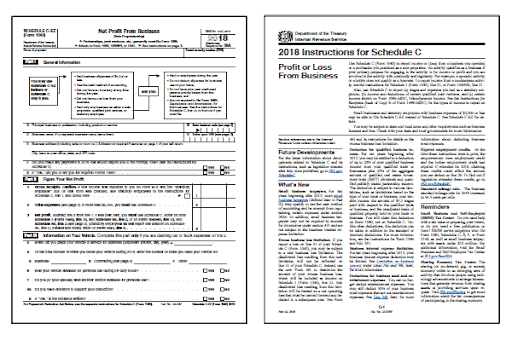

As a small business owner, it’s easy to become overwhelmed with tax-filing requirements. The number of different IRS forms can seem extremely confusing. For example, in 2018, qualifying businesses could report income on Schedule C-EZ, which is a simplified version of a Schedule C form. However, beginning in the 2019 tax year, the IRS eliminated this option. All businesses that previously filed with Schedule C-EZ must use the Schedule C, Profit or Loss from Business forms.

Now that Schedule C-EZ no longer applies, businesses may need to update their reporting procedures. This article will help businesses owners that used to file with Schedule C-EZ and will cover the following topics:

- What is a Schedule C-EZ Form?

- Who Should Use these forms?

- Do These Forms Save Money?

- Is It Right for My Business?

- Final Thoughts

What is a Schedule C-EZ Form?

Before 2019, Schedule C-EZ provided self-employed individuals a simplified tax filing option for reporting business results. Rather than use the longer Schedule C, business owners could reduce their administrative burden with a Schedule C-EZ. More precisely, this simplified version required far less time to complete. And, when business owners save time, they save money.

The standard Schedule C requires owners to report all of their income, expenses, and calculate net income. Conversely, the C-EZ version only requires basic information about the business and a simplified calculation of business profit. Naturally, the latter option required far less time to complete.

Who Should Use a Schedule C-EZ Form?

Before the IRS phased the form, business owners had to confirm that they qualified for Schedule C-EZ filing. This meant confirming that as a business owner you were, in fact, self-employed. According to the IRS, you qualify as self-employed if you either:

- Operate a business as a sole proprietorship (including a single-member LLC)

- Earn income as an independent contractor

Additional Criteria

After clearing this threshold, business owners had to meet a series of other requirements to qualify. In particular, self-employed individuals needed to meet all of the qualifications below:

- Your total business expenses don’t exceed $5,000

- You use the cash method of accounting

- Your business or profession doesn’t require inventory

- The business isn’t reporting a loss

- You operate one business

- You don’t receive certain credit card payments

- The business has no employees

- You don’t claim the home office deduction

- You satisfy the requirements of other less common situations that relate to depreciation and losses from prior years.

As this list illustrates, business owners needed to check a lot of boxes to use Schedule C-EZ. More often than not, self-employed individuals didn’t meet one of the above requirements, negating the simplified filing option. The IRS opted to remove Schedule C-EZ as a filing option for self-employed individuals.

What Options Do Business Owners Have Now?

The C-EZ form saved small businesses time and, subsequently, money. The form was shorter and easier to complete for the average business owner without an accountant. Now that the C-EZ has been phased out, business owners must submit the classic Schedule C form to declare the business earnings and expenses.

Unfortunately, the IRS removed Schedule C-EZ as a filing option. As of 2019, all self-employed individuals must file the full Schedule C. Due to this change, small business owners should focus on better organization and record keeping. Maintaining organized books will make it much easier to calculate the totals for your Schedule C when the time comes.

If you don’t have an organized accounting system, you will struggle at tax time. No one wants to spend hours chasing down invoices, receipts, and other records.

Taking the time to organize your books ahead of time can provide a huge payoff down the road. Save time and money by ensuring your record and bookkeeping department is organized.

Final Thoughts

At Shared Economy Tax, we live and breathe accounting and bookkeeping for small business owners. And we recognize the challenges that sole proprietors face, especially since Schedule C-EZ is not an option. Rather than trying to figure out the more complicated Schedule C, let us help!

We’d be happy to sit down with you to get your bookkeeping in order. Our team has decades of combined experience tracking small business income and expenses, implementing accounting information systems, and filing taxes. Contact us today, and we’ll set up a tax planning strategy. Schedule C-EZ may no longer exist, but filing your business taxes doesn’t have to be a challenge!