How to Pay Quarterly Taxes Online or By Mail

For business owners, taxes don’t end on April 15th. Most self-employed professionals and business owners need to pay quarterly taxes. Quarterly taxes represent down payments on your annual taxes. If you’re running your own business, nobody is withholding taxes from your checks. However, that doesn’t mean you’re off the hook from paying them.

Covering your estimated taxes is your responsibility. The IRS doesn’t want to wait all year to collect, so they want you to send out schedule payments. Quarterly tax payments are due four times per tax year.

Yes, quarterly taxes apply to shared-economy gigs too. Expect to owe quarterly taxes if your year-end taxes total over $1,000. Estimated tax rules apply to all side businesses, both full and part-time.

“How do I pay taxes on income I haven’t earned yet?”

Great question. The first step to paying quarterly taxes is estimating how much you owe. If you don’t know how to calculate your quarterly tax payments, check out our Estimated Tax Payment Guide.

How To Pay Your Quarterly Taxes Online

The IRS makes it easy to pay taxes online. You can handle most of your tax transactions on the IRS website. It has everything you need to pay your taxes, including installment options, digital payments, estimated tax payment forms, and more. To pay online, you have to use an ACH transfer from your checking account or a debit/credit card. Paying your taxes online is completely secure, and it’s the quickest way to pay your taxes.

Most states allow online tax payments too. Remember, if your business operates in multiple states or cities, you could also be subject to taxes from other jurisdictions. Taxes can vary from state to state and city to city, so be sure to check the tax laws in all the areas you operate.

How To File Quarterly Taxes By Mail

Another way you can pay your taxes is by mail. You can pay by check or money order, however, you should never pay with cash by mail. Payments must have the following information:

- Your name and address

- Daytime phone number

- Social Security number or employer identification number

- Tax year

- Related tax form or notice number

Where you mail your payment will depend on the state you live in. Be sure to confirm the address on the IRS website.

Don’t forget to send the 1040-ES form along with your payment. The 1040-ES also has filing instructions and a mailing address. Get the 1040-ES form from the IRS here.

What Happens if You Pay Quarterly Taxes Late

Estimated taxes must be paid on time. Paying late could result in penalties of about 4% over the underpayment period. If you completely fail to make estimated tax payments, the penalty will be added to your year-end tax bill.

Some self-employed freelancers receive 1099s from their clients. Business issue form 1099 when they paid you more than $600 during the tax year. If you get a 1099 form, the IRS does too. Make sure you report the income accurately.

Sharing Economy businesses like Airbnb, Turo, or Upwork, you will usually only receive a 1099-K if you earn more than $20,000 or have more than 200 transactions. Regardless of whether you receive 1099 forms, you still need to report your earnings to avoid IRS scrutiny.

Quarterly Tax Deadlines

Paying your quarterly taxes is the easy part. Estimating taxes can be a lot more challenging, especially for first-timers. To avoid penalties, pay at least 90% of the previous year’s tax bill. You can spread the total across each quarterly payment.

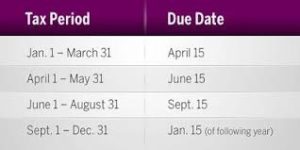

Quarterly payments are usually due on the following dates. However, they get pushed back if they land on a weekend. These are the quarterly tax deadlines:

- Q1 Deadline: April 15 (Taxes due for January, February, and March earnings)

Save or link to this handy infographic for quick reference. - Q2 June 15 (April and May)

- Q3 Sept. 15 (June, July, August, and September)

- Q4 Jan. 15 (October, November, and December)

Self Employment Taxes

Estimated tax payments go towards your tax bill, which also can include self-employed tax. Independent contractors need to pay both the employee and employer portion of payroll taxes. Together, social security and medicare taxes add up to about 15.3%. Self-employed professionals don’t have traditional employers, so no one is withholding these taxes. Ultimately, it’s up to business owners to pay their self-employment taxes.

The Easy Way to Pay Estimated Quarterly Taxes

Just because you’re self-employed doesn’t mean you have to go it alone! The experts at Shared Economy Tax can help you with all of your quarterly tax needs. Don’t risk calculating your estimated taxes incorrectly, let us give you a hand. We can help you estimate annual taxes and much more. Tax time doesn’t have to be stressful. With a Shared Economy Tax pro on your side, quarterly taxes are no sweat. Get started now with a free one-on-one call with one of our specialists.