Most adults have needed some slack at one point in time or another. Maybe a young person starting out needs a loan from the parents. In other instances, drivers who missed a stop sign or speed limit indication could ask for leniency from an apprehending police officer. Still other cases may find struggling students seeking extra time from professors to complete a term paper. In fact, time extensions are common among pleas for leniency. The Internal Revenue Service (IRS) is no stranger to these sorts of requests. To grant such an appeal, however, requires a form, namely the IRS 4868 form.

What Is the IRS 4868 Form?

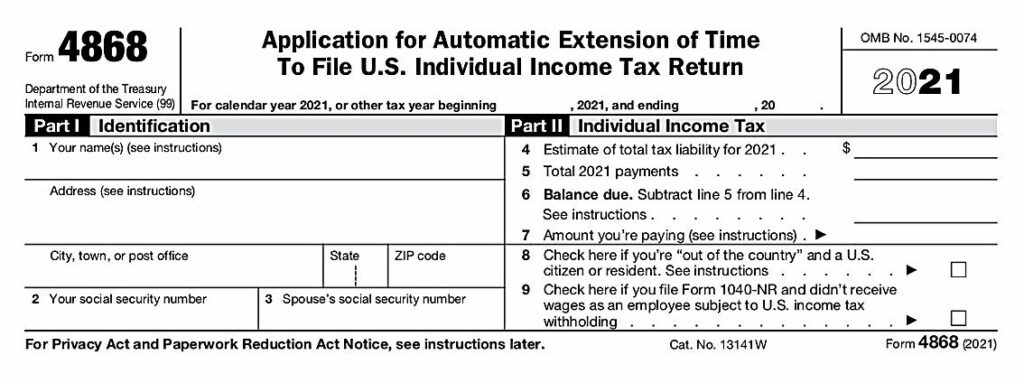

IRS 4868 is a request for an automatic six-month extension to file a personal income tax return. In most years, personal tax filings are due at the IRS by April 15. Should the 15th fall on a Sunday, or national circumstances, the COVID-19 pandemic, for example, make timely filing more difficult, the agency might push the date back at its discretion. Otherwise, personal circumstances, like traveling or living abroad, may qualify a taxpayer for an extension. Important to remember is that the extension is for filing the return. Any taxes owed are still due on April 15th and are subject to late fees.

Where Can I Get an IRS Form 4868?

Form 4868 can be submitted in hard copy or sent to the IRS electronically. The paper copy can be accessed here or received through postal delivery on request. The local public library may also keep copies available for its patrons. Those wishing to file using online means need only access the IRS e-file programs to send the request instantaneously. In 2022, the filing deadline is April 18, so any mailed IRS 4868 form must be postmarked by that date.

How to File a 4868 Form

As noted above, there are several options to forward the IRS 4868 form online. IRS Free File is one such option. Other no-cost alternatives go through the Volunteer Income Tax Assistance (VITA) program or the Tax Counseling for the Elderly (TCE) avenue. Another way is to employ tax preparation software that will provide, fill out and convey whatever form you need. Getting a hard copy form to the Internal Revenue Service by mail on time demands that the sender select the appropriate address on page four of IRS Form 4868. Not only does your receiving office depend on where you live, it is also contingent on whether you are mailing in a payment with the extension request.

Important Notes on Form 4868

2021 tax filings are due on April 18, 2022. An automatic extension places the new due date for filing a return on Monday, October 17, 2022. These dates take into account the weekends and holidays that coincide with the regular dates.

- Again, Form 4868 gives you six more months to file a return, but the (estimated) payment is still due in April. If this amount is not feasible to pay in one lump sum, then the taxpayer can request a partial payment schedule, such as one of these.

- Filing later may seem like a wonderful luxury for taxpayers who feel put upon by the mid-April deadline. After all, a whole six months extra to collect documentation and go over the calculations would appear to lend a great advantage. It all depends. If procrastination is the problem, things will not get any easier in October than they are in April. Furthermore, if payment is due, the filer must come within 90 percent of the amount that will show on the return when ultimately submitted, according to the IRS. Otherwise, interest and penalties will be attached.

- Avail yourself of an extension only if conditions make it absolutely necessary. Do not ask for one simply to make things easier. As noted above, extensions can sometimes make the postponed return more complicated. Often, starting on the return early, and completing it in bite-sized pieces, make the whole task less overwhelming and produces less anxiety. While an extended filing is never cause for an audit, those returns that trickle in later may be subject to greater scrutiny.

More Options for Late Filers

Up to now, the assumption is that the late filer owes money to pay income tax. In fact, according to CNBC, 2020 saw 74 percent of tax filers receive refunds. In such cases, late filings do not incur penalties. Therefore, those assured of a refund can avoid filing the IRS 4868 form.

For those who owe, if the six months is not adequate for preparation of an accurate return, the taxpayer can send a letter to the IRS explaining the hardship or obstacle necessitating the lengthened extension. In this letter, the filer should specify how much more time is needed.

Perhaps a better alternative is to file on time and follow it up with an amended return when all the information is available. The amended return is filed with Form 1040-X. In almost every case, the 1040-X must be filed as a hard copy or paper return. Most often, the amended return is used when the filing status is incorrect on the original 1040, when the income is wrong or when deductions and credits are entered incorrectly. Errors in math or omitted schedules do not require a 1040-X.

IRS Form 4868: Closing Thoughts

April 15th (on or about) has a way of sneaking up on people. As the tax code evolves, confidence in an acceptable return erodes and the idea of an extension can seem irresistible. Of course, there are times when a six-month extension is just the thing needed to assemble, collate and systematize all the information that goes into a personal tax return. Nobody, after all, wants to be audited. In any event, taxpayers do well to analyze the reasons for seeking an extension through IRS Form 4868. On-time filing has its benefits in both the short and long run.

Get Help With Your Taxes Now

Shared Economy Tax can help you get your taxes in order and filed by the deadline. We also handle extended returns and other challenging tax issues. Our experts specialize in helping small businesses like yours, so click here to set up a one-on-one strategy session now, or sign up for our newsletter using the form below for more tax tips!