In August 2022, the Inflation Reduction Act was signed into law. Along with boosting domestic energy production, this law provides tax credits to homeowners who take steps to improve efficiency. The Energy Efficient Home Improvement Credit helps homeowners reduce their taxes by making specific home improvements, buying the right equipment, and obtaining audits. This guide takes an in-depth look at the Energy Efficient Home Improvement Credit and how you can take advantage of it.

What is the Energy Efficient Home Improvement Credit?

The Energy Efficient Home Improvement Credit was created when the Inflation Reduction Act became law. The purpose of this credit is to promote energy efficiency among U.S. homeowners and to reduce the impact of climate change. From the beginning of 2023 to the end of 2032, qualifying homeowners have access to a credit that’s worth as much as $1,200. An extra $2,000 per year is available for qualified biomass systems and heat pumps.

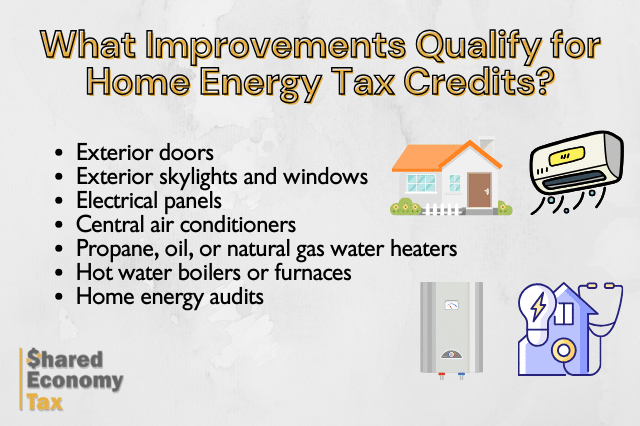

What Improvements Qualify for Home Energy Tax Credits?

Some of the home improvements that qualify for this tax credit include the following:

The credit includes up to $150 for home energy audits, $500 for all exterior doors, and $600 for the remaining equipment. While the limit for the items mentioned above is $1,200, the credit for heat pumps and biomass systems is extra, which means that you can potentially get $3,200 back.

If you’re installing exterior doors, they need to come with the Energy Star label. Keep in mind that you need to multiply your costs by 30% or .30. Let’s say you purchased an HVAC unit for $2,000. multiply this by .30 to arrive at a credit of $600. Make sure you don’t count any labor costs in your calculations.

How to Maximize Your Energy Tax Credit

With the right strategy, you can maximize your energy tax credit. For example, consider spreading these improvements across multiple years. Every year from now until 2032, you get access to the Energy Efficient Home Improvement Credit, which amounts to $1,200 and an additional $2,000 depending on what you do. If you make one or two major improvements every year, you can claim a credit on each annual tax return.

It’s also a good idea to request a home energy audit, which should make it easier for you to identify the best improvements you can make to your home’s efficiency. If you’re thinking of upgrading your HVAC system, this audit might tell you to first improve your attic insulation.

Regardless of the types of improvements you make in your home, the best way to ensure you claim the maximum credit every year is by properly planning each project. Don’t let project costs spin out of control. The IRS will require comprehensive documentation to ensure eligibility. Keep receipts, paid bills, invoices, and any documents that prove you made specific upgrades to your home. Properly index and categorize these documents to make sure you know where everything is. Keep them in a home lock box or filing cabinet for additional security.

How to Use the Energy Efficient Improvements Worksheet

The Energy Efficient Home Improvement Worksheet is available in the instructions for Form 5695, which you must file to claim your tax credit. With this tool, you can effectively calculate the credit amount you should receive. Make sure you scroll down to the end of the instructions to find the worksheet.

- Step 1: Check line 18 on your 1040, 1040-SR, or 1040-NR form. If you have anything written here, place it on line 1 of this worksheet.

- Step 2: Now it’s time to fill out the second section, which includes lines where you can enter any credits or adjustments you’re claiming for the 2023 tax year.

- Step 3: You can find most of the eligible credits and adjustments on Schedule 3. For example, the credit that covers expenses for child or dependent care is shown on Schedule 3, line 2. If you qualify for the credit that’s available to elderly or disabled individuals, you can find it on Schedule R, line 22. Mark this number down in the worksheet.

- Step 4: If you have multiple credits, add them up and place them on line 2.

- Step 5: Subtract the total on line 2 from the number on line 1. Place this amount on line 31 of Form 5695. From here, you can calculate your Energy Efficient Home Improvement Credit on line 32. Double-check the math for any calculation you’ve made on Form 5695 to make sure you receive the full credit you’re owed.

Common Mistakes and Compliance Risks

Several mistakes are easy to make if you don’t know how to avoid them. Even though Form 5695 isn’t too complex, you might place a number on the wrong line or make a typo. If this happens, you’ll need to fix these errors to ensure the IRS processes the form and gives you the credits you qualify for.

Some homeowners make the mistake of expecting this credit for new construction projects. However, if you’re building a home from scratch, you don’t qualify. The same is true if you purchase used equipment or materials. The energy-efficient improvements you make to your home must be done with new items.

Many of the issues that occur during this process are minor problems. However, there are a couple of errors that could lead to an IRS inquiry or audit, the primary of which is not having the right documentation. If you don’t submit extensive documentation of the improvements you’ve made, the IRS could order an audit that examines your financial information to make sure you’ve reported it correctly. You can avoid these mistakes and ensure a successful credit claim by speaking with a tax accountant or CPA before filing.

Closing Thoughts on the Energy Efficient Home Improvement Tax Credit

The Energy Efficient Home Improvement Credit allows you to significantly reduce the amount you pay to upgrade your home. Once you’ve made the necessary improvements, you’ll also benefit from lower monthly energy bills. Whether you’re adding insulation or installing a new HVAC system, the right changes can net you a large sum of savings and a sizable reduction in your annual tax return. Start making energy-efficient improvements to your home today to take advantage of the available credits for the 2024 tax year. Contact Us for strategies to maximize your energy tax credit.