Tax Deadlines for Airbnb and VRBO Hosts

Airbnb and VRBO taxes can be complicated. In fact, you might not even need to pay taxes at all. Whether or not you owe depends on several factors, including your regular wages, property location, and more. However, if you need to make quarterly payments, you need to remember the dates for tax deadlines.

Regardless of how much you earn on these platforms, you need to get organized so you don’t run into trouble at tax time. You could end up owing late fees, penalties, worse. To help you get started, here is a quick overview of what you need to know about paying taxes on Airbnb and VRBO income.

VRBO & Airbnb Taxes

All Airbnb and VRBO hosts are subject to federal, state, and local taxes on their short-term rental earnings. As a result, Airbnb and VRBO hosts should familiarize themselves with tax regulations that apply to short-term rentals in their area.

Short-term rental hosts can avoid taxes if they fall under the 14-day rule. However, most hosts will owe taxes on their earnings. Even if you don’t get a form 1099 from Airbnb or VRBN, you still need to calculate your earnings and report them to the IRS.

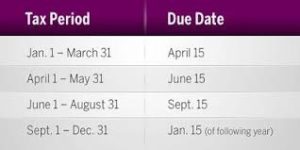

Some hosts might need to make quarterly tax payments. If you owe more than $1,000 in annual income taxes, you must make estimated tax payments. Estimated tax payments are made three times during the taxable calendar year and on time shortly after new year’s.

2020 Quarterly Tax Deadlines

VRBO and Airbnb quarterly tax deadlines fall at the same time as other 1099 taxes. You must make your quarterly tax payments before these dates or you risk being penalized.

Q1 Estimated Tax Payment Due April 15, 2020

First-quarter payments usually need to be sent in by April 15th. It’s the same day that annual tax filings are due. This is one of the quarterly tax dates to remember because it stays the same, year after year. This payment covers income generated in January, February, and March.

Q2 Payments Due June 15, 2020

Your second annual tax payment is due on June 15th. It covers April and May. It’s only two months, so it might be smaller than your other quarterly payments.

Q3 Payments Due October 15, 2020

The second quarter is short, but the third quarter makes up for it. This payment is due on October 15th and it covers four calendar months. You will need to pay estimated taxes for June, July, August, and September before this tax deadline.

Q4 Payments Due January 15th, 2021

The last of the tax deadlines for 2020 is on January 15th. You’ll have to pay taxes on your income from October, November, and December before this date.

More on Home Share Taxes

You can avoid paying estimated taxes on your Airbnb income by increasing your W4 withholding. Simply request to have more federal income tax deducted from your paychecks. Use Form W4 to increase federal tax withholding.

Some municipalities also charge lodging and occupancy taxes on short-term rentals. It could result in additional rental taxes for hosts. If your property is in an affected area, VRBO and Airbnb collect taxes on your behalf. They deduct them directly from your earnings after a guest booking.

You can see a complete list of all the VRBO tax-deducting municipalities here.

For Airbnb, click here.

Do I Need a VRBO / Airbnb 1099?

Airbnb issues Form 1099-K to hosts with earnings greater than $20,000 and over 200 platform transactions in a calendar year. VRBO’s payment processor, YapStone, has a similar policy. VRBO only issues Form 1099-K if you earned over $20,000 and 200 transactions in gross payments for the calendar year.

If you do not meet this threshold, you will not receive an Airbnb 1099 or VRBO 1099.

What Kind Of Expenses Can Be Deducted?

As a short-term rental host, you can deduct your business expenses, including the cost of guest services and amenities. Common write-offs include repairs, maintenance, cleaning costs, mortgage interest, property insurance, and other household supplies.

You can deduct VRBO and Airbnb service fees from your taxes too. Last but not least, if manage your business from a home office, you can claim a home office deduction.

Airbnb and VRBO Tax Deadlines: Key Takeaways

Don’t let tax deadlines take you by surprise. If you’re an Airbnb or VRBO host, mark these dates on your 2020 calendar now. Be ready for your quarterly tax payments and it will help you organize your finances. If you need more help with quarterly taxes, check-in with the pros at Shared Economy Tax. They understand the home share business better than anyone else. Click here to get started with a free consultation.