With a new year comes new changes to the tax rules. We’ve outlined some of the most impactful items on your 2023 taxes.

Note that since the year has just begun, there may be additional changes throughout the year.

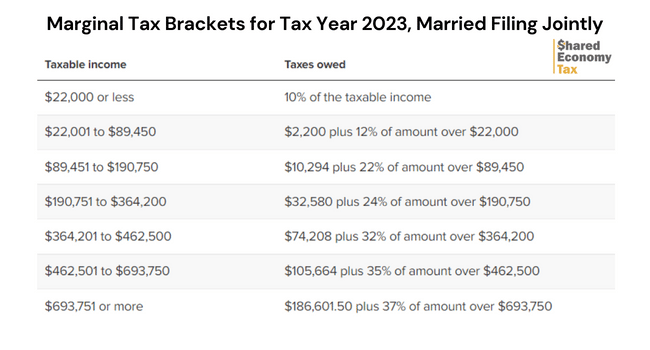

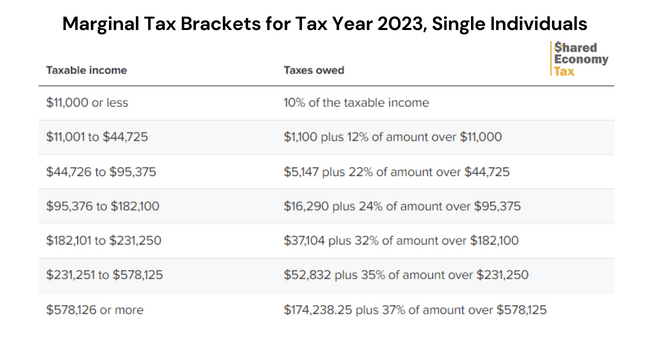

Income Tax Brackets Changes

Tax brackets change each year to reflect inflation. For example, the tax brackets for 2023 are the result of 2022’s higher-than-usual inflation.

Updated IRS Tax Brackets for 2023

Below are the tax rates in effect for 2023.

Standard Deduction Amount Change for 2023 Taxes

The standard deduction is a set amount that individuals can subtract from their taxable income when filing their taxes. The amount changes each year and is typically adjusted for inflation.

The amount can vary depending on a taxpayer’s filing status, and higher standard deduction amounts are available for certain groups, such as the elderly or the blind. Take note of the current standard deduction rate when you prepare your taxes because it could take a substantial chunk out of your tax bill.

For 2023, the standard deduction is $13,850 for single taxpayers and $27,700 for married filing joint taxpayers. In addition, head-of-household taxpayers can claim a $20,800 standard deduction.

Taxpayers over age 65 can take an additional standard deduction of $1,850; or $1,500 per spouse over age 65 if married filing jointly. This deduction doubles for blind taxpayers.

Retirement Account Contribution Limit Increase for 2023 Taxes

Retirement contributions are the amounts individuals can save and invest for their retirement through various types of accounts, such as 401(k)s, IRAs, and defined benefit plans.

The government places limits on the amount of money that can be contributed to these accounts each year, and these limits are typically adjusted for inflation on an annual basis. This means that the amount of money individuals are allowed to contribute to their retirement accounts can increase yearly.

Individuals need to be aware of these contribution limits, as exceeding them can result in additional taxes and penalties. Stay up-to-date on the current contribution limits to ensure you take full advantage of opportunities to save for your retirement.

401k Contributions

For 2023, the contribution limit for 401k plans is $22,500. In addition, 401k contributions may be subject to additional restrictions by your employer.

IRA Contributions

The IRA contribution limit for 2023 is $6,500. The catch-up contribution for taxpayers over age 50 is an additional $1,000. This limit applies to all your IRA contributions, whether traditional or ROTH.

Note that IRA contributions may be limited if you participate in an employer-sponsored retirement plan. In addition, higher-income earners may have additional limitations on their ability to contribute.

HSA Exemption Increases

HSAs aren’t retirement accounts, but they have similar tax incentives. Unlike most tax-advantaged accounts, you can access HSA funds at anytime to pay for approved medical expenses not covered by insurance.

The HSA limit for a single taxpayer is $3,850, but family HSAs have a higher limit of $7,750. Taxpayers over age 55 also have the option to contribute an additional $1,000 if they choose.

Please note, you must have a qualifying high-deductible medical insurance plan to utilize an HSA account. If your insurance plan doesn’t qualify, you cannot use this type of account.

Increase in the Retirement Savings Contribution Credit

Along with the increase in contribution limits, the credit for low-income taxpayers who make retirement contributions has also increased. This credit is commonly referred to as the Saver’s Credit.

To be eligible for the credit, you must be at least 18 years old, not claimed as a dependent on someone else’s return and not a student.

The maximum saver’s credit is $2,000 for the 2023 year. The credit varies based on income and filing status. The credit ranges from 50% of your contribution for single taxpayers with incomes below $21,750 or married taxpayers with incomes below $43,500.

Taxpayers with higher incomes are subject to a phaseout of the credit.

Continuation of the Earned Income Tax Credit for 2023 Taxes

In 2023, the maximum earned income tax credit (EITC) is $7,430. The maximum credit is available to qualifying taxpayers with three children.

Though there are several rules for claiming the EITC, taxpayers must make less than $57,414 and have investment income of less than $10,000. The income phaseout levels change based on marital status and the number of children.

Higher Exemption for the Alternative Minimum Tax (AMT)

The alternative minimum tax (AMT) is a separate tax system that ensures that high-income taxpayers pay a minimum amount of tax. The AMT system has different rules and rates than the regular tax system, and taxpayers must calculate their tax liability using both systems to determine which results in a higher tax liability. If the AMT results in a higher tax liability, the taxpayer must pay the AMT instead of the regular tax. The AMT can affect taxpayers with a high income and/or who claim certain types of deductions or credits.

To calculate your AMT, you remove various tax credits and deductions from your adjusted gross income calculation, then deduct the AMT exemption. For 2023, the AMT exemption is $81,300 (or $126,500 for married filing joint returns).

Conclusion

Tax laws are constantly changing, and taxpayers need to stay up-to-date on any changes that may affect them. The changes listed above can significantly impact an individual’s tax liability, and it’s important to understand how they may affect you. Consult with a tax professional or refer to the IRS website for the most latest information on tax regulations and how they can affect you.

Shared Economy Tax is the leading provider of tax & accounting services for the sharing economy. Our tax specialists have decades of experience helping small businesses and independent contracts resolve their toughest tax challenges. Set up a one-on-one strategy session with one of our tax pros now to see how much you can save in 2023.