Many people have discovered the benefits of opening up their homes to rent on sites like Airbnb and VRBO. It is a good source of income and can be very rewarding both personally and financially. Some people have even been able to scale their operations where they manage multiple listings. When you are generating a good income, be it primary or secondary, it is important to understand how the tax laws affect you. Some things, like rental income tax rate, can be a little confusing.

Is Rental Income Taxed?

This is a common question for new Airbnb and VBRO hosts. The IRS wants all income reported so the appropriate taxes can be collected. For tax purposes, most sharing economy participants receive non-employee compensation. You need to pay taxes on your shared economy earnings. According to IRS rules, anyone who earns more than $400 on any home-sharing platform needs to report that income for taxes. You might have to pay federal, state, and self-employment taxes.

If you rented a space for more than 14 days during a calendar year, your rental income needs to be reported. This is called the 14-day rule. So, if you only casually rent out your space and use the property yourself for at least 14 days or 10% of the time you rent to others, the income does not need to be reported. We’ve heard this referred to commonly as the Augusta rule, referring to the individuals with homes in Augusta, Georgia who rent their homes during the Masters Golf Tournament.

Your net income determines your taxes, and net income equals earnings after deductions. The government taxes Rental income as “pass-through” income. As a result, the income only gets taxed once as it flows through to your personal return (Form 1040). However, your rental income tax rate varies based on several factors. More on that below.

What Taxes Do I Need to Pay as an Airbnb Host?

Airbnb and VRBO hosts may be subject to various taxes including occupancy taxes, property taxes, self-employment taxes, beyond just income taxes. You should calculate these taxes yourself and see how they apply. Below, you can find key tax categories and their characteristics:

Occupancy Taxes or Hotel Taxes for Airbnb Hosts

Occupancy taxes (also called transient or hotel occupancy taxes) are assessed on revenue or gross earnings and are remitted to local municipalities, cities, states, and/or townships. The federal government does not collect these kinds of taxes. For most localities, Airbnb collects Occupancy Taxes for the host and remits them to the local tax authorities. However, you may still be required to file local taxes on a regular basis even though your taxes are paid for you. For VRBO, hosts are required to pay and file their own taxes. Occupancy taxes can be fully deductible for the short-term rental business.

Property Taxes for Airbnb Hosts

Property taxes are assessed locally on a regular (usually annual or bi-annual) basis. In some states such as California, property values go up by a fixed percentage every year, however, in most cities, local officials will update the assessed value of the home any time improvements are made.

These are often one-sided adjustments, leaving many taxpayers scratching their heads, wondering why their taxes increased so much after a renovation. Hosts looking to make major improvements should know that assessments can be challenged and in certain cases provided by the taxpayer based on comparables or other factors.

Property taxes are generally deductible within the business, however, for hosts who split personal and business use of their home, part of these taxes will be reported as an itemized deduction on Schedule A where local tax deductions are limited to $10,000 and therefore less helpful in reducing taxable income.

Income Taxes for Airbnb Businesses

From a Federal and State income tax perspective, only your net profit (not gross earnings) are subject to taxes. Unlike traditional wages, income taxes are only assessed at the net level after all deductions. Since net income and net losses flow through to the personal return, income (if earnings exceed allowable deductions), is taxed at personal rates.

Self-Employment Taxes

In certain situations, your Airbnb or VRBO business can be considered an active trade or business and file a Schedule C. If you file a Schedule C with a profit, those profits will be subject to Federal Insurance Contributions Act (FICA) taxes which are as high as 15.3%. If you file on a Schedule E, there are no additional taxes on profits.

What Is The Rental Income Tax Rate?

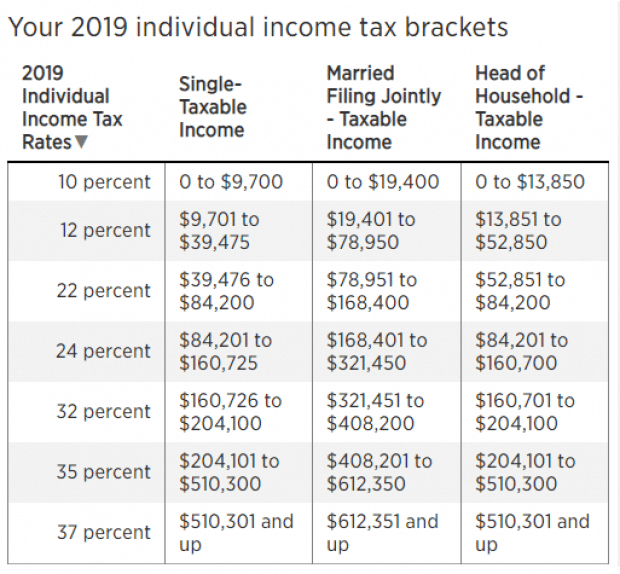

Your rental income tax rate will depend on your tax bracket. The tax bracket you are in will depend on your AGI (adjusted gross income), this is your gross income, less your deductions. There are currently 7 tax brackets which range from 10% to 37%. We advise you review the Federal tax brackets with all your income in mind as the tax rates are based on your full taxable income including wages, stocks, bonds, dividends, and other 1099 work as applicable. Reference the chart put together by our Airbnb tax accountants below to find your rental income tax rate.

How To Determine Your Property Tax Rate

The purchase price of your home determines your property tax rate. Your home’s purchase price equals its assessed value. The value of your property tends to increase every year because of inflation, so calculating property taxes can be confusing. In addition, tax rates vary from state to state and city to city.

Who To Contact to Find Out Your Property Tax Rate

Your monthly mortgage payment might include property taxes. Experts refer to these added taxes as impounds. Property tax impounds go to an escrow account. Then, the authorities deduct their property taxes from the escrow account twice a year. Contact your county assessor’s office to inquire about property tax rates..

How To Reduce Taxable Income

The most effective way to lower your tax bill is to reduce your taxable income. The best way to achieve this is by deducting rental expenses and other tax write-offs. When you have rental income, there are certain expenses that can be deducted from your taxes as a business expense. Some of the best deductions for Airbnb hosts and rental property owners are:

- Mortgage interest

- Property taxes

- Insurance

- Depreciation

- Marketing fee

- Professional fees

- The cost of improvements

- Maintenance expenses

- Travel expenses

- Subscription fees

- Processing fees

In addition to business expenses, you can also contribute to your IRA. Contributions are deductible up to the maximum contribution limit of $6,000. This is an above the line deduction, meaning you can take it regardless of if you itemize or take the standard deduction.

Tax credits can also be used to lower your tax bill. When it comes to real estate, there are some tax credits available if you make energy-efficient improvements. This could be updating appliances or even installing in new windows. You can learn more about energy-efficient tax credits here.

Get Help At Tax Time

One of the best ways to lower your tax bill is to work with a tax advisor. A tax advisor can help you save money on taxes with a tax planning strategy. This involves planning for deductions, creating a tax savings plan, timing income and expenses, and saving for retirement. In addition to forming a tax savings strategy, having the right guidance can help keep you in compliance with the various tax laws that affect you. Contact Shared Economy Tax to get help with your rental income taxes. To learn more subscribe to our newsletter.

Related Articles

Tax Deadlines for Airbnb and VRBO Hosts

Escaping Airbnb Scrutiny – How To Protect Your Airbnb Business