Maybe you’ve been doing your taxes on your own for years, or perhaps you’re filing taxes for the first time ever, but at some point, most people ask themselves: Tax Software or accountant?

Should I buy software for tax season or hire someone to do it for me? In this article, we’ll discuss the intricacies of the tax software vs accountant argument and explain which one you should use.

Tax Software vs Accountant: Key Considerations

Businesses have their own set of tax laws, and knowing which set applies to your business can require hours (or days) of research. For example, a sole proprietorship may be able to complete a simple Schedule C on their own, but partnerships and corporations require separate tax returns.

In addition, business tax returns for partnerships and corporations require special knowledge of complicated tax forms and tax laws to complete.

When considering whether you can complete your business return on your own, you should consider several key factors. The first is how much time you want to devote to preparing your returns. If you’re busy running your business, it might be best to outsource the task to a tax preparer.

The second is how complicated your return is. If your company operates in multiple states or is eligible for special tax credits, it might be best to defer to an expert.

If you are trying to minimize expenses and are concerned about the cost of hiring a tax professional, you should attempt to prepare your business return on your own tax return in 2023.

However, sometimes the added expenses of a tax professional can yield more significant tax savings by maximizing your deductions and tax credits.

Modern tax software can guide you through much of the tax preparation process but may require additional research and accounting knowledge to use the software effectively.

Tax preparation software also does not perform reasonableness checks or offer insight into your business operations and tax burden.

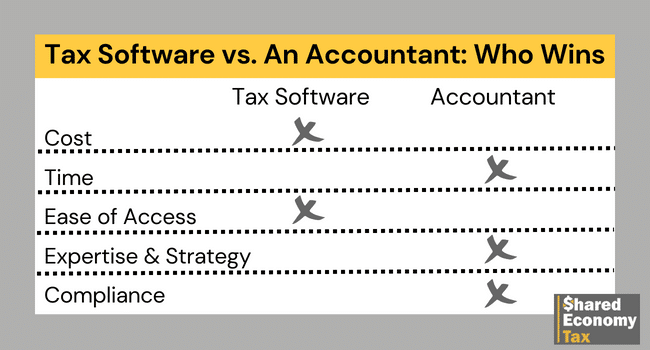

Costs Involved with Tax Software vs Accountant

There’s not much competition when it comes to cost. Though the price of software and accountants can vary widely, overall, software will be cheaper than hiring an accountant.

Winner: Tax Software

Accounting software for business tax returns can cost less than $200. Finding a tax preparer for that price would be extremely difficult.

The average cost for a CPA to prepare an S-corporate or partnership return is over $1,000. Note that the cost of hiring an accountant will vary based on your type of business and location.

Working with a virtual accounting firm can offset some of the location-based premium on accounting fees. THere are other factors in deciding whether to use tax software vs. accountant.

Time

The time involved will vary widely based on your knowledge of tax laws and how clean your books are. It will also depend on what type of business you have.

For example, partnerships, LLCs, and corporations all require separate tax returns. You may also be required to file both federal and state tax forms.

Winner: Accountant

Accountants will translate your accounting records into a clean set of financials. This may include reconciling your bank (if you haven’t already done so), making journal entries, and verifying the reasonableness of your income and expenses.

Handing off your books to a professional can save you countless hours and stress, freeing you up to run your business.

Accounting software will also save you time, but how much time you’ll spend will depend on your accounting knowledge and familiarity with the software.

Modern accounting software can also automate much of the data entry and categorization of expenses.

In addition, some accounting software directly integrates with tax preparation. But ultimately, it’s up to you to ensure you’ve entered your information accurately and thoroughly.

Ease of Access

Accountants can take a lot of work to get a hold of during the busy season. It’s not that they’re ignoring you. It’s just that they have a lot of clients to handle, and everyone has the same deadlines.

You’d need to hire one full-time to have constant access to your accountant.

Winner: Accounting Software

You can access accounting software at anytime as long as you have access to your server (or the internet if you’re using cloud-based software).

Once you know how to use your accounting software, you can generate reports and check balances whenever you want.

Expertise & Strategy

Tax software gets a little better every year with better prompts and automation. But it takes work to rival the expertise of a well-trained accountant.

Winner: Accountant

Tax accountants have built their careers by learning the intricacies of tax laws and regulations. As a result, they have earned unmatched insights into tax and accounting processes. This means they will know the right questions to ask about your business and provide valuable insights.

Software can provide some feedback, but it usually can’t match the expertise of a professional accountant. This means in favor of the accountant in the tax software vs. accountant debate.

Tax Software vs. Accountant in Regards to Compliance

When it comes to accounting, compliance may be the most important criteria. Tax software can provide some built-in compliance checks, but you’re solely responsible if you make an error (even if it’s unintentional).

On the other hand, accountants provide some assurance that they prepare your return correctly and according to applicable tax laws. However, you are still ultimately responsible for the information included in your return.

Winner: Accountant

Accountants specialing in tax preparation have amassed considerable experience with business tax returns. Accountants can ensure your return is mistake-free and make sure your return adheres to all federal and state regulations.

Accounting Software vs Accountant: Which One Should I Choose?

Ultimately the choice between accounting software and an accountant will depend on your circumstances. Small businesses, such as sole proprietors, may be able to get away with using sophisticated software to prepare their returns.

On the other hand, partnerships and corporations may need to hire an accountant to navigate complex business tax laws. Smaller businesses with minimal business activities can probably get by with accounting software early on but may need to transition to an accountant as their businesses grow.

Remember that the upfront expense of hiring an accountant may pay off since they will help you identify potential tax savings and save you time (and headaches) compared to preparing your return on your own. We hope this article helps you decide tax software vs. accountant.

Have you been thinking about the accounting software vs accountant debate? Are you toying with the idea of hiring an accountant for the first time? Our pros at Shared Economy Tax can help you make keep your taxes simple.

When it comes to the most difficult questions, our experts have got you covered. Get started now with a complimentary one-on-one strategy session! No more worries – talk to us today and get back on track.