Amortization is a term you’ve probably heard a few times, but it’s a little tricky to define. To complicate things more, it has more than one meaning in the financial sense. However, it’s important that you understand how amortization impacts your business taxes so you can take advantage of amortization expense deductions. Learning about amortization can help you identify deductions that you didn’t know about, so every business owner should at least understand the basics. So, what the heck is amortization anyway?

What is Amortization?

Amortization has two perfectly acceptable uses in finance terms. One describes a type of loan, and the other describes a way to calculate deductible expenses.

Definition 1: Loan Amortization

When you make a payment on certain types of loans, you’re covering both the principal loan balance and interest. This process of paying down interest and principal over time is called amortization.

Examples of Amortized Loans

Loans with fixed payments that incorporate both principal and interest are amortized over time. A few common examples of amortization loans include:

Mortgages

Each month, your mortgage payment is allocated towards both interest and principal. At first, the interest portion is much larger than the principal. However, this eventually inverts and the principal begins to comprise most of your payment over time. Most mortgages have an amortization schedule of 30 years. However, shorter-term mortgages allow borrowers to amortize their loans more quickly.

Car Loans

Auto loan payments also typically include both interest and principle. Most auto loans range from 36 to 60 months. Once you have paid off the interest and principal balance, you own the vehicle and the loan is fully amortized.

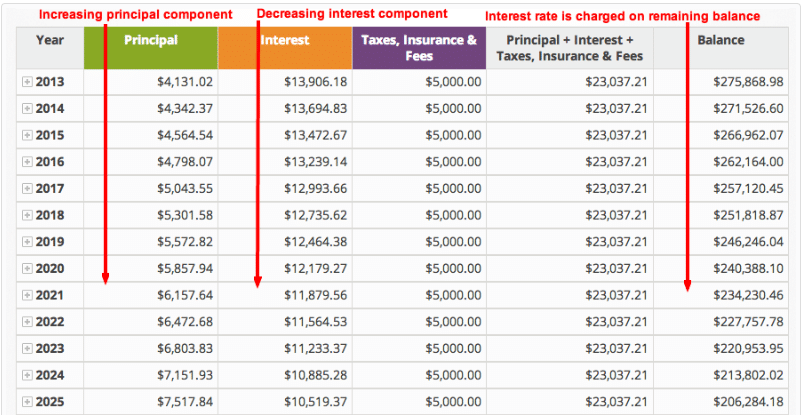

Amortization Schedules

An amortization schedule lists each scheduled payment and outlines how it is split between principal and interest. At first, most of your payment goes towards interest, but this inverts over time. Eventually, the principal portion becomes much larger than the interest. An amortization schedule explains exactly how the principal-to-interest ratio changes as the loan matures, so you know exactly what you’re paying for each over the lending term.

Here is an example of an amortization schedule:

Definition 2: Amortized Intangible Assets

When businesses invest in an asset, the upfront cost is usually not deductible. In most cases, businesses use depreciation to slowly deduct the cost of the asset as it progresses through its useful life. However, you cannot depreciate intangible assets because they are not physical in nature. We use amortization to gradually write off the cost of an intangible asset. Depreciation and amortization are essentially the same in this regard, but they’re used for different types of assets. More on this below.

Intangible Assets

Intangible assets include anything that is not physical in nature, including patents, business licenses, copyrights, and trademarks. These types of assets usually have no value at the end of their useful lives. Businesses can either acquire or create intangible assets. Purchased intangible assets usually have a set value based on their purchase price, and amortization allows business owners to deduct the cost of those assets over the course of their useful lives.

Businesses can also create intangible assets, but these assets have no balance sheet value so they aren’t typically amortized. Instead, businesses immediately write-off the cost of creating the asset as a fully-deductible expense. For example, a business that receives a patent has just created its own intangible asset. While this asset has no immediate book value, the company can immediately deduct the patent application fee and other associated costs as an expense.

Amortization vs Depreciation

Businesses use depreciation to gradually write off the cost of a tangible asset, like a building or vehicle. However, businesses use amortization to gradually deduct the cost of intangible assets, like startup costs and goodwill. Accounts usually calculate amortization expenses using a straight-line method. Just like with depreciation calculations, you can spread out the cost of an asset over its useful life.

What is Amortization Expense?

You can deduct amortization expenses to reduce your tax liability. Deducting amortization lowers taxable earnings and shrinks your year-end tax bill. You can deduct a portion of the cost of an intangible asset for each year that it’s in service until it has no further value.

How to Calculate Amortization

Accountants typically use the straight-line method to calculate amortization. First, you start with the total cost of the asset. Next, you determine its useful life. Determining the asset value can be tricky in some instances. However, most intangible assets have a clear and predetermined life span, like with a term insurance policy or a multiyear building lease. Once you know the numbers, take the asset cost and divide it by its useful life in years. The resulting number is your annual amortization expense, and you can deduct this total as an expense every year until the asset’s value goes to zero.

Let’s look at an example involving a liquor license to get a better idea of how amortization expenses work.

Example

Your business buys a 10-year liquor license in a hot market for $100,000. The liquor license is an obvious business asset but it’s not a physical object, so it’s classified as an intangible asset. Since it’s an asset, you can’t immediately claim a $100,000 write off for the year you purchased the license. Instead, we can use the straight-line method to calculate amortization expense over the license’s 10-year term. Each year, you can claim a $10,000 depreciation expense until the liquor license expires after ten years.

How Does Amortization Affect Business Taxes?

You can deduct amortization expenses from your taxable business income, thus reducing your overall tax liability. This can ultimately lower your year-end tax bill. You can spread out amortized deductions over time instead of taking an upfront write-off on the purchase. If you’re not claiming an amortization expense on your intangible assets, you’re missing out on an easy write-off. In most cases, you want to claim every applicable deduction so you can minimize your tax liability, so you should take advantage of this deduction if you can.

Start Minimizing Your Tax Bill Now

There are tons of deductions that can help you minimize your taxable income, and amortization is only one of them. If you’re not a tax pro, you might not even be aware of all the deductions that you can claim. You should consult with a tax advisor to ensure you’re taking advantage of every available write-off. A tax pro can also help you develop a tax planning strategy that can help you save even more money.

Shared Economy Tax has been serving the small business community for years, so we know all about the hidden deductions that can help you save. Get started today with a one-on-one strategy session with a certified tax pro from Shared Economy Tax. We can answer all of your toughest tax questions, and there’s absolutely no obligation for scheduling a chat. For more free tax tips, sign up for our official newsletter using the form below.