If you’re thinking about wading into homeownership or are considering refinancing this year, it’s important to know how the mortgage interest deduction will affect you. The IRS limits the amount of mortgage interest that homeowners can deduct. We’ll take a look at the mortgage interest deduction limits for 2023, how mortgage interest affects your deductions, and other possible deductions for homeowners.

What is the Mortgage Interest Deduction Limit for 2023?

The mortgage interest deduction is one of the most significant deductions for most taxpayers.

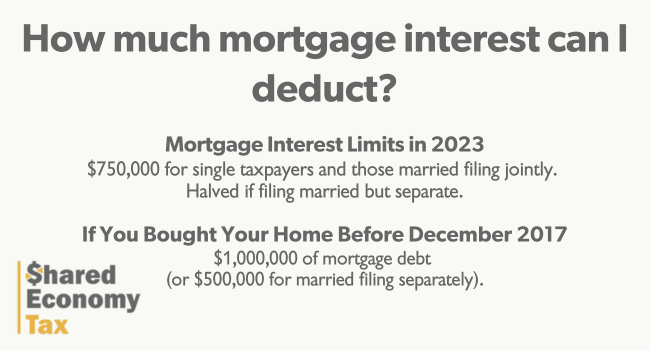

For the year 2023, the mortgage interest deduction limit is set at $750,000 for single taxpayers and those married filing jointly. This means that if you have a mortgage of $750,000 or less, you can deduct all the interest you pay on that loan from your taxable income.

However, the limit is halved to $375,000 if you’re married and filing separately. Each spouse can deduct the interest paid on a mortgage up to this amount.

If you got your mortgage before December 1, 2017, you can deduct interest on up to $1,000,000 of mortgage debt (or $500,000 for married filing separately.)

As for income limits, there are currently no income limits on the mortgage interest deduction. Whether you make $50,000 a year or $500,000, as long as you have a qualifying mortgage, you can deduct your mortgage interest.

There are no lifetime limits on mortgage interest. As long as your mortgage is within the aforementioned limits ($750,000 for single or joint filers and $375,000 for those married filing separately), you can deduct your mortgage interest each year for as long as you hold the mortgage.

How Will High-Interest Rates Impact Mortgage Interest Deductions?

As interest rates have been on an upward trend since the beginning of 2022, new home buyers and those looking to refinance their homes will likely face higher interest costs than in previous years. This rise in interest rates directly affects your mortgage interest deductions.

Because you’re paying more interest on your loan due to the higher rates, you’ll likely have more interest to deduct when you file your taxes. This bigger deduction can offset some of the costs associated with these higher rates, effectively reducing your overall tax burden.

Now, if your loan is smaller than the limit for the mortgage interest deduction ($750,000 for single or joint filers, $375,000 for those married filing separately), you should be able to deduct all your interest costs. However, this deduction applies only to mortgages used to buy, build, or substantially improve your primary or secondary residence. Mortgages used for other purposes may not qualify for the total interest deduction.

What Loans Qualify for a Mortgage Interest Deduction?

As you navigate the landscape of homeownership and mortgages, knowing which types of loans qualify for the mortgage interest tax deduction is essential. According to Rocket Mortgage, several kinds of home loans can give you access to this beneficial deduction.

Any home loan used to buy, build, or significantly improve your home qualifies for this deduction. This includes your primary mortgage and loans you might take out for significant renovations or constructions.

Home equity loans and home equity lines of credit (HELOCs) are also eligible. Similarly, a second mortgage may qualify for the mortgage interest deduction. It qualifies provided its use is for buying, building, or improving your home.

If you refinance your home, you’re still eligible for the mortgage interest deduction. This is, provided, the new loan meets the same qualifications (buy, build, or improve). Just ensure that the home associated with the loan’s use is to secure the loan.

What Other Mortgage Costs Can I Deduct?

Your mortgage deductions may not be limited to just your mortgage interest.

Interest On The Mortgage For Your Main Home:

The interest you pay on your primary residence’s mortgage is tax-deductible up to loan limit. This makes it one of the most significant tax benefits for homeowners.

Interest On The Mortgage For A Second Home:

This tax deduction applies to mortgages on a second home as well, provided the home’s use is for the mortgage. There are specific requirements if you rent out the second home. There are requirements such as living there for more than 14 days or over 10% of the rental days.

Late Payment Charges On Your Mortgage: Unexpectedly, even late payment charges on your mortgage are deductible. If you miss a payment and incur an extra fee, that fee is tax-deductible.

Interest On A Home Equity Loan:

The interest on a home equity loan or line of credit is also deductible. It is deductible as long as the funds’ use is to buy, build, or substantially improve the home that secures the loan.

Prepayment Penalties:

If you face a penalty for paying off your mortgage early, known as a prepayment penalty, this too can be written off on your taxes.

Interest Paid Before Selling Your Home:

The interest paid on a home loan is also deductible before you sell the home. This can include interest from the date you close to the date of your first payment, known as prepaid interest.

Final Thoughts on High-Interest Rates & Mortgage Interest Deduction Limits

It’s vital to understand how these factors interact when it comes to high-interest rates and mortgage interest deduction limits. The structure of the mortgage interest deduction means that higher rates won’t push you over the limit. This is because as the deduction bases itself on the loan’s value, not the interest you pay.

You can deduct your mortgage costs on your itemized return if your mortgage stays within the set boundaries. Although higher rates may mean more out-of-pocket expenses. You can find some relief in the fact that these expenses will lead to more substantial deductions on your taxes.

While higher rates may not be ideal, they come with the silver lining of larger tax deductions to help buffer the impact. As always, each financial situation is unique, and it’s wise to consult with a tax professional or financial advisor to guide your mortgage and tax decisions.