The IRS classifies your Airbnb earnings as income, and you have to pay taxes on those earnings. If you expect to owe more than $1,000 in 1099 taxes, you must pay quarterly taxes for your earnings. Some new hosts might feel overwhelmed with these new tax hurdles, but it’s not as bad as it sounds. In fact, it’s pretty simple when you get used to it. Keep reading to learn how to file your Airbnb estimated taxes.

Calculating Airbnb Estimated Taxes

Airbnb sends 1099 forms at the end of the year, and the forms include your total recorded earnings for the period. Since Airbnb paid you directly, you didn’t pay taxes on these earnings, and that means you owe. Usually, your taxes get deducted from your paycheck under traditional employment arrangements, and your employer covers your payroll tax obligations with these funds. However, that’s not the case for Airbnb hosts because they get paid directly. You will owe taxes for Federal Income Tax, Social Security, and Medicare. These tax obligations are commonly referred to as self-employment taxes.

Airbnb Estimated Taxes Pay Schedule

You have to pay estimated taxes on your Airbnb income every quarter. Ideally, you should set aside money every quarter to cover these obligations. Quarterly payments are due on April 15th for Q1, June 15th for Q2, September 15th for Q3, and January 15th for Q4.

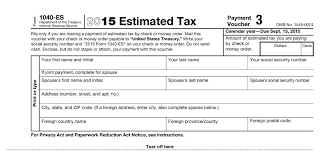

You can submit your quarterly payments by mail or online. If you go the traditional mail-in route, you will use 1040-ES to submit your payment. Here’s an example of a typical 104-ES form:

How to Calculate Quarterly Tax Obligations

You can choose from two methods to calculate your tax obligations. If you use the safe harbor rule, you just pay 25% of your previous year’s tax liability every quarter. This is a simple method, but it could leave you with a larger year-end tax bill. If you want to spread your payments out more evenly, you should calculate your actualy obligation. The more precise method is to annualized your estimated Airbnb income and deductions for the year and then calculate the liability for the quarter. What this means is that you pay tax on the income as you have received it. The amount you set aside and pay quarterly for taxes depends on what your net taxable income is likely to be when all is said and done. Other items such as outside earnings and withholding’s and other credits are also factored into this payment.

Get Airbnb Tax Help Now

Once you’ve figured out your tax liability and completed the form, mail the coupon along with your payment to the IRS. Check the IRS.gov web site for the correct address to mail it to, which depends on your state of residency. Not making estimated tax payments can also mean in a higher tax bill come April 15th, since the IRS can assess a penalty for not paying your taxes as earned. If you feel like you need help with your Airbnb estimated tax payment, please feel free to book us for any additional tax questions that you may have. You can also sign up for our complimentary tax tips newsletter using the form below.