Tax season can be stressful enough without the added worry of falling victim to IRS scams. But unfortunately, scammers are constantly coming up with new ways to take advantage of taxpayers and steal their money.

What You Need to Know About IRS Scams

Scammers are continuously improving their tactics and becoming more sophisticated in their approaches, making it important for you to stay informed and alert. By understanding the nature of IRS scams and the methods employed by scammers, you can better recognize and lessen the chances that you will fall victim to these schemes.

IRS scams have become a widespread issue. Scammers often impersonate IRS officials using phone calls, emails, and text messages. In addition, they employ fear tactics, threatening legal action, fines, or imprisonment to trick you into providing sensitive personal information or making fraudulent payments.

The impact of falling victim to an IRS scam can be severe. It can lead to financial loss, identity theft, and significant emotional distress. In addition, victims may face difficulties in resolving their tax-related issues and may experience long-lasting repercussions on their credit scores and financial well-being.

What Are Some Common Tax-Related Scams?

Scammers use several common tactics to trick unsuspecting people.

Phone IRS scams

IRS phone scams typically involve fraudsters posing as IRS agents and contacting individuals by phone. They will attempt to intimidate you and press for a quick response or payment. In addition, the scammer will threaten jail time if you do not make a payment over the phone.

Phone scammers often change their caller ID information to make it look like the phone call is coming from an IRS number. You should know that the IRS usually communicates with taxpayers via letters. The IRS rarely, if ever, calls taxpayers to inform them of issues. Therefore, if you get a call from someone saying they are from the IRS, you should be skeptical and not give any information over the phone.

Phishing IRS scams

IRS phishing scams involve fraudsters using deceptive emails, text messages, or websites to trick individuals into revealing personal information. Scammers impersonate the IRS or related organizations, creating fraudulent communications that appear legitimate. They use urgency and fear tactics, claiming issues with tax refunds, pending payments, or discrepancies in tax returns.

Phishing messages request personal information, ranging from basic details to sensitive data like bank accounts or credit card information. They may direct recipients to fake websites designed to collect information through forms that mimic official IRS forms. Consequences for non-compliance, such as penalties, legal action, or threats of audit, are often mentioned to add credibility and pressure.

Fake refund IRS scams

Fake refund scams involve scammers attempting to deceive individuals into believing they are eligible for a tax refund and enticing them to provide personal information or make payments to claim a fake refund. In these scams, fraudsters often contact their targets through phone calls, emails, or text messages, posing as IRS or tax agency representatives. They use various tactics to create a sense of urgency and credibility, claiming that the individual is owed a substantial refund and must act quickly to receive it.

Once the scammers have gained the individual’s trust, they typically request sensitive personal information, such as Social Security numbers, bank account details, or credit card information, under the pretense of verifying eligibility for a refund. They may also ask for payment of a fee or taxes upfront to process the refund. However, there is no actual refund, and any information or payment provided only benefits the scammers. Therefore, it’s important to be cautious and skeptical of unexpected refund offers and to remember that the IRS does not initiate refund communications through unsolicited phone calls, emails, or text messages.

The IRS “Dirty Dozen”

The IRS Dirty Dozen is an annual list compiled by the IRS that highlights the most common tax scams and schemes targeting taxpayers. This list warns taxpayers to be cautious and vigilant in protecting their personal and financial information.

The Dirty Dozen covers a range of scams, including phishing, phone scams, identity theft, return preparer fraud, and more. The IRS urges taxpayers to be aware of these scams, stay informed about current tactics used by fraudsters, and take necessary precautions to safeguard their tax-related information and finances. By raising awareness about the Dirty Dozen, the IRS aims to reduce the number of victims falling prey to these fraudulent activities.

How Can I Spot an IRS Scammer?

You can spot scammers in several ways – but the most important thing is to remain skeptical of any unexpected communication (whether by phone, email, or text) that says it’s from the IRS.

Red flags to watch out for

Regarding IRS scams, there are several red flags to watch out for. First, be cautious of unsolicited calls or emails claiming to be from the IRS and demanding immediate action. The IRS typically initiates contact through official correspondence, so unexpected communication should be suspicious. The IRS also gives you several weeks to respond to any communication.

Another warning sign is requests for payment through unconventional methods, such as gift cards, wire transfers, or cryptocurrency. The IRS primarily uses traditional payment methods like checks or electronic transfers.

You should also be wary of poor grammar or spelling errors in official-looking correspondence. Scammers often make mistakes in their attempts to replicate official documents. Staying alert to these red flags can help you identify and avoid falling victim to IRS scams.

How to Verify the Legitimacy of an IRS Communication

To verify the legitimacy of an IRS communication, there are a few steps you can take.

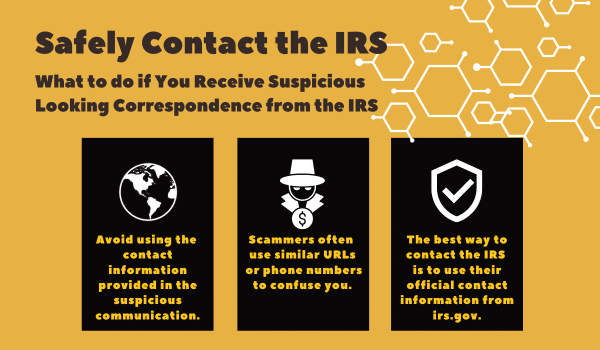

You can directly contact the IRS through official channels to confirm the authenticity of the communication. Use the contact information provided on the official IRS website or in previously received correspondence. Please avoid using the contact information provided in the suspicious communication itself, as it may be fraudulent.

You should also double-check the contact information and URLs provided in the communication. Verify that they match the official IRS contact details. Scammers often use deceptive tactics, such as using similar URLs or phone numbers, so it’s important to be diligent in verifying the accuracy of the information.

What are the Consequences of Falling Victim to IRS scams?

Falling victim to an IRS scam can have severe consequences, including financial losses and potential identity theft. Scammers can deceive victims into disclosing sensitive personal and financial information, leading to unauthorized access to bank accounts, fraudulent purchases, and filing fraudulent tax returns.

Victims may face legal implications and potential consequences, such as being held responsible for fraudulent activities committed in their name. The emotional and psychological impact of such scams is also significant. Victims experience anger, fear, embarrassment, and vulnerability.

How to protect yourself from IRS scams

To protect yourself from IRS scams, it is important to take proactive measures. First, education and awareness are essential. Stay informed about the latest IRS scams, their tactics, and warning signs. Secondly, implement cybersecurity best practices. Implement practices such as using strong and unique passwords, enabling two-factor authentication, and keeping your devices and software up to date.

Additionally, safeguard your personal and financial information by being cautious with sharing it, particularly over phone calls or email. Be wary of unsolicited communication claiming to be from the IRS.

How to Report an IRS Imposter

Reporting an IRS imposter is essential to help authorities combat tax scams and protect other potential victims. Accordingly, the IRS provides official channels for reporting such instances, including the IRS Impersonation Scam Reporting webpage and the Treasury Inspector General for Tax Administration (TIGTA) hotline.

Other relevant government agencies, such as the Federal Trade Commission (FTC) and local law enforcement, can also be contacted to report IRS imposter scams. In addition, online platforms and websites dedicated to tracking scams and sharing experiences, such as the FTC’s Complaint Assistant and consumer advocacy forums, provide further avenues to report scams and provide valuable information to assist in investigations.

By promptly reporting IRS imposters, individuals contribute to the collective effort of identifying and stopping these scams. You can do this while helping protect others from falling victim to fraudulent schemes.

Closing Thoughts on IRS Scams

IRS scams have several negative impacts, including financial losses, identity theft, and potential legal implications. Therefore, staying vigilant and informed about the tactics used by scammers is crucial to protecting yourself.

The more people that share information report scams, and raise awareness, the better off all taxpayers are. By remaining vigilant, you can help prevent others from falling victim to IRS scams. You can also contribute to a safer and more secure environment.