Short term rental platforms like Airbnb and VBRO have increased in popularity over the last several years. What once started out as a part-time income for some, has been scaled to quite a profitable enterprise for others. Regardless of if you are a part-time or full time, you probably have some Airbnb tax questions. Taxes can be complicated, so asking the right questions can be vital to your financial well being. Here are some of the most common Airbnb tax questions.

Do I Have To Pay Taxes On Short Term Rental Income?

In short, yes. The IRS wants all income reported so that proper taxes can be paid. This includes your short term rental income. However, there is something called the 14-day rule exemption, which stipulates that if your rent out your listing for less than 14 days per year, and occupy your listing at least 14 days per year or at least 10% of the time you make your rental available, then you do not have to report the income.

What Are Estimated Taxes, And Do I Owe Them?

As an Airbnb host, you are considered self-employed if you actively manage the business. Self-employed individuals are required to remit estimated taxes on a quarterly basis because an employer isn’t remitting taxes for you. The IRS does not want to wait to get their money, instead, they require you to pay as you go. Estimated taxes are typically owed if you expect to owe more than $1,000 in taxes. Estimated taxes are due on a quarterly basis: April 15, June 15, Sept. 15, and Jan. 15. If the 15th falls on a holiday or weekend, the due date is moved to the next business day.

What Kind Of Expenses Can I Deduct?

Maintaining your short term rental requires certain ongoing expenses, which can qualify as deductible expenses if they are deemed ordinary and necessary. Some examples of qualifying expenses include:

- Marketing expenses

- Cleaning and maintenance fees

- The cost of furnishings

- Subscription costs like Netflix

- Utilities

- A portion of mortgage interest, homeowners insurance, property taxes

- Travel expenses

- Educational expenses for learning about business, finances, and operations

- Professional fees paid (to accountants, lawyers, and consultants)

- Contractor expenses

- Fees charged by Airbnb

What Are Transient Occupy Taxes?

Taxes can vary in different states and localities, some cities might impose a transient occupy tax, which serves as a sales tax for accommodations. The guest pays it and then it gets remitted to the tax authorities. Sometime you will hear these taxes referred to as a hotel tax. Airbnb may or may not collect the tax on your behalf, so you have to check. In addition, if you have more than one location, you should check the state and local tax laws in each area.

Will I Get a1099 Form from Airbnb?

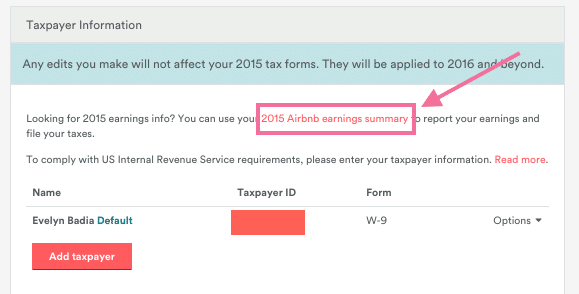

Airbnb will typically issue a 1099 form if you have over 20k in sales and 200 transactions in a year. When reporting 1099 income, it’s important to report accurate information. After all, the IRS receives the same information. If you do not receive a 1099 from, you still need to report the income. You can download your earnings summary from your Airbnb dashboard for easy access to your up-to-date accurate income information.

What Type of Records Should I Maintain?

Having immaculate records of all transactions can help protect you in the event of an audit and also make preparing and filing your taxes a lot easier. Keep track of everything; maintenance records, receipts, guest records, travel times, etc…The more detailed the better. Having a good accounting system in place is a must. Many of our clients like to use Xero, because of the customizable features when it comes to running reports. For example, if you manage multiple properties you have the ability to categorize profit-and-loss statements by rental units.

Airbnb taxes can be complicated, especially if you have more than one property. Remember the more you scale your business, the more income you have, the more sources of income you have, the more complicated your tax situation can be. Which is why it is good to ask questions. For more answers to your Airbnb tax questions subscribe to our newsletter using the form below, or get started with a free one-on-one strategy session with a Shared Economy Tax expert today!