Many people only associate their tax advisor with tax preparation. However, the benefits of working with a tax advisor go well beyond tax preparation, especially for your Sharing Economy business. Whether you are full time or part time in your Sharing Economy business, having the right support when it comes to finances and taxes is crucial to scaling your business. One of the most important Sharing Economy tax tips we can offer is to take advantage of the relationship you have with your tax pro. So whether you’re looking for advice on depreciation for your short term rental or depreciation rules for your Turo car, a good tax advisor can give you the tips you need to make your year successful.

Finding The Right Tax Advisor For Your Sharing Economy Business

Working with the right tax advisor is one of the most important Sharing Economy tax tips. Perhaps you are already working with a tax advisor, or maybe you have been on the fence about hiring one. After all, you’ve been managing things pretty well by yourself so far, right? The truth is the more income you make, and the more sources of income you have, the more complicated your tax situation becomes. But complicated tax situations don’t have to be ominous. In fact, with the right strategy, under the guidance of the right advisor, you can position yourself to come out on top.

When it comes to tax professionals, it’s important to realize that it’s not a one-shoe-fits-all hire. There are many different facets of taxes and accounting that a tax advisor may choose to specialize in (intentionally or not).

For example, some tax advisors specialize in tax preparation, others specialize in tax laws and compliance, some only do accounting, and others may specialize in state and local taxes. In other instances, some advisors only work seasonally and are looking for simple engagements, while other advisors are looking for a relationship-based engagement where they can add value at each step of your business.

When interviewing tax advisors, it is important to make sure you know what you want to gain out of the relationship.

Ask Your Tax Preparer About their Areas of Expertise

When it comes to Sharing Economy tax tips, we like to advise clients to work with someone who is well rounded and can guide them on all aspects of their taxes. Often, for those making money in the Sharing Economy, the majority of clients use Airbnb, Turo, or Upwork as supplemental income. That means that you likely have a W2 job or other sources of income in addition to your Sharing Economy business.

So if you have stock options from your company, long-term real estate rentals, big bonuses or trust / brokerage income, you may want to make sure that your tax preparer can speak to how those streams of income are taxed. At Shared Economy Tax, our preparers all have broad backgrounds in income tax to be able to handle the wide mix of situations we face on a daily basis. We encourage you to find not just a single practitioner who can do it all (any single person rarely can), but to find a team that can peer review your return and triangulate different views and areas of expertise.

In addition, working with someone who is familiar with Sharing Economy businesses is a huge plus as they are familiar with the tax laws and accounting nuances that specifically affect you.

Ask Your Tax Preparer if They Also Handle Accounting and Bookkeeping

A tax advisor who can handle your accounting as well as your tax preparation is a valuable asset and helps ensure a smooth and accurate process.

The goal is to have an advisor that has given your accounting, records, and calculations their “blessing.” Meaning, before the end of the year, a great accountant who can handle bookkeeping can tell you what changes you need to make (if any), to your books and records. Books and records that have been reviewed and improved by an accountant are ready to be reported on a tax return, making for a frictionless transition from year-end planning to reporting.

Be weary of any tax preparer that doesn’t have high fluency with your accounting software (Quickbooks, Xero, or Wave accounting systems), since you’d likely be paying them to learn these programs.

Ask Your Tax Preparer What Stage of Business Their Average Client Is In

This question will help you gauge experience and focus. A tax professional whose average client doesn’t have a business for instance, may be great for personal tax issues (reporting on W2’s, taking child care deductions, itemizing) but wouldn’t know how to leverage your business to get to your optimal tax situation.

Also, a tax preparer who has mostly mature businesses isn’t going to be a good fit if you’re getting started. Since for one, they likely collect most of their fees from their large clients (therefore valuing their smaller business clients less). And second, they may consider fair questions for early-stage businesses as amateurish.

A firm or practitioner that has businesses across all stages of business and has programs specifically designed for new businesses is going to allow you the benefit of getting the guidance you need at early stages, while allowing you to learn from best practices of larger, more established clients.

Ask Your Tax Preparer How They Bill

This is a critical question for clients. Especially for those migrating from Do-It-Yourself software, which can be under $100, to hiring a professional for the first time. While many clients get frustrated hearing “it depends,” the truth is that you should be able to get a tight-ish range of fees based on a set of assumptions (explained in detail below).

The first thing to get clear on is whether your professional charges a fixed fee or charges hourly. Hourly can make sense if you have a simple tax situation and don’t expect to ask many questions. However, you don’t want to run into a scenario where an unforeseen question or tax form gets your hourly billing out of control. The good news is that many tax practitioners today have a fixed fee billing arrangement (even the Big 4 accounting firms).

Second, note that discounts should be pursued cautiously. For any first year engagement, there is going to be an investment on both sides of the relationship: on your part to answer questions and provide information and on the provider’s part who is learning your situation. That is why it is rare to get heavily discounted fees in the first year and you should be cautious about those who are willing to discount their fees since it will compromise quality. Any service provider is going to want to get things right, and getting things right takes time.

Third, be clear about your estimate. While fees always depend on complexity, you should be able to get an estimate of fees based on your prior year return and certain information. Data points that may be helpful for your tax preparer may include:

- Your type of business,

- Your W2 salary and whether you received stock compensation,

- Whether you do your own accounting vs. having a bookkeeper,

- How your numbers are tracked (e.g., piece of paper, shoe box, excel, accounting software, or tracked elsewhere),

- Whether you have a rental property and claim depreciation and the number of properties,

- Withdrawal of contributions to retirement accounts, and

- How many 1099’s you received and other streams of non W2 income.

In summary, be clear on how your advisor bills and get a range based on the information provided. Any tax advisor or firm should be able to give you a reasonable range based on a series of assumptions about your tax information (see list above).

You Probably Need To Hire A Tax Advisor If…

Here are some tax scenarios where it is better to work with a tax advisor than do it yourself. While the added cost of working with a professional may seem like a lot, in the end you will end up saving money on taxes, not to mention stress, and time. Knowing when to outsource your taxes, is one of the most important Sharing Economy tax tips. If you find yourself in any of these scenarios, it may be in your best interest to hire a tax advisor:

- If you are self employed or own your own business

- You have multiple streams of income

- If you have to track depreciation for business assets

- You have a partner in your business

- If you have a lot of investment accounts

- You had a major change, for example, got married

- If you bought or sold property

- You are very generous and give to a lot of charities

- If you itemize deductions

- You conduct business in multiple states

- If you find yourself getting stuck

Any of the scenarios listed above can either cause you lots of pain or raise a red flag with the IRS, particularly if you aren’t keeping good records. A tax advisor can help make sure you aren’t taking too many liberties in these areas, and offer you some peace of mind to handle your accounting correct. An audit is a scary thing, and nobody should go at it alone, which is another benefit of working with a tax advisor since they’re on the hook for the return you file.

Accounting vs. Tax Preparation

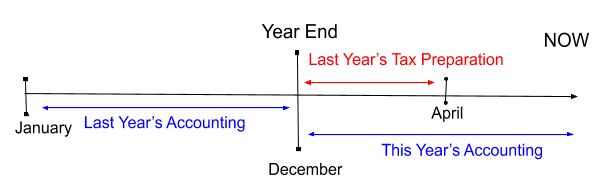

It is important to understand the distinction between accounting and tax preparation, which often get confused together. Yes, one affects the other, but they are two separate processes. Your accounting process takes place all year long, it’s how you measure your income, expenses, cash flows, assets, and other key numbers. Tax preparation is different in that it takes the numbers from your accounting process and reports these numbers on the appropriate tax forms that calculate how much you owe. Accounting is done in the present (live) while tax preparation is retroactive (looking backwards).

Understand that when you engage a professional for a tax return that doesn’t include the day-to-day bookkeeping that should be happening in your Sharing Economy business day-to-day during the year. From a tax professional’s perspective, they assume the accounting has been managed and completed.

Having a good accounting process in place is a must regardless of if you choose to maintain your books yourself or outsource to a professional. Staying organized with your accounting will help in the end with your tax preparation and satisfy a taxing authority if your tax return is ever reviewed. As a firm, we recommend getting a professional to handle setup and reconciliation at some level.

Taxes Don’t Begin And End With Tax Season

Many people don’t realize the benefits of working with a tax advisor beyond tax season. Aside from accounting and tax preparation, tax planning is an important process to discuss with your tax advisor. This process involves strategizing and timing purchases and income, contributing to retirement accounts, planning for deductions, creating a tax savings account, and making estimated tax payments. All of which are designed to help lessen your tax burden and save you money on taxes.

Don’t Leave Money On The Table

Are you familiar with all of the tax deductions and credits available to you? These are important when it comes to saving money on taxes, you may be leaving money on the table. A tax advisor will know all of the tax deductions available to your for your Sharing Economy business. Some common tax deductions include:

- Operation Costs – If you operate an Airbnb listing this could include: utilities, cleaning expenses, and insurance costs. If you operate a fleet of cars on Turo this could include: maintenance, repairs, and insurance expenses.

- Marketing Expenses

- Depreciation

- Service Fees

- Professional Fees

- Subscription Costs

Staying Compliant

Compliance is also up there when it comes to Sharing Economy tax tips. Do you conduct business in multiple states? If so, you probably owe taxes in more than one state. Tax laws vary from state to state and city to city, so if you conduct business in multiple locations you could be liable for taxes in those areas. The best way to be certain and to stay compliant is to work with a tax advisor who specializes in state and local taxes, known as a SALT accounting specialist. Like we said the bigger your business gets, the more area you might cover. This is one area where taxes can get really confusing. In this instance it is always better to work with a professional. This ensures that all of the correct taxes are paid and to the right authorities.

For more Sharing Economy tax tips contact the the tax advisors at Shared Economy CPA, or subscribe to our newsletter.

Related Articles

The Best Way To Pay Your Sharing Economy Taxes

The Most Pressing Airbnb Tax Questions

How Tax Planning Can Save You Thousands