Airbnb rental arbitrage has emerged as an intriguing option in the shared economy space, promising potentially lucrative returns with strategic planning. But as with any venture, it’s a balance of reward and risk. Before diving into its depth, it’s essential to understand the landscape of opportunities and the potential hurdles lying ahead.

What is Airbnb Rental Arbitrage?

Rental arbitrage in the context of Airbnb refers to the practice of leasing a property under a long-term rental agreement and then subsequently renting out that same property at a higher rate.

A person, often referred to as an “arbitrager,” identifies a property in a desirable location that they believe can be successfully rented out on Airbnb or similar platforms. This location could be in a city center, near tourist attractions, or in any area with a high demand for short-term lodging.

The arbitrager then enters into a long-term lease agreement with the property owner. This is typically a traditional lease for a period of 12 months or more.

Once the long-term lease is secured, the arbitrager lists the property on platforms like Airbnb for short-term stays, which can range from one night to several weeks.

The arbitrager charges higher nightly or weekly rates for the short-term rentals than the prorated monthly amount they’re paying for the long-term lease. The difference between what they earn from short-term renters and what they pay in monthly rent is their gross profit. From this gross profit, the arbitrager would then subtract any additional expenses such as cleaning fees, utilities, and platform fees to arrive at their net profit.

The arbitrager often manages bookings, cleaning, maintenance, and guest communications, much like a traditional Airbnb host would. However, they can also employ property management services to handle these responsibilities.

Is Rental Arbitrage Allowed on Airbnb?

Airbnb itself doesn’t explicitly prohibit rental arbitrage in its Terms of Service. Instead, Airbnb’s platform operates on the premise that hosts are responsible for ensuring they have the right to list their space.

if a host is engaging in rental arbitrage, they must ensure they have permission from the property owner and that they are in compliance with their lease agreement. Many cities have specific regulations about short-term rentals. Additionally, many lease agreements prohibit subletting without the landlord’s permission, or they might have clauses that specify under which conditions subletting is permitted.

If Airbnb discovers that a host doesn’t have the proper rights to list a space or is otherwise violating their terms, it can suspend or remove the listing and the host’s account. Additionally, the host could face penalties or be held liable for any damages or issues that arise.

Why is Airbnb Arbitrage Becoming Popular?

One of the most significant appeals of Airbnb arbitrage is the ability to generate income from the short-term rental market without owning a property. Buying real estate requires significant capital, a good credit score, and often long-term financial commitments. Rental arbitrage allows individuals to tap into the lucrative short-term rental market without these barriers to entry.

The short-term rental market, especially in tourist hotspots or major cities, can have considerably higher nightly rates compared to what someone might pay monthly for a long-term lease. If managed efficiently (considering occupancy rates, guest reviews, and operational expenses), arbitrage can result in attractive profit margins.

Once an individual understands the mechanics of Airbnb arbitrage and has a successful model in place, it becomes relatively easier to replicate the process with multiple properties. This scalability is especially appealing to those looking to grow a business without the immense capital requirements of purchasing multiple properties.

How Does Airbnb Arbitrage Work?

Because of the high potential profit margin and low capital expenditure to get started, Airbnb arbitrage can be very appealing to people getting started in the short-term rental market.

This model is also very flexible since you’ve only locked in a lease for 12-months at a time. You can easily add additional leases or let them lapse if certain properties are not profitable.

Getting Started

Begin your search by doing market research on the areas you are interested in. You should look for locations with strong tourism and business travel demands and low inventories of short-term rentals. Make sure that the area you are considering allows short-term rentals.

When negotiating a lease with a potential landlord, make sure that you are honest about your intentions to sublease the property. You should ensure language allowing arbitrage is included in your lease. You should also consider negotiating a longer lease term to ensure your rental can operate for several years without interruption.

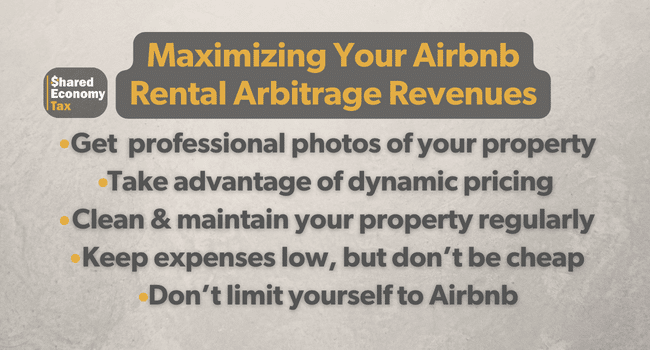

To maximize revenues, you should consider:

- Getting professional photos of the property

- Use dynamic pricing to adjust your pricing to demand

- Make sure you property is clean and in good repairs to ensure you receive outstanding reviews

- Keep your expenses as low as possible without sacrificing quality

- Consider other platforms outside of Airbnb

Airbnb Arbitrage Tips and Tricks for Beginners

Before you get started, you should run various scenarios of your potential cash flow. Consider how different occupancy rates and nightly rates will affect your bottom line.

Make sure you consider local regulations and any homeowners association rules that the property is subject to. Even if the municipality allows short-term rentals, some homeowners associations do not allow them.

If you’re listing multiple properties, maintain a consistent branding style in your photos, descriptions, and communication. It builds trust and professionalism. Create standardized check-in and check-out processes, cleaning checklists, and guest communication templates to save time and ensure quality. Make sure you respond quickly to inquiries and requests from your guests.

What to Watch Out For

There are some potential issues you may run into while running your Airbnb arbitrage business.

Your landlord may monitor your bookings and decide not to renew your lease at the end of the term if they decide they want to take over the property as a short-term rental. They may also increase your lease rate when the lease is up for renewal. You should be ready for these possibilities.

Local regulations are still evolving in various areas. Recently, New York effectively banned all short-term rentals from websites like Airbnb. This could happen in other areas as well and would leave you holding a lease without being able to sublet your listing.

Short-term tenants also tend to be harder on properties and your rental may need additional repairs and maintenance. You should keep a reserve ready for unexpected costs.

Is Airbnb Rental Arbitrage Right for Me?

Deciding if Airbnb rental arbitrage aligns with your strengths and lifestyle demands careful consideration.

Individuals best suited for this venture often possess an entrepreneurial spirit, keen attention to detail, and strong organizational and people skills. Being adaptive is crucial, given the dynamic nature of the short-term rental market.

The initial phase demands significant time for research, negotiations, and market understanding, followed by ongoing commitment to property management, guest interactions, and adapting to platform or regulatory changes.

While the prospects are potentially lucrative, challenges like financial risks, evolving regulations, guest management, and dependence on platforms like Airbnb can’t be ignored.

Closing Thoughts

Airbnb rental arbitrage offers a unique blend of opportunities and challenges. On one hand, it presents a chance to tap into the booming short-term rental market without the hefty commitment of property ownership. The model allows for scalability, flexibility, and potentially high profit margins.

This venture is not without its complexities. Regulatory changes, lease nuances, guest management, and financial fluctuations require astute attention and adaptability.

For those serious about maximizing their potential while navigating the maze of regulations and tax implications, consulting with professionals is a wise choice.

At Shared Economy Tax, we specialize in the unique tax needs of Airbnb hosts and other short-term rental operators. Out veteran tax pros can provide invaluable guidance and ensure you stay compliant with federal, state, and local tax regulations. Contact us now to get started with a one-on-one strategy session with one of our tax experts.