Although people have been sharing since the beginning of time, the sharing economy is still in its infancy. With ever-changing regulations and tax laws, it can take a lot of work to keep up with it all. However, the IRS will be receiving over $50 billion in additional funding over the next ten years.

So, how will this additional funding affect your taxes and the sharing economy? We’ll examine how the IRS will use this funding, if you should be more worried about audits, and what to do if you’re up for an audit.

What is the Deal with the New IRS Funding?

The inflation Reduction Act (IRA) added funding for several programs, including climate change and healthcare. The Furthermore, the IRS received an additional $80 billion over the next few years as part of the act. You can read more about the details here.

So, how will the IRS use this extra money?

The IRS will use a significant portion of the funds to increase the number of auditors. They expect to hire and train 87,000 auditors over the next several years. Additionally, it’s worth noting that many of these new auditors will replace retiring IRS agents.

Despite the large number of new auditors, the IRS has pledged not to increase the audit rate on taxpayers making less than $400,000. However, many people (including us) are dubious of this claim.

The IRS will also be using the funds to update its technology. Many IRS systems were programmed decades ago and use outdated programming languages. The IRS plans on upgrading its hardware systems with additional funding.

Some of the funding will go towards improving taxpayer services, including reducing hold times for phone calls and processing paperwork more timely.

Has the IRS Funding Been Cut?

As part of the recent debt-negotiation legislation, the additional funds allocated to the IRS were cut by $21 billion. The clawback is way to prevent cuts to other programs, including the IRS’s normal operating budget.

The IRS has been slow to hire and train new auditors, so the immediate funding cut will not significantly impact its long-term expansion plans.

What Does the IRS Funding Mean for Shared Economy Businesses?

As an entrepreneur in the shared economy, you may wonder what this IRS funding increase means for you. There’s a strong likelihood that you may experience higher audit rates in the coming years.

This doesn’t necessarily mean that you will have an audit. But it’s important to understand that the probability may increase. The IRS’s plans include hiring more agents, leveraging AI-powered technology, and other potential enhancements. This expansion, fueled by additional funding, means more resources will be available to conduct audits and better technology to evaluate returns.

So while it’s not a guarantee that you’ll have an audit, it’s likely that audits will become more common in the sharing economy.

Do Shared Economy Businesses Face More Audit Risks?

As a participant in the sharing economy, you might be wondering whether your business faces a higher risk of being audited. If you run a smaller business, particularly as a sole proprietor, your risk might indeed be elevated. The unique nature of sole proprietor income often draws more attention from tax authorities, making audits more likely.

If you’re a higher earner within the shared economy, bringing in $400K or more annually, you should prepare yourself for an increased likelihood of audits. Given the larger potential discrepancies in these tax returns, the IRS is particularly interested in higher income brackets.

So, while participating in the shared economy offers many advantages, it’s important to be aware of the potential risks. Furthermore, preparing yourself and keeping meticulous financial records can help mitigate these risks and make any potential audits smoother.

How to Minimize Your Audit Risk

Start by keeping all your receipts and maintaining organized, accurate records. More importantly, this isn’t something you can delay – it’s crucial to begin right now. If the IRS does start an inquiry, being able to quickly provide evidence to back up your claims can help resolve the matter swiftly.

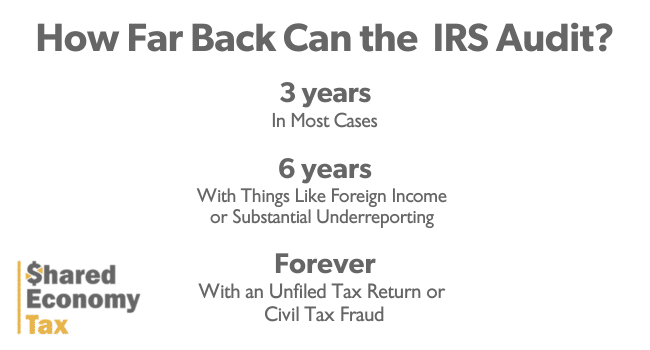

By keeping your books organized and being ready to produce receipts when asked, you can prevent an inquiry from escalating into a full-scale audit. Remember, the IRS can review records from several years back, so keeping your financial documents well organized from the get-go is important.

Doing these things might seem like extra work, but they’re well worth it. They’re your first line of defense against an audit and can save you a lot of trouble down the line.

What Do I Do if the IRS Audits Me?

First of all, don’t panic. It’s crucial to stay calm and approach the situation rationally.

Never try to dodge contact with the IRS. Avoiding them will only make things worse. Instead, respond to their information requests promptly and cooperatively. Always be respectful and courteous to the auditors. They are just doing their job.

Remember, honesty is the best policy. Never lie or try to hide information from an auditor. Furthermore, doing so could land you in legal trouble, as the IRS might see it as an attempt to commit tax fraud.

If you feel overwhelmed or need more clarification about the process, consider hiring a tax lawyer specializing in IRS audit defense. They can provide valuable guidance and advocacy to help you navigate the audit.

Finally, if you’ve been honest and maintained good records, you’ll come out of the audit just fine. Afterall, the best defense against an audit is a clean, well-documented financial history.

Final Thoughts on the IRS Increased Funding

With the IRS receiving increased funding, we will likely see a surge in audit rates in the near future. This impending reality makes it crucial for you to immediately strengthen your accounting and tax practices. Make sure all your financial records are comprehensive, organized, and accurate.

Moreover, having an experienced tax advisor by your side is also now more important than ever. Their insights and advice can help you navigate the intricacies of tax law. Afterall, this is particularly true if you’re participating in the sharing economy. They can help you adhere to all relevant tax rules and regulations, thereby minimizing your risk of an audit.

While it may feel daunting, with proper preparation and expert guidance, you can confidently face any increased scrutiny. Remember, it’s about proactively managing your financial practices and seeking professional advice when needed.

Concerned about the impact of the new IRS funding on your sharing economy business? We offer guidance and support to ensure you are ready for any potential audits. Contact us now for a free strategy session to get you on the right track. Click here to get started.