the long-term benefits of accurate bookkeeping concerning the fees charged.

Best Monthly Bookkeeping Services for 2023

There are several big names in outsourced bookkeeping. We’ll take a look at some of the best options.

Wave Advisors Bookkeeping

Features: Wave Advisors Bookkeeping offers precise recording of financial transactions and monthly reconciliations for bank and credit card accounts. In addition, they will create monthly financial statements for your business so you can stay up-to-date on the financial health of your business.

Unique Features: Wave Advisors Bookkeeping stands out for integrating with Wave’s accounting software. This seamless integration allows for efficient data transfer and real-time financial analysis. Furthermore, Wave also offers specialized industry expertise, catering to small businesses, freelancers, and entrepreneurs’ unique needs.

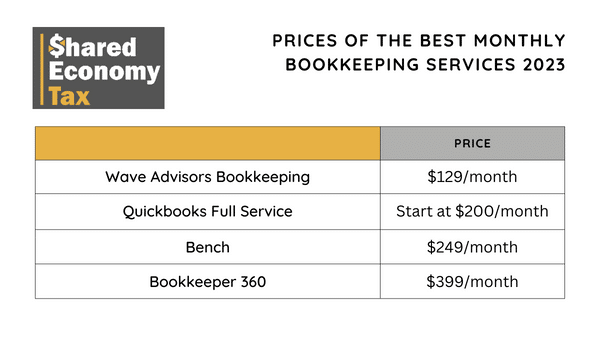

Pricing: Wave Advisors Bookkeeping pricing starts at $129/month for monthly financial services. They have additional packages available that include payroll processing and tax return support.

Customers Love: Customers report that the service is accurate and reliable. In addition, the integration with Wave is appreciated by those companies already using the platform.

Quickbooks Full Service Bookkeeping

Features: Intuit offers QuickBooks full-service bookkeeping and integrates directly with QuickBooks online. The service will handle daily bookkeeping tasks and reconciliations.

Unique Features: QuickBooks Bookkeeping provides a dedicated team to service your business, ensuring the bookkeeper is familiar with your company. The service integrates directly with QuickBooks, which is one of the most widely used accounting software.

Pricing: You’ll have to contact QuickBooks Bookkeeping directly to get a quote for your specific business, but prices start at $200/month. There may be additional cleanup charges during the initial setup.

Customers Love: Customers frequently comment on the convenience of having a dedicated team working on their books. Also, they love using the QuickBooks platform that they are already familiar with.

Bench

Features: Bench provides regular updates on your books and reconciliations. Bench assigns most businesses to a dedicated bookkeeping team. Bench also provides tax time support and can work with your tax preparer to ensure that your books are accurate for your return.

Unique Features: Bench differentiates itself by specializing in serving small businesses. They have developed expertise in working with various industries, understanding their unique accounting needs and compliance requirements. In addition, Bench’s focus on small businesses allows them to tailor their services to meet the specific challenges these companies face.

Pricing: Monthly fees for Bench’s bookkeeping services start at $249/month.

Customers Love: Clients appreciate the ease of use, accuracy, and professionalism of the Bench team. In addition, many testimonials highlight how Bench has streamlined their financial processes.

Bookkeeper360

Features: Bookkeeper360 offers comprehensive bookkeeping that includes recording journal entries along with the standard transaction recording and reconciliations. Also, they guarantee that your books adhere to tax reporting rules.

Unique Features: Each customer is assigned an account manager, so you have a single point of contact for your bookkeeping needs.

Pricing: You can pay for hourly support starting at $125/hour or sign up for a monthly plan starting at $399/month.

Customers Love: Customer reviews for Bookkeeper360 highlight the professionalism, accuracy, and reliability of their bookkeeping services. In addition, clients appreciate their dedicated account managers’ expertise and personalized attention.

Comparison and Analysis of the Best Monthly Bookkeeping Services

Regarding pricing, Wave Advisors Services wins with the lowest monthly fee. However, the other providers’ pricing varies significantly based on your company’s revenue and whether you use cash or accrual accounting.

Wave Advisors and QuickBooks Bookkeeping integrate seamlessly with their own software but don’t work with any other software. On the other hand, Bench and Bookkeeper360 can work with several online platforms.

Each company has its own strengths. Customer reviews for Wave Advisors Bookkeeping highlight its accuracy and reliability. QuickBooks Full Service Bookkeeping has positive customer reviews, emphasizing its convenience.

On the other hand, Bench receives positive customer reviews for its ease of use, accuracy, and professionalism. Bookkeeper360 has positive customer feedback, highlighting its accuracy and personalized attention.

Ultimately, the best bookkeeping service will depend on your business’s needs, like transaction volume, and how often you review your numbers, and others. You’ll also need to consider your bookkeeping budget.

Based on our criteria and balancing the various categories, including pricing, services, and reviews, we ranked the four bookkeeping services:

- Bench

- QuickBooks Full Service Bookkeeping

- Bookkeeper360

- Wave Advisors Bookkeeping

Additional Considerations in Choosing a Bookkeeping Service

Along with the features we’ve already discussed, you should consider several additional factors when choosing bookkeeping services.

Scalability and flexibility: Choose a bookkeeping service that can grow with your business and adapt to changing needs. Ensure they can handle increased transaction volumes and complex financial requirements as your business expands.

Data security: Prioritize the security of your financial data. Furthermore, look for bookkeeping services that have strong security measures in place, such as encryption, secure data storage, and access controls. Verify their compliance with data protection regulations.

Communication and accessibility: Evaluate the bookkeeping service’s communication channels and accessibility. It’s important to have easy access to their support team or account manager when you have questions or need assistance. In addition, consider their responsiveness and willingness to address your concerns promptly.

Customization options: Look for bookkeeping services that offer customization options to meet your specific business needs. Additionally, they should be able to accommodate industry-specific requirements, integrate with your preferred software or tools, and tailor their services accordingly.

When to Upgrade to a Real Bookkeeper

These online solutions are great options for small, up-and-coming businesses, but most companies eventually outgrow them.

If your business is successful, you’ll eventually find that these services can’t deliver the personalized service and functionality your business needs.

If you’re at this point, it’s time to start looking into a professional bookkeeper, and you should start your search with Shared Economy Tax.

We specialize in bookkeeping for small businesses, independent contractors, and other sharing economy entrepreneurs. Our experience tax experts understand the nuances of your business, so we can hit the ground running with your books and provide unmatched insights into your current accounting system.

Book a no-obligation one-on-one strategy session with one of our tax experts today to see how you can take your growing company to the next level with our bookkeeping services. Don’t wait, do it now!