Selling a business asset may feel like a win, but have you considered the tax implications? In this article, we break down the nuts and bolts of depreciation recapture and offer strategies to navigate it effectively.

What is Depreciation Recapture?

Imagine buying an asset for your business at $10,000 and depreciating it by $4,000 over several years.

Now, let’s say you sell this asset for $11,000. You’ll have a total gain of $5,000, and $4,000 of that is subject to depreciation recapture.

Essentially, the IRS recaptures some of the depreciation benefits you’ve received over the years.

Why is It Important for Taxpayers?

Being aware of this tax complication is crucial because it directly influences your tax liability. In our example, the $4,000 tagged as recapture will be taxed at your ordinary income rate, which is capped at 25%.

How Does the IRS Calculate Depreciation Recapture?

Calculating depreciation recapture involves several key steps:

- Determine the Asset’s Adjusted Basis: Your asset’s original cost minus any accumulated depreciation gives you the adjusted basis.

- Calculate the Gain on Sale: This is straightforward—just subtract the adjusted basis from the selling price.

- Identify the Depreciation Recapture: The depreciation recapture is the lesser of the gain on sale or your total accumulated depreciation.

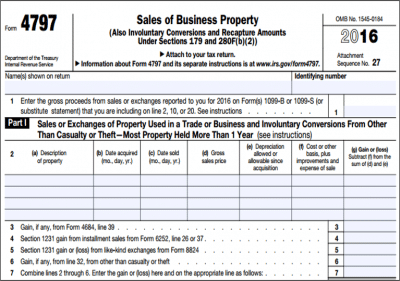

Tax Forms Involved

You’ll need to report depreciation recapture on IRS Form 4797, which is specifically designed for the sale of business property. This form has multiple sections that need to be filled out accurately to ensure full compliance with tax regulations.

Example Scenario

Suppose you’ve purchased equipment for $10,000 and claimed $4,000 in depreciation. Your adjusted basis would then be $6,000. If you sell this equipment for $8,000, your gain on sale is $2,000. This entire gain is considered recaptured depreciation since it is less than the total depreciation claimed.

How to Avoid Recapturing Depreciation

You can mitigate recapture expenses using several strategies:

- Utilize a 1031 Exchange: You can defer both capital gains and recapture taxes by reinvesting your gains from the sale into a similar asset.

- Invest in Qualified Opportunity Zones (QOZs): You can invest in and potentially defer or reduce capital gains by investing in government-designated opportunity zones.

Working with a Tax Advisor

Depreciation recapture can be a complex topic, so it pays to talk to a trusted tax advisor if you’re concerned you may run into an issue. A tax pro can help you navigate the IRS regs and minimize your total tax liability.

Shared Economy Tax specializes in taxes for Airbnb hosts and real estate investors, so we have deep expertise on this subject. Click here to connect with one of our tax pros now.

Final Thoughts and Next Steps

Depreciation recapture may seem complex, but understanding its implications can save you significant money and headaches. While some strategies like 1031 exchanges and investing in QOZs offer temporary relief, it’s essential to consult professionals for long-term tax planning.

The key takeaway? Stay informed and make strategic decisions that align with your financial objectives—both now and in the future. Your financial well-being is our utmost priority at Shared Economy Tax, so stay tuned for more in-depth insight