Getting a copy of your IRS tax transcript can make it much easier to gather the information you need for filing, income verification, or financial planning. It’s also a smart way to confirm that what the IRS has on file matches the income reported by your employers, clients, or platforms.

If you’re preparing to meet with a tax advisor, pulling your transcript in advance can save time and help ensure your return is based on accurate records. Here’s how to get your IRS tax transcript — and why it matters.

How Tax Transcripts Fit Into Your Financial Records

A tax return transcript isn’t just a replacement for a missing tax return — it’s an official snapshot of what the IRS has on file for you.

In many cases, lenders, financial institutions, and government programs rely on transcripts instead of full tax returns because they come directly from IRS records. This makes them a trusted way to verify income and filing history.

For example, tax transcripts are often required when:

- Applying for a mortgage or refinancing

- Verifying income for student financial aid

- Supporting a small business loan application

- Confirming prior-year information for tax filing

Self-employed individuals and gig workers — including rideshare drivers, freelancers, and Airbnb hosts — may be asked for transcripts more frequently than traditional employees because their income can vary from year to year.

In these situations, a transcript serves as a standardized form of income verification tied directly to your IRS filing history.

Understanding how transcripts fit into your overall financial documentation can make it easier to respond quickly when lenders, advisors, or institutions request proof of income.

Types of IRS Transcripts

The IRS offers several types of tax transcripts, each serving a different purpose depending on the information you need.

Understanding the differences can help you request the right document the first time — whether you’re preparing taxes, applying for a loan, or verifying income.

Tax Return Transcript

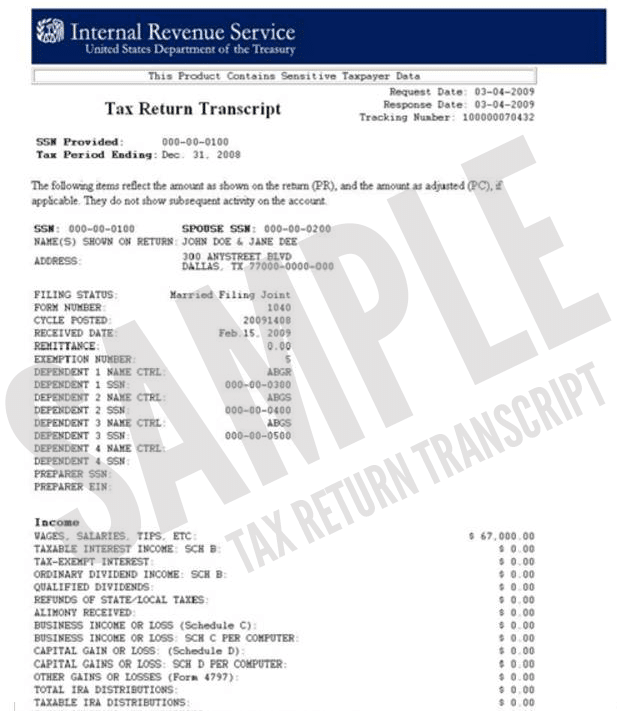

A Tax Return Transcript summarizes the information from your originally filed tax return, including your adjusted gross income (AGI), filing status, and reported income.

It reflects what was submitted on your Form 1040 but does not include changes made after filing, such as amendments or IRS adjustments.

This transcript is often requested by lenders or used to verify prior-year AGI when e-filing.

Tax Account Transcript

A Tax Account Transcript provides a more detailed view of your IRS account activity.

In addition to basic filing information, it includes:

- Adjusted gross income

- Taxable income

- Payments made

- Penalties or interest assessed

- Any changes made after the original return was filed

This transcript is helpful when you need to confirm updates or resolve discrepancies.

Wage and Income Transcript

A Wage and Income Transcript shows income reported to the IRS by third parties.

This includes forms such as:

- W-2

- 1099

- 1098

This transcript is particularly useful if you’re missing income documents or want to ensure the IRS received the same information you did.

What Does A Tax Return Transcript Look Like?

A typical tax return transcript summarizes the information from your tax return. It summarizes most of the information filed within your 1040. Here is an example of what a tax return transcript looks like:

How to Obtain IRS Tax Transcripts in Less Than 10 Minutes

You can request IRS tax transcripts for the current tax year and the prior three years at no cost.

The fastest way to access them is online through the IRS Get Transcript system. After verifying your identity through ID.me, you can immediately view and download your transcripts. Setting up an online account will also allow you to conveniently access other crucial tax information, like payment plans, correspondences, and more.

If you go this route, you can get your transcript without delay. It’s usually the best option, so this is what we typically recommend to our clients. However, there are other options for those who prefer them.

Requesting Physical Copies of Your Tax Transcripts

If online verification isn’t possible, transcripts can also be requested through these channels:

- IRS website

- Calling the IRS hotline at (800) 908-9946

- Submitting Form 4506-T

Mailed transcript requests typically arrive within 5 to 10 business days after processing when submitted online or via phon. If you submit your request via mail, it could take much longer to receive your transcript.

Reviewing Your Transcript Before Year-End

Reviewing your IRS tax transcript before the end of the year can help you catch discrepancies early and ensure your records align with what the IRS has on file.

This is especially important for self-employed individuals and gig workers whose income may come from multiple sources. Comparing your transcript with your internal records can help confirm that all reported income matches the forms submitted by employers, clients, and platforms.

In some cases, reviewing this information ahead of filing season may also uncover planning opportunities that could reduce your tax liability.

Closing Thoughts on IRS Tax Transcripts

IRS tax transcripts are more than just a backup for missing tax returns — they’re an essential tool for verifying income, confirming filing accuracy, and staying prepared for financial requests from lenders, schools, or tax professionals.

Whether you’re filing your taxes, applying for a loan, or reconciling your records, having quick access to your transcript can save time and prevent costly errors. By understanding how to obtain and review your IRS transcripts, you can stay organized, respond confidently to documentation requests, and ensure your tax filings align with what the IRS has on record.

If you’d like help reviewing your transcripts or making sure everything is reported correctly before filing season, schedule a one-on-one strategy session with a Shared Economy Tax professional today.