The Setting Every Community Up for Retirement Enhancement (SECURE) Act was enacted in 2019. It changed many rules around retirement savings. In 2022, a second version, the Secure Act 2.0, was enacted, further strengthening retirement options for taxpayers.

What is the Secure Act 2.0?

The primary purpose of this law was to address the issue of retirement savings. It means to incentivize people to save more for retirement.

Before the act, Americans were significantly underfunding their retirements. Although it will take years before the full impact of the Secure Act 2.0 will be known.

Congress passed the SECURE Act with bipartisan support. This spoke to the urgency of addressing significant underfunding of retirement. The Act made tax savings available to encourage more people, especially small businesses, to beef up their retirement savings.

In 2022, Congress passed a second version of the SECURE Act, known as SECURE 2.0. Again, lawmakers in both parties supported the passage of the Act. The 2.0 version addresses shortfalls in the original plan and expands the original law’s provisions.

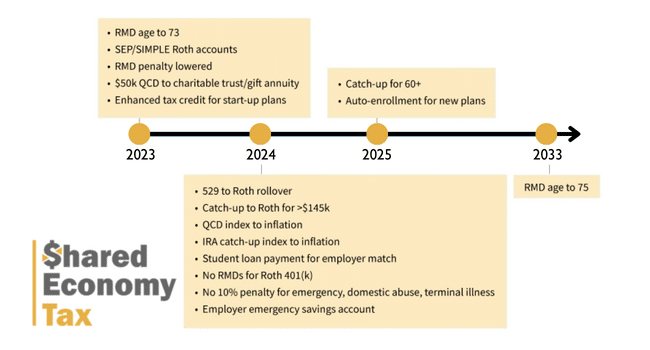

This new law, SECURE Act 2.0, brings changes to retirement planning rules, which will be implemented over several years starting in 2023.

The purpose of SECURE Act 2.0 is to provide motivation and opportunities for individuals to increase their retirement savings. The Act makes it easier for small businesses to offer retirement benefits to employees. This allows more Americans to save effectively for retirement.

The Act enhances the accessibility and flexibility of retirement plans and allows savers to tailor their retirement savings strategy more effectively to their individual needs and circumstances.

When Does Secure Act 2.0 Take Effect?

The Secure Act 2.0 takes effect over several years. The first changes started in 2023 with the change in age to begin taking RMDs. The final changes in the law don’t take effect until 2033.

We’ll take a look at the upcoming changes in detail in the next section.

New Rules from Secure 2.0

While there is a delay for some of the Secure Act 2.0 changes, some will take effect in the next few years:

Changes to RMDs

One of the most impactful changes in the Act is the change in the age when Required Minimum Distributions (RMDs) start. The original SECURE Act increased the age from 70.5 to 72. Secure 2.0 further increases it to 73. Beginning in 2033, RMDs will not be required until age 75.

By increasing the age for RMDs, you can stretch retirement savings to more advanced ages.

The SECURE Act 2.0 also provides relief in terms of the income tax penalty for failing to take an RMD.

Previously, individuals faced a 50% penalty for failing to take an RMD. The new legislation reduces this penalty substantially, reducing it to 25%. Correcting any mistakes within a certain timeframe can reduce the penalty even further to just 10%.

“Rothify” Catch-Up Contributions

From 2024, there will be a significant change to the rules governing catch-up contributions. These are the additional contributions that individuals aged 50 or older can make to their retirement plans beyond the usual annual limit.

Under the SECURE Act 2.0, anyone earning over $145,000 will have to make these catch-up contributions on an after-tax basis or “Rothify” their contributions. While this adjustment will help recover some of the tax revenue that might otherwise be lost due to other provisions in the SECURE Act 2.0, it also has the added benefit of allowing these individuals to withdraw their catch-up contributions tax-free once they are in retirement.

New Catch-Up Contribution Limits

In 2025, the SECURE Act 2.0 will implement another significant change regarding catch-up contributions.

The SECURE Act 2.0 says that individuals aged 60-63 will be able to contribute an additional $10,000 or 50% more than the regular catch-up amount, whichever is greater.

This rule encourages individuals to increase their savings during the final years leading up to their retirement.

Small Business IRA Overhaul

The Act includes several provisions to equalize retirement savings options between small and large businesses.

Small business owners will now have the ability to contribute to Roth SEP IRAs and Roth SIMPLE IRAs. These new rules aim to establish equality between small and large employer retirement plan options, which could have significant implications for the small business sector in terms of recruitment and employee retention.

529 Plans

Another interesting provision of the Act relates to 529 College Savings Plan accounts.

Unused funds in these accounts can now roll over into a Roth IRA for the account beneficiary, subject to annual contribution limits and an aggregate lifetime limit of $35,000. Suppose the remaining funds in these accounts are for your children or grandchildren. In that case, you can use this strategy over a 5–6-year period to assist them with their retirement planning and income tax considerations.

What Does It All Mean for Taxpayers?

Here’s how the new Secure 2.0 rules will affect taxpayers:

Individuals

Individual taxpayers, particularly those close to retirement, will enjoy more flexibility and potentially higher savings. The increase in the RMD age and the changes to the catch-up contributions rules can both significantly impact an individual’s retirement strategy and potential savings.

High earners will have to make catch-up contributions to a Roth plan, which will lower current-year deductions.

Businesses

The new rules can lead to long-term benefits for small businesses, as the expansion of retirement benefits options can aid in attracting and retaining talented employees.

Our Thoughts on Secure 2.0

When assessing the SECURE Act 2.0, it’s important to focus on its financial and tax implications.

While it’s challenging to categorize a bill as universally ‘good’ or ‘bad’ due to the various financial circumstances of taxpayers, the SECURE Act 2.0 appears to provide more opportunities for retirement savings.

These increased opportunities may translate into long-term financial benefits for many Americans. On the downside, taxpayers with higher incomes will now see their catch-up contributions taxed upfront, which some may perceive as a disadvantage.

How to Plan for Secure Act 2.0

To prepare effectively for the SECURE Act 2.0, it’s essential to remain informed about when the various components of the law will come into effect and how they may impact your financial situation.

Tailoring your retirement savings strategy to maximize the new law’s benefits, such as taking advantage of the increased catch-up contributions or delaying RMDs, can be hugely beneficial. Talk to our tax pros to see how your retirement strategy could benefit from the Secure Act 2.0.