If you work as an employee, your employer automatically withholds money to cover your taxes. However, freelancers and independent contractors need to handle their own taxes. If you’ve been freelancing for a while, you’ve probably had a client that asked for a W9 form. You probably know that these forms list your tax data for the client, but what else do they do? Does From W9 affect taxes? Where do you get one? How do you fill it out? You’ll find answers to all of these questions in this helpful article.

What is a W9 Form?

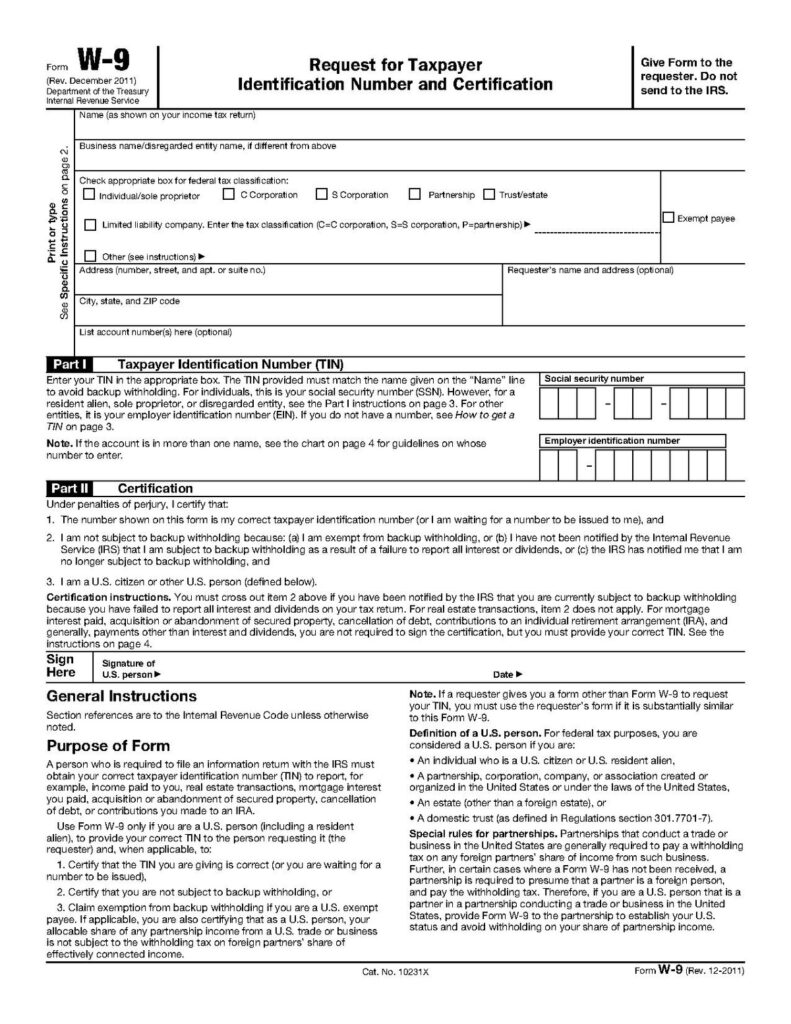

A W9 form is a request for taxpayer information and certification. It’s typically used to file an information return, such as a W2 form or 1099 MISC. These forms can help the employer identify when they submit paperwork to the IRS. If an employer wants to write off your wages, it has to file a 1099 listing total payments and the payment recipient. This gives the company proof of the expense and it tells the IRS who received the income.

W9 forms include fields for your name, address, tax ID number, and social security number. The form never actually goes to the IRS. Instead, an employer or individual keeps it on file to reference when they file their information return.

What is a W9 Used For?

If you work freelance or as an independent contractor, your clients may ask you to fill out a W9 form. They usually request these forms when they plan on submitting a 1099 MISC to the IRS for your wages. Clients usually issue a 1099-MISC whenever they pay a contractor more than $600. For example, if you earned $750 in 2020 for freelance photography work, you will likely receive a 1099-MISC declaring the income. Conversely, if you hired a contractor and paid them $600 in 2020, you have to file a 1099-MISC for the expenditure.

Employers need your taxpayer information to submit a 1099 Form, so they use the W9 form to catalog that info. They keep the W9s on file and reference them when they’re ready to issue a 1099 MISC. If you need to submit a 1099 Form for one of your contractors, you have until January 31st to get it done.

How to Get a W9

You can access tons of basic tax forms on the IRS website. If your client asks you for a W9, play it cool and say, “Sure, no problem!” Next, pop onto the IRS website and download the most recent version here. It only takes a few seconds to complete the form, but make sure you save a copy once its filled out. That way, you’ll have one ready the next time a client asks for it.

How to fill out a W9

Filling out a W9 form is simple. First, you list your name, address, and business entity type. If your business isn’t organized as an entity, fill it out as an “individual/sole proprietor”. Next, you must provide a tax ID or social security number. The form also asks for exemptions, but most individuals can skip this section. Finally, sign it at the bottom and you’re all done. You can complete your W9 form entirely online or print it out for an old school approach.

How will a W9 Affect My Taxes?

If you filled out a W9, chances are you can expect to receive 1099. If you receive a 1099 form, the IRS knows about the income. If your reported income doesn’t match what the IRS has on file, the IRS will likely look into it. If you expect to owe more than $1,000 in taxes, you need to make estimated tax payments. You can easily submit tax payments online. Click here to learn more.

More Help with Freelancer Taxes

Taxes can be confusing for many people. Working with a tax advisor can help you avoid pitfalls and maximize your tax savings. Shared Economy Tax has been providing tax and accounting services for hard-working freelancers like you for years. We understand the complex challenges that your business is facing. Our dedicated team is here to help you tackle even your most complex tax issues. Get started today with a no-obligation one-on-one strategy session with a certified tax pro today. You can also sign up for our free tax tips newsletter using the form below.