Roth IRAs offer substantial benefits for retirement savers, but there are limits on annual contributions. However, you can bypass the limits by converting a regular IRA to a Roth account. A Roth IRA conversion is a powerful tax planning tool, but it comes with some potentially severe tax implications.

This blog post will explain everything you need to know about converting your existing IRA into a Roth, so you can make an educated decision about what’s best for you.

What is a Roth IRA Conversion?

Retirement savers have the option to convert a traditional Individual Retirement Account (IRA) into a Roth IRA. The term Roth IRA conversion refers to this practice.

The IRS considers any funds converted into a Roth IRA as taxable income for the year of the conversion. As a result, you will incur taxes on any funds that you convert. However, your money will generate tax-free growth once it’s deposited into the Roth account.

Why Should I Convert My IRA?

Roth IRAs offer unique tax benefits that other retirement accounts simply cannot match. Unlike traditional retirement accounts, you pay upfront taxes on any funds you contribute to your Roth account. The benefits come later, when you withdraw the money.

After you reach the age 59½, you can withdraw your Roth funds without paying any tax on the income. This can be a huge benefit for retirement savers, especially those who will be in a higher tax bracket in retirement than they are now.

Roth IRAs also provide more income flexibility in retirement. Traditional IRAs currently require mandatory distributions starting at age 72, but many expect this age limit to increase in coming years. Roth IRAs don’t require distributions until the account owner’s death, so you have no requirement to make withdrawals during your lifetime.

Converting your IRA can also offer potential tax benefits. Depending on your income, you can qualify for tax credits or deductions to offset taxes incurred as a result of the conversion. Roth IRAs can also potentially lower your taxable income in retirement and reduce your overall tax costs.

Who Qualifies for an IRA Conversion?

You must have an existing IRA account to convert into a Roth IRA. There are no income limits for IRA conversions, but there are restrictions on direct contributions.

You should also consider the tax cost of an IRA conversion. Any converted funds are considered taxable income for the year of the conversion.

Finally, think about long-term tax planning. Consider your current tax bracket and whether you’ll be in a higher tax bracket upon retirement. If you expect to have a more modest income during retirement, a traditional IRA might be a better option.

How Do I Convert my IRA?

Converting your traditional IRA to a Roth IRA is a fairly simple process. First, contact your IRA custodian and tell them you want to convert your account, and they’ll send you the necessary paperwork. Oftentimes, you can also complete this process online.

Next, decide how much of your balance you want to convert. You can convert your entire account or just a portion of it. Remember, your conversion is considered taxable income, so make sure you can cover the tax costs.

Once you submit the paperwork, your IRA custodian will initiate the conversion process. Your funds will move from your traditional IRA to your Roth IRA. Depending on your custodian, the process takes anywhere from a few days to a few weeks.

After the conversion, you’ll receive a Form 1099-R from your custodian showing your total conversion and resultant taxes. Consult with a tax professional to ensure you properly report the conversion on your taxes.

What is a Backdoor Roth IRA Conversion?

High-income earners can’t usually make direct contributions to a Roth. However, they can use a “backdoor” Roth IRA conversion to skirt income restrictions.

A backdoor Roth IRA contribution starts with a non-deductible contribution to a traditional IRA. Now, they can convert that IRA balance into a Roth with no income restriction.

Backdoor conversions offer higher earnings a chance to take advantage of tax-free growth and withdrawals in retirement. You can’t make direct contributions to the “backdoor” Roth if your income is too high, but you can still contribute to a regular IRA.

However, this appealing strategy also comes with some potential tax implications. For example, the pro-rata rule may impact the tax treatment of the conversion. Always consult with a tax professional to understand the potential risks and benefits of a backdoor Roth IRA conversion.

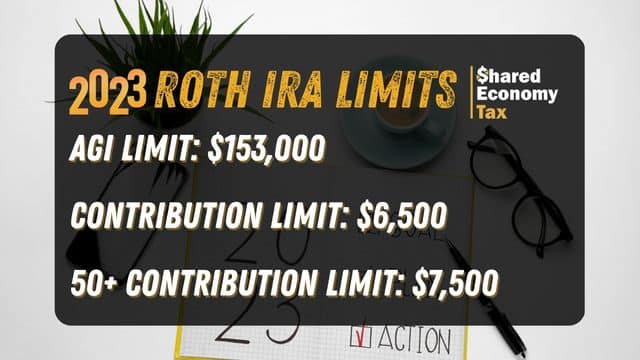

Contribution Limits and Income Restrictions for 2023

For 2023, the contribution limit for IRAs is $6,500 per person. However, taxpayers aged 50 or older can make an additional “catch-up” contribution of $1,000, so their max limit is $7,500.

Contribution limits apply to total IRA contributions for the year, regardless of whether they’re traditional or ROTH.

For tax year 2022, you must have an adjusted gross income below $144,000 to qualify for a Roth. In 2023, the limit goes up to $153,000.

There is no limit on the amount you can convert from a traditional to a Roth IRA each year.

Should I Consider a Roth IRA Conversion?

A Roth IRA provides substantial tax benefits, but there are strict limits on contributions and income. Converting your IRA to a Roth can help you go around some of these requirements. However, a large conversion can result in an enormous tax bill, so careful tax planning is of paramount importance.

Questions about IRA Conversions?

Shared Economy Tax can assist you with all your tax planning needs. Our talented team has decades of combined experience helping small businesses and independent contractors keep more of their hard-earned money.

If you have additional questions about Roth IRA conversions, set up a -one-on-one strategy session with a tax pro now. We can answer your toughest tax questions and help you save big.