Transportation expenses can be among the biggest expenses for employees and business owners. The IRS allows you to take either the actual expenses for your travel costs or a standard mileage rate. Knowing which one to take can mean significant tax savings. We’ll look at the current standard mileage rates, their use, and the alternative option.

What is the Standard Mileage Reimbursement?

The standard mileage rate simplifies the deduction for vehicle-related expenses. With the standard mileage rate, you multiply by the number of miles driven to calculate the vehicle-related deduction. Without the standard rate, taxpayers would have to track gas, maintenance, insurance, and vehicle depreciation expenses.

Note that once you have claimed actual expenses for a vehicle, you must continue to use the actual expense method as long as you use the car for business. If you use the standard mileage rate, you can later switch to the actual expense method.

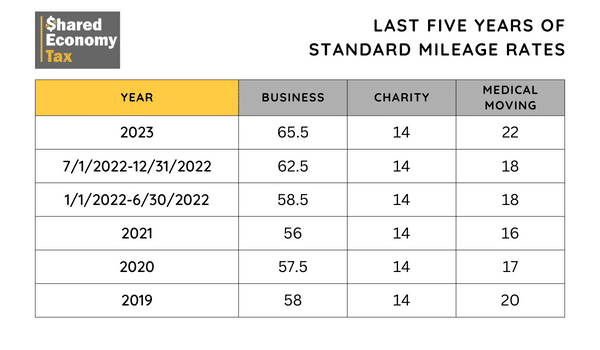

The IRS sets the standard mileage reimbursement rate. Though it usually only changes once a year, the IRS sometimes makes midyear adjustments. An increase/decrease would be due to gas prices rising significantly during the year. This happened in 2022. Other factors, such as changing vehicle maintenance expenses, can also affect the mileage rate.

Should I Use the Standard Mileage Method?

There is no one size fits all answer. Whether you should use the standard mileage method or the actual expense method is an individual decision. The right method depends on numerous factors.

One of the biggest benefits of using the standard rate is that it simplifies your record keeping throughout the year. You only need to log your miles during the year and then use the standard rate to calculate your deduction at the end of the year.

The standard rate may also yield a larger deduction than actual expenses, depending on your area’s gas price, the vehicle’s age, and insurance costs.

The standard mileage method is usually a good option for split-use vehicles. Split-use means your vehicle’s use is for both personal and business purposes.

For new vehicles or luxury cars, the actual expense method tends to yield higher deductions, since depreciation is highest in the earlier years of owning a vehicle. Note that in recent years, the IRS has allowed bonus depreciation on vehicle purchases, which increases the depreciation deduction in the first five years.

Heavy vehicles (over 6,000 pounds) are also eligible for a 100% first-year Section 179 deduction, so the actual expense method generally yields a larger deduction. Depreciation rules and calculations can be tricky, so it’s best to consult with a tax professional when calculating the deduction.

For the actual expense method, you’ll need to keep careful records throughout the year for your vehicle-related expenses in order to take the deduction at the end of the year.

But the only way to know for sure which option is best for you is to calculate using both methods. Then see which one gives you a more significant deduction.

What Was the Standard Mileage Rate for Tax Year 2022?

The high inflation during 2022 led the IRS to change the standard mileage rate halfway through the year. This was to account for the rapidly increasing expenses.

In 2022, the standard mileage rate was $0.585/mile for the first half of the year and $0.625/mile for the second half of the year.

When calculating the vehicle-related deduction for the year, taxpayers need to track miles driven in each half of the year. Taxpayers cannot use the higher rate for all their annual miles.

What’s the Standard Mileage Rate for 2023?

With inflation still high, the IRS increased the mileage rate again for 2023. The rate (currently) in effect for 2023 is $0.655/mile. The IRS may increase the rate midyear again to account for ongoing inflation.

Note that this rate only applies to business mileage for employees and business owners. Other rates apply to charitable miles, moving miles, and medical miles.

How to Claim the Standard Mileage Rate

You need to take several important steps to claim a vehicle expense deduction.

You need to keep a business mileage log. The log should contain miles driven, the trip’s purpose, and the trip’s date. The more details you have, the easier it will be to justify your expenses in the event of an audit.

It was standard in the past to track your miles in a notebook. But today, there are several apps that allow you to keep track of your business miles on your phone.

To claim the business mileage deduction, you’ll use Form 2106-EZ. The form asks for a description, the date you place the vehicle in service, the total mileage driven for the year, and the number of business miles.

In years with multiple rates, the business miles will require multiple inputs for each time period.

There are several criteria for a mile to be considered a business mile. Commuting from your home to your primary work locations is not considered business driving, so you should be careful to exclude these miles.

However, if you usually work from home and need to go into an office location, it would be considered business mileage. You can also count the driving between various work locations.

The calculation of business mileage can be complicated, so you should consult a tax professional to ensure that you are only claiming eligible miles and have the necessary documentation to justify the expense.

Closing Thoughts on Business Mileage Deductions

Vehicle expenses can be a significant deduction for many businesses. Because of the importance of the deduction, you should keep documentation to justify your expenses, make sure you’re using the correct mileage rate, and only claim appropriate miles.

A tax professional can help you sort through the ever-changing rules and ensure you comply with the requirements for claiming the deduction.

Do you have questions about calculating the standard mileage reimbursement for you or your employees, or do you need other accounting assistance? Get started now for a free one-on-one strategy session with our tax pros.