Many taxpayers turn to Certified Public Accountants (CPAs) for their expertise and guidance. However, hiring a CPA can come with substantial costs. In this article, we’ll answer the question, “do I need a CPA?,” and we’ll explain what to consider when deciding on the answer for yourself.

What is a Certified Public Accountant (CPA)?

CPAs are specialized accountants licensed by a state board of accountancy. States set their own criteria for issuing CPA licenses, but they generally require a series of exams and 150 hours of college credits.

Specialties can vary among CPAs. Furthermore, some of the most focuses include auditing, taxation, accounting, and financial planning.

As a state-licensed professional, CPAs are held to high ethical and professional standards set by the American Institute of Certified Public Accountants (AICPA). As a result, AICPA rules require CPAs to maintain the highest level of integrity and professionalism in their work.

Furthermore, these standards include maintaining confidentiality, avoiding conflicts of interest, and ensuring that all work is performed with competence and due care.

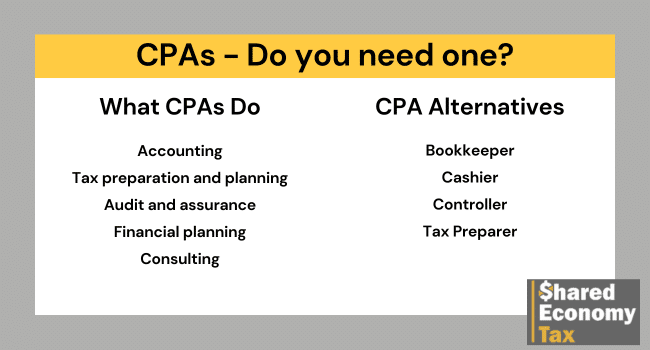

What Do CPAs Do?

Generally, CPAs are responsible for providing financial services and advice to individuals, businesses, and organizations. The specific job responsibilities for CPAs depend on their area of specialization.

Accounting:

CPAs can prepare and maintain financial records for businesses. Therefore, any lending institutions require CPA certification of financial statements for business loan applications.

Tax preparation and planning:

CPAs specialize in tax laws and regulations. Also, they can prepare complex business returns that include special credits or multi-state situations.

Audit and assurance:

Also, CPAs can provide assurance services, such as auditing financial statements, to ensure that businesses are complying with accounting standards and regulations. Financial regulations often require CPAs to certify audit results.

Financial planning:

CPAs can assist individuals and businesses with financial planning, including retirement planning, investment strategies, and risk management. At any rate, financial planning from a CPA will often include an indepth analysis of the tax impact of various investment options.

Consulting:

CPAs provide consulting services to businesses and organizations. For example, advising on mergers and acquisitions, accounting analysis, and determining business valuation.

When to Call in a CPA?

There are several circumstances where calling a CPA would be a prudent move.

You Need to Audit Your Finances

There are several times you may want to perform an audit on your company’s books: if you’re considering selling, if you’re concerned about your company’s internal controls, or if you are required to perform an audit to meet financial regulations.

You Have a Complex Tax Situation

Tax CPAs can help you work through complex tax issues that might be outside the scope of a traditional account. For example, some tax credits require the endorsement of a certified expert.

Does My Business Need a CPA?

Here are some questions you should ask yourself before bringing in a CPA.

Is My Business an Entity?

Typically, pass-through entities and sole proprietorships don’t need a CPA. Most of the time, these businesses can get by with a regular accountant or bookkeeper. However, some pass-through entities may consider hiring a CPA for tax guidance, but it isn’t typically the most cost-effective solution.

Is There a More Affordable Solution to the Problem?

CPAs carry much higher costs than accountants, so you should consider alternatives when possible. Bookkeepers can handle most administrative tasks for a fraction of the price, and accountants can usually cover most small business needs.

CPA Alternatives

There are several alternatives to using a CPA to help you run your business.

Bookkeeper

A bookkeeper is responsible for recording and maintaining a company’s financial transactions, including purchases, sales, receipts, and payments. Also, they ensure financial records are accurate and assist with the preparation of financial statements and tax returns.

Cashier

A cashier is responsible for handling cash transactions and maintaining accurate records of sales and receipts. They play a critical role in a business’s money management by ensuring that cash is accounted for and that transactions are accurately recorded.

Controller

A controller is responsible for overseeing a company’s accounting and financial reporting functions, including managing budgets, preparing financial statements, and monitoring cash flow. They ensure that financial records are accurate and timely and providing guidance and insights to help the company make informed financial decisions.

Tax Preparer

A tax preparer is responsible for preparing and filing tax returns on behalf of a business, ensuring compliance with tax laws and regulations. Furthermore, they help companies minimize tax liabilities and avoid penalties while providing guidance on tax planning strategies.

Closing Thoughts: Does My Business Need a CPA?

While Certified Public Accountants (CPAs) can be valuable resources for businesses, most small businesses may not require their services on an ongoing basis. As a matter of fact, hiring a controller, bookkeeper, or experienced accountant may be a more cost-effective solution.

If you need CPA, don’t hesitate to hire one. However, whether a CPA is the right option will depend on your business and tax needs.

Get Expert Tax Help Now

Above all, Shared Economy Tax specializes in serving the small business and independent contractor community. If you need high-level tax help, skip the CPA and give us a call! Our veteran tax pros can help you tackle your toughest tax challenges. Get started now with a one-on-one strategy session with one of our experts.