varItMak

Most people are well aware of income tax and sales tax, but are less aware of excise taxes. So what is excise tax?

What are Excise Taxes?

An excise tax is an additional type of tax imposed on the sale of specific goods and services.

Manufacturers and retailers collect most excise taxes, but there are a few exceptions, such as DMV fees and property taxes, that consumers pay.

What is the Purpose of Excise Tax?

The excise tax is often used as a way to discourage people from purchasing these items. In some cases, the government may use the tax to generate revenue.

In other cases, the government may use the tax to finance programs designed to reduce these items’ consumption.

The government charges excise taxes on top of regular sales tax. Businesses are usually the ones to pay excise taxes to state and local governments.

However, consumers indirectly pay the tax in the form of higher prices.

Excise Tax Examples

In some cases, the government levies excise taxes on activities that might be considered harmful, such as gambling.

This sort of excise tax aims to discourage consumption of the taxed goods, improve public health, and generate revenue for the government.

Excise taxes keep prices high enough to make the products or activities prohibitively expensive for many people, hence calling them “sin taxes.”

State vs. Federal Excise Tax

State and local governments both levy excise taxes, but there are some critical differences between the two.

For one thing, states typically impose excise taxes on items like gasoline and tobacco, while local governments are more likely to apply excise taxes to things like alcohol and hotels.

Another difference is that federal excise taxes are generally imposed at the point of production, while state and local excise taxes charge at the point of sale.

Finally, state excise taxes often fund specific programs or initiatives, while local excise taxes usually generate revenue for general expenses.

Despite these differences, both state and local excise taxes can be effective methods of generating revenue.

Federal Excise Taxes

The federal government charges excise taxes on various activities and products. These include fuel taxes, environmental taxes, ship transportation, tires, and foreign insurance.

The rates for these taxes vary significantly by activity. For example, ship transportation excise tax runs $3 per person, while foreign insurance excise taxes run between $0.01-$0.04 per dollar spent.

The federal government also imposes a 6% excise tax on retirement contributions above the annual limit and a 10% on early withdrawals from retirement accounts.

Declare and pay these taxes on an individual tax return.

State Excise Taxes

Each state sets its own rules for excise taxes. Common state excise taxes include taxes on vehicles, alcohol, cigarettes, and fuel.

Rates vary for each of these taxes from state to state, along with how the taxes are collected.

Consumers won’t see a line item for excise taxes on their receipts, but sellers typically pass the added cost down to consumers through higher prices.

Retailers collect excise taxes and remit them to the appropriate state taxing authority.

Excise Tax Forms

Businesses must fill out the appropriate state or federal form to pay excise taxes and then remit the payment to the proper taxing authority.

Federal Forms

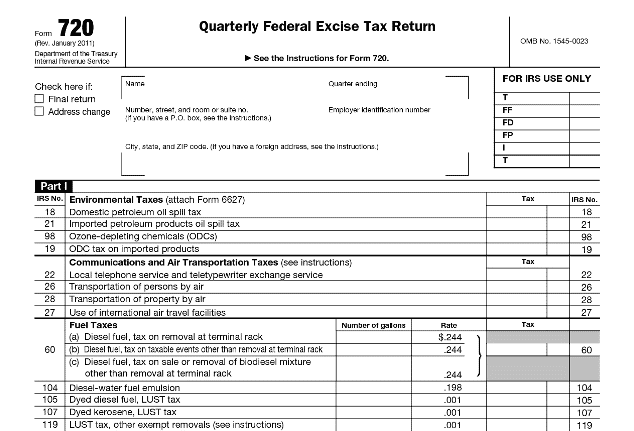

To pay the federal excise tax, complete Form 720, Quarterly Federal Excise Tax. To pay, fill out and mail in the form or complete the form through approved software vendors.

Make payment through EFTPS or by sending a check with your paper filing.

State Forms

Each state has its own form for remitting state-level excise taxes. Most states collect vehicle taxes through their respective DMVs, while the sales tax authority may collect other excise taxes.

California, for example, charges a 1% tax on the sale of lumber and an additional $0.7015 per gallon on fuel.

Are Excise Taxes Deductible?

Businesses that pay excise taxes can deduct the amount paid as a business tax on their returns. The excise tax must be ordinary and necessary to be deductible on a business tax return.

Individuals can include excises taxes paid on their individual tax returns if they itemize. Common taxes included on the returns include property taxes and DMV fees.

However, the deduction for these taxes on an individual return is limited by the State and Local Tax cap of $10,000.

How Can I Save Money on Excise Taxes?

It’s usually not possible to avoid excise taxes. However, consumers can minimize these taxes by making different choices.

Individuals must pay a 6% excise tax on excess IRA contributions that are not withdrawn by the tax filing due date, and a 10% penalty on early withdrawals from retirement accounts.

However, consumers can avoid these taxes by following the contribution rules and waiting until 59 ½ to make withdrawals from retirement accounts.

Businesses should research their products and services to determine which excise taxes apply to their business.

The IRS tracks down companies that don’t comply with excise taxes regulations, and underreporting penalties are stiff.

Businesses can minimize excise tax costs by avoiding products that are subject to such taxes

If you do sell these products, make sure you’re pricing them higher to compensate for the additional taxes.

Final Thoughts

Companies must understand the federal and state excise taxes that apply to their business. Understanding which excise taxes apply ensures that the retailer provisions enough to cover the tax and pass on the additional cost to consumers.

Most consumers never see excises taxes, but they still pay for them when they purchase certain products.

Answers to Your Toughest Tax Questions

If you have more tax questions, talk to the pros at Shared Economy Tax. We can help you solve your toughest tax challenges, including excise tax and more. Contact us today for a complimentary one-on-one strategy session with one of our tax pros.