No one wants to take a loss on an investment, but it happens to the best. Fortunately, the government may allow you to deduct your losses on your tax return. Some taxpayers use strategically this write-off to lower their taxable income with a technique called tax loss harvesting.

With tax laws constantly changing, it’s important to stay up-to-date on the latest strategies and techniques to optimize your tax planning. In this article, we will discuss how tax loss harvesting works, its benefits, and how you can use it to potentially save a significant amount on your taxes.

What is Tax Loss Harvesting?

Tax loss harvesting starts with a capital loss.

What is a Capital Loss?

If you sell something for less than you bought it for, you just took a capital loss. Capital losses results from negative investments in securities, real estate, or other assets.

You incur a capital loss upon sale of the asset. Prior to sale, the investment’s negative value is an unrealized loss. From a tax perspective, a capital loss can only occur once the loss is realized by selling the asset. You cannot claim an unrealized loss as a capital loss.

Similarly to capital gains, capital losses can be short-term or long-term. A short-term capital loss occurs when you sell an asset that you’ve held for less than one year at a loss. For a long-term capital gain to occur, you must own the asset in question for more than one year.

Capital Loss Deductions

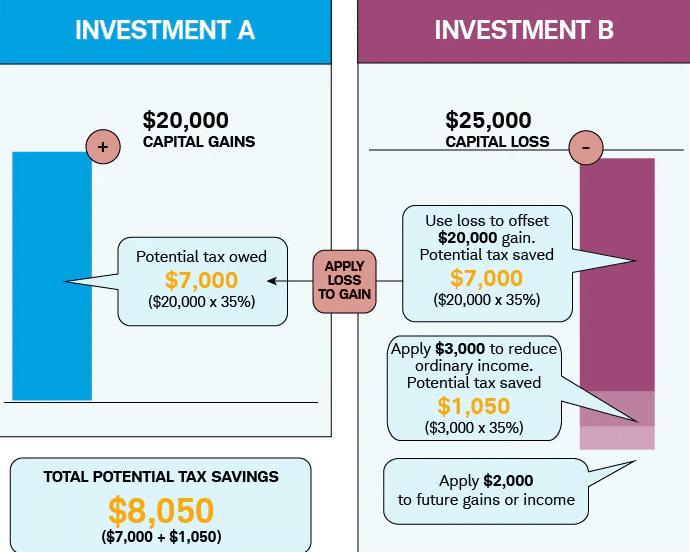

Taxpayers can use their capital losses to reduce their tax liability on investment gains from other assets. IRS rules allow up to $3,000 in capital losses deductions per year against ordinary income. You can also carry over losses exceeding $3,000 to use in subsequent tax years.

Capital losses can also offset capital gains. Your positive investments are balanced with your negative investments to calculate your taxable gain or loss. The IRS doesn’t limit the amount of capital losses you can use to offset a capital gain.

Tax loss harvesting is a tax strategy that makes strategic use of capital losses. Investors intentionally sell losing assets in years when they’re expecting a large capital gains tax because it can substantially reduce their total tax costs.

What is Tax Loss Harvesting?

If you had a good year in the market, you’re probably looking at a substantial tax bill. If you also own stocks that are down substantially from your purchase price, you can earn extra deductions by selling them before the end of the tax year. Tax loss harvesting is a term referring to the strategic selling of losing assets to generate tax savings.

Tax loss harvesting is a popular technique used by many investors to minimize their tax liability and increase after-tax returns. However, it’s not always the right call.

Taking a loss is never the ideal outcome of an investment. However, when the market gives you lemons, tax loss harvesting can help you make lemonade. Don’t go out of your way to sell assets at a loss when doing so would be contradictory to your long-term financial goals.

What are the Rules for Tax Loss Harvesting?

The IRS maintains a few rules when it comes to tax loss harvesting.

Limits on Deductions and Carryover of Losses

It’s essential to understand that there are limits to how much you can deduct or carryover losses from tax loss harvesting. As mentioned, if your capital losses exceed your capital gains, you can claim up to $3,000 in excess losses to lower your income.

However, if your net loss is greater than $3,000, you can carry the remaining loss forward to future tax years. The good news is that you can carryover these losses indefinitely until they are fully utilized or until you sell the investment.

It’s also crucial to note that the $3,000 limit only applies to losses exceeding any capital gains. If your capital gains are greater, you can deduct more. Finally, it’s important to work with a tax professional to ensure that you are appropriately reporting your losses and adhering to IRS regulations.

The Wash-Sale Rule

The wash-sale rule is a crucial consideration for tax loss harvesting. As mentioned earlier, selling securities at a loss can help offset capital gains and reduce taxes owed. However, if you repurchase the same or a substantially identical security within 30 days of the sale, the transaction is considered a wash-sale.

In this case, the IRS disallows the loss for tax purposes, and you won’t be able to claim the write-off. To avoid violating the wash-sale rule, investors should wait at least 31 days before repurchasing the security or consider buying a similar security that is not substantially identical, such as a different company’s stock or a different type of investment.

It’s crucial to note that this rule applies to both taxable accounts and tax-advantaged accounts like IRAs.

Loss Harvesting for Real Estate

Real estate investors can sell an investment property at a loss and use that loss to offset gains from the sale of another property, or other capital gains. Additionally, the loss can be used to offset up to $3,000 of ordinary income per year, with any remaining losses carried forward to future tax years.

It is important to note that the IRS has specific rules for what constitutes a loss on a real estate investment, and investors should consult with a tax professional to ensure that they are maximizing their tax benefits while staying in compliance with regulations.

The Bottom Line on Tax Loss Harvesting.

Tax loss harvesting can be a valuable strategy for investors to offset capital gains and reduce their tax bills. However, it’s important to use this strategy wisely and with caution to avoid violating the wash-sale rule or intentionally taking losses to reduce taxes.

It’s crucial to consult a financial advisor or tax professional to determine if tax loss harvesting is right for your unique financial situation. Tax loss harvesting is just one tool among many in managing your investments and taxes. Consult with your tax pro and financial advisor before making any major decisions.

Save More on Taxes

Shared Economy Tax can help you save big with tax loss harvesting and other sophisticated tax strategies. Our veteran tax pros specialize in serving small businesses & independent contractors like you. Contact us today for a one-on-one strategy session with one of our season tax experts.