RECEIVING 1099 FORMS

ISSUING 1099’S

1099-MISC should be issued anytime you pay $600 in rents or services to contractors. You don’t need to issue 1099’s for personal purposes, only if you intend to deduct the expenses for business purposes. You can issue form 1099 to any individual, partnership, or Limited Liability Company (“LLC”). There’s no need to issue 1099 forms to corporations.

Typically for home sharers, the most common 1099 will be for:

- Cleaners – Typically, cleaners are sole proprietors who operate under a fictitious business name;

- Home Improvements – Projects that cost more than $600 require a 1099-MISC, except if the contractor is a corporation. Include supply costs if you billed them on Form 1099-MISC.

- Landscaping – Issue a 1099-MISC to claim deductions on jobs that cost more than $600.

Just note that these only apply when you contract work. If you are purchasing supplies, an invoice should be sufficient documentation to claim a deduction. One way to limit 1099 issues is to use corporate services for these routine tasks. Corporate services, like TurnoverBnB cleaning service, don’t require form 1099, so there’s less tax-time hassle for hosts. Some corporate contractors even offer direct billing and cost-by-project reports..

The Cost of Not filing

We definitely recommend filing 1099 forms. Failure to file can result in penalties between $30 to $100 per form. If the IRS deems that you didn’t file intentionally, you will face a minimum penalty of $250 per statement.

The IRS can disallow a deduction for contract work where form 1099 was required but not issued, so you could be looking at paying taxes on contract fees due to the lack of proper documentation. Keep track of payments to contractors in your accounting software or in a simple Excel or Google Sheet where you can easily add up totals per contractor.

HOW TO FILE 1099’S WITH THE IRS

First, you’ll want to issue a Form W9 to your contractors and use that information to fill out form 1099. We recommend issuing 1099 forms before your contractors begin working. It’s much harder to get a W9 filled out after the year is over.

Unfortunately, you can’t simply print 1099 forms online and send them to the IRS. You can only mail official 1099-MISC forms to the IRS, because each form contains a unique document locator number. In fact, sending in the wrong 1099 form incurs a $50 penalty. You can pick up hard copies at your local office supplies store (e.g., Staples or Office Max).

Indicate non-employee compensation in box 7. If you reimbursed your contractors for supplies, you’ll need to indicate that in box 7 as well. The total should include all payments, including parts and materials.

Check the IRS instructions for how to mail returns or reach out to your tax pro for detailed advice.

Help With Airbnb 1099 Forms

You don’t have to go it alone. You can save yourself from endless hours of paperwork by hiring a professional. Plus, you could save thousands in write-offs. Contact the pros at Shared Economy Tax to get help with your Airbnb 1099 today. Our tax pros will meet with you one-on-one so you can get answers to all of your questions. Sign up today to get started.

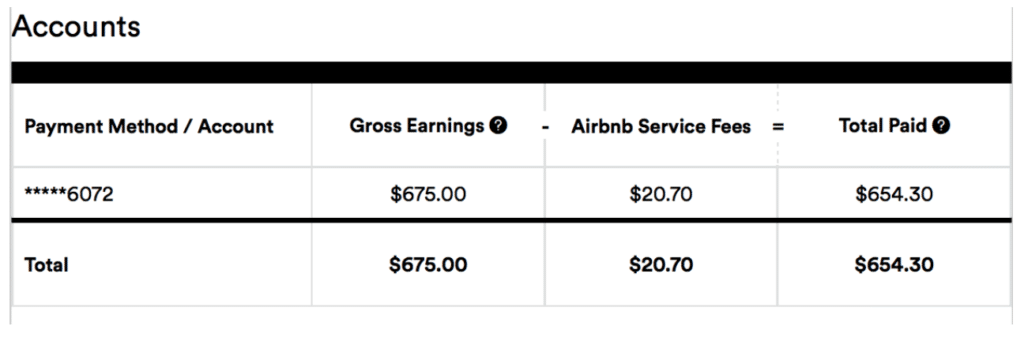

Thanks for information above! I am an Airbnb host and have a co-host who helps with bookings, communications, cleaning and upkeep of an Airbnb. We split the income. Initially in early 2018 Airbnb sent payments directly to the co-host, but mid-year changed their policy on co-hosts with all funds being directed to the host. After the policy change I directed a portion of the income to my co-host’s account through the Airbnb platform.

Should I issue a 1099 to my co-host for the amount of the income that was directed to them? And then deduct that amount as a “co-host expense”?

Thanks for your ideas!

Generally, that sounds right. You can also split the income as a partnership or as you say, record all the income on your taxes and deduct their split via 1099.

Good afternoon! I called Airbnb and they told me that they are not sending 1099-K form, where I can get this form?

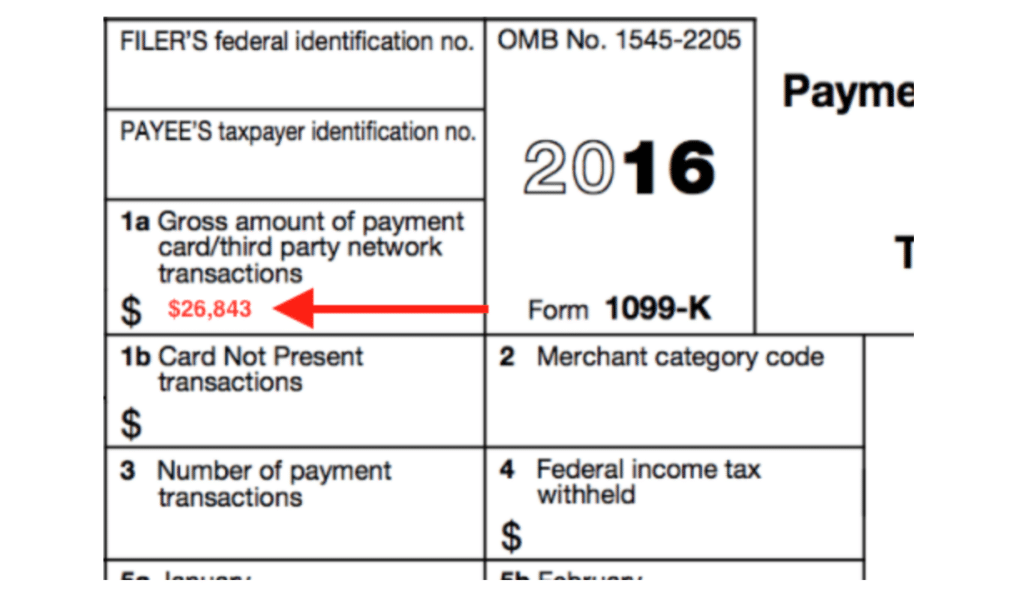

If theyre not sending a 1099-K that’s because you didn’t hit the 200 transactions & $20,000 in annual gross revenues. If you’re not getting one, they won’t prepare a 1099-K. That doesn’t mean Airbnb insn’t reporting your income to the IRS in other ways.