The influencer market is booming, turning content creators into entrepreneurs running profitable businesses. But this financial growth means you need good accounting practices. The IRS is watching influencers closely, and poor accounting can lead to audits. As influencers become more economically significant, managing finances professionally is key.

Accounting for Influencers: The Basics

Influencer Marketing Hub reports the influencer market now generates over $21 billion in revenue each year. Even if you earn just a tiny fraction of that, the IRS is paying attention to the money flowing through the market.

You may think you’re just creating content and having fun, but the IRS views you as a full-scale business. So, you need accurate books and records. Track your income and its sources, as well as your expenses. This prepares you for tax time and helps you defend your deductions if the IRS audits you.

Remember, your reputation is your brand. Headlines about tax evasion can damage your brand and erode public trust.

Influencer Income Classification

The ways you can earn money are diverse and lucrative. Sponsored posts are a common income source, where you get paid to promote brands or products. This income falls under self-employment, making it subject to both income and self-employment taxes. You can often deduct business expenses tied to content creation.

Another way to earn is through affiliate marketing, where you promote products and earn commissions. You must report this income, and you may be able to deduct associated expenses. Companies often send you a Form 1099-MISC if you exceed a certain earning threshold.

Selling branded merchandise is another way to boost earnings. The money you make from this is taxable, and you have to handle any applicable sales tax. You can usually deduct expenses for production and marketing.

How Taxes Work for Influencers

Most influencer income is freelance income. This means you’re responsible for all income taxes and self-employment taxes. No one is withholding taxes from your pay, so you must make quarterly estimated tax payments.

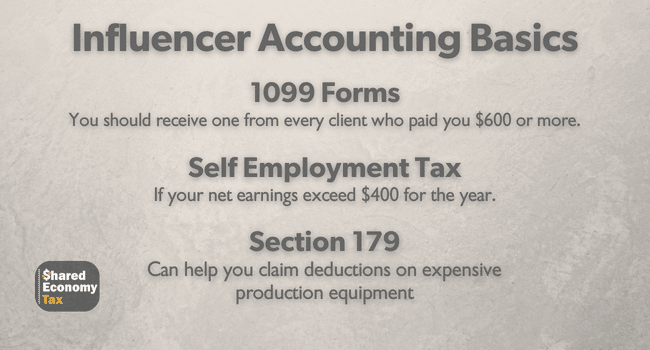

If you make more than $400 per year after operating expenses, you’re expected to make payments on your self-employment taxes every quarter.

If a company pays you more than $600 in a year, they should send you a 1099-NEC. You must report all your income, even if you don’t get a 1099.

To figure out your taxes, use these forms and your records to calculate your annual income. Then, divide your estimated taxes into four quarterly payments.

Tax Tips for Influencers

Here are some strategies to minimize your taxes:

Maximize Deductions

This list isn’t exhaustive but should help you start:

- Equipment: Deduct the cost of cameras, computers, and other tech used for content creation. Keep all purchase receipts.

- Travel Expenses: You can deduct costs for travel related to your business, like events or meetings with sponsors. Keep detailed records.

- Home Office Expenses: If you use a part of your home only for business, you can deduct related expenses with the home office deduction. Document the space used to verify your claim in case the IRS comes knocking.

- Advertising and Marketing: Deduct costs for promoting your content. Keep receipts and note the associated campaigns.

- Professional Services: Fees paid to managers, accountants, or lawyers are deductible. Keep detailed invoices.

- Educational Expenses: Deduct costs for relevant workshops, courses, or training. Keep receipts and note the relation to your business.

Keep Accurate Records

Consistent accounting throughout the year saves you time and stress later. Software like Xero and QuickBooks can help you stay organized.

Review Your Business Structure

You might start as a sole proprietor but consider becoming an LLC or corporation for added benefits and protections.

Work with an Expert

With diverse income streams, consulting an accounting expert can help you navigate the complex rules of your industry.

Closing Thoughts

The tax world for influencers is complicated, and the IRS is watching closely. Being self-employed increases your audit risk. Managing both the creative and business aspects of your career requires a strategic approach to finance. Remember to document and accurately report each deduction to ensure compliance and a smooth tax season.

Shared Economy Tax specializes in tax services for influencers and other independent contractors. Our veteran tax experts craft custom tax strategies that can save you thousands on your current tax bill.

Get started now with a complimentary one-on-one strategy session, and see how much you can save.