Inflation has been in the news lately, and it’s hard to ignore it at the grocery store or gas station. But one silver lining that comes with high inflation is that the interest on I-Bonds is nearing all-time highs. I-Bonds are inflation protection bonds issued by the U.S. government, which you can purchase yearly through the Treasury.

What Are I-Series Treasury Savings Bonds?

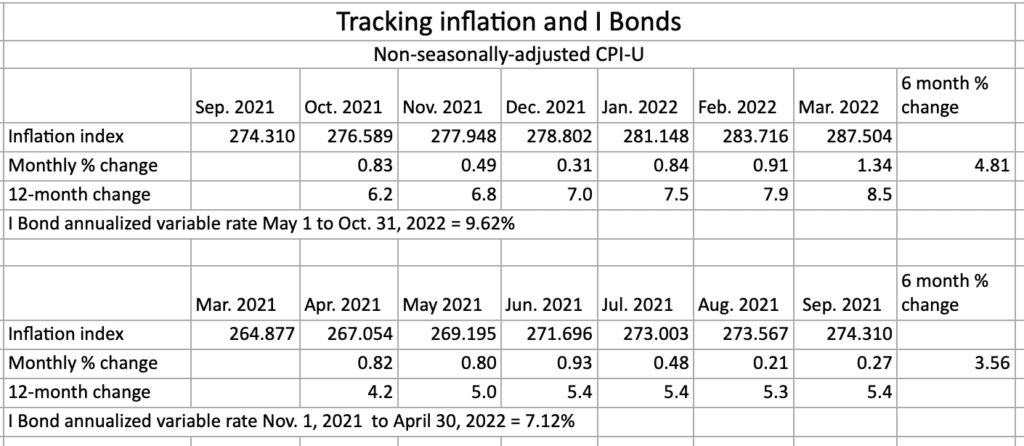

I-series savings bonds (interest-bearing treasury savings bonds, aka I-bonds) are government-issued bonds that pay interest every six months. The interest rate on these bonds has two parts: a variable base rate, which is recalculated every six months and does not change for the life of the bond, and a variable inflation rate, which is based on the Consumer Price Index for All Urban Consumers (CPI-U) and changes every six months.

Because the U.S. government backs the bonds, the bonds are as close to risk-free as possible.

You can get paper I-bonds in multiples of $25, with a maximum purchase limit of $10,000 per person per year. They can be held for up to 30 years, but if they are redeemed within the first five years, there is a three-month interest penalty.

Interest earned on I-bonds is exempt from state and local taxes. Additionally, you can defer federal taxes until the bonds are redeemed or reach maturity. In addition, they are a safe and low-risk investment option, making them an ideal choice for people looking to preserve their capital.

How Do I-Bond Interest Rates Work?

Two things determine I-Bond interest rates: the rate of inflation and a fixed rate that doesn’t change for the bond’s life. The average inflation rate over the last six months is 80% of the current rate, plus a fixed rate set when you buy the bond. The combination of these two rates is what we know as the composite rate. It’s what you earn on your I-Bonds while you hold them.

The most significant advantage of this type of bond is that they keep pace with inflation, so your investment grows along with the cost of living. In addition, I-Bonds are free from state and local taxes, making them an attractive choice for investors in high-tax states.

I-Bonds may be a good option if you’re looking for a safe investment that can help you keep pace with inflation. You’ll need to hold them for at least five years to avoid paying the penalty, and you won’t be able to cash them in until they mature (30 years from the date of issue). But if you’re willing to wait, I-Bonds can be a great way to protect your purchasing power over the long term.

There is a $10,000 per person limit each year. However, by stipulating your tax refund (or a part of your refund) be set aside to buy I-Bonds, you can purchase an additional $5,000.

Where Can I Buy I-Bonds?

You can purchase I-Bonds through the Treasury Direct website. You can purchase paper I-Bonds in $25 increments and electronic I-Bonds in any amount from $25 to $10,000. The U.S. government will mail them if you purchase the paper option.

You can also set up an account on the website and have your bonds automatically deposited into it each month. These bonds are a great way to save for retirement, as they offer a guaranteed rate of return and the U.S. government backs them.

You can also purchase up to $5,000 using your tax refund. When you prepare your return, you will complete Form 8888 to allocate some (or all) of your refund to the I-Bond purchase. Note that the $5,000 limit is per return, not per person, so a couple filing jointly will have the limit of $5,000.

You can also purchase I-Bonds for other people, including family members. However, their total I-Bonds purchase and received gifts for the year can still not exceed $10,000.

Are I-Bond Purchases Tax Deductible?

Unfortunately, the answer is no. Because it’s an investment, purchasing an I-Bond is not tax-deductible.

While you won’t get a tax deduction for purchasing I-Bonds, you won’t have to pay taxes on the interest until you cash in your bonds.

Are I-Bond Interest Payments Taxable?

Interest payments are subject to federal income tax, but they may be exempt from state and local taxes. The bonds are also subject to a federal alternative minimum tax (AMT).

You may be able to withdraw the funds from your I-Bonds to pay for higher education expenses for yourself or a dependent without paying federal taxes on the income. For more information on that option, see the Treasury’s article on Education Planning.

Can I Buy I-Bonds Through My IRA?

Generally, you can’t purchase Series I bonds in a tax-advantaged account, such as an IRA.

However, you can purchase them through a trust. So, if you have a self-directed IRA, you may be able to buy I-bonds. But, the interest is already tax-deferred, so there would be little benefit to doing so.

Outlook for I-Bond Rates

I Bond rates are currently at 9.62% until Oct. 2022, which is well above the average savings account rate of less than 1%.

Rates readjust every six months, so future rates will depend on inflation, but they’re like to remain high until inflation cools.

Disclaimer: This is just conjecture. It’s too early to tell how the government will respond to today’s inflation situation and the sudden popularity of I-Bonds.

Pros and Cons of I-Bonds

Here are the pros and cons of Treasury I-Series Savings Bonds:

Pros of I-Bonds

- Good hedge against inflation

- Can cash after one year; redeem without penalty after five years

- Interest rate guaranteed for six months

- Guaranteed by the federal government

- Pays higher interest rates than most savings accounts

- No state or local taxes on interest income

Cons of I-Bonds

- Interest taxes on I Bonds at the federal level

- Six-month interest penalty for cashing before five years has passed

- Adjustable interest rate moves over time

- Can’t deduct bond purchases

- Maximum investment of $10,000 per individual, per year

Closing Thoughts on I-Bond Tax Considerations

I-Bonds are a safe investment which are paying guaranteed high-interest rates. If you have the funds available and will not need the money for a few years, purchasing some now can.

For more answers to your toughest tax questions, talk to the pros at Shared Economy Tax. Our team of tax experts can help you tackle your business challenges and save big money in the process. Contact us for a one-on-one strategy session today and see how much you can save!