The U.S.’s progressive tax system charges higher tax rates for higher earners. This system is designed to ensure taxpayers of various income levels pay a fair tax rate at the end of the year. In this article, we’ll explain how the progressive tax system works and show how tax brackets can influence your effective tax rate.

What is a Progressive Tax System?

A progressive tax system utilizes different tax rates based on a taxpayer’s total earnings. Tax rates typically increase along with income, so higher earners tend to pay a higher rate.

The system operates on the philosophy that higher-income taxpayers can absorb higher tax rates better than their lower-income counterparts.

The system is described as progressive because tax rates increase as income goes higher. Conversely, a regressive tax system charges lower rates as income increases.

In the United States, tax rates are organized into income-specific brackets. The amount of tax you pay on your income will depend on which tax bracket you fall into.

Do I Pay the Same Percentage of Tax on All My Income?

One of the most common misconceptions about the progressive tax systems is that individuals pay the same tax rate on all of their earnings. However, this view is incorrect. Only the income that falls within the corresponding tax bracket is taxed at that rate.

For example, in the United States, the tax rate for earnings up to $11,000 is 10%. Next, it goes up to 12% for income between $11,001 and $44,275.

Let’s say an individual earns $44,275 per year. They would pay 10% on the first $11,000 they earned. Then, they would pay 12% on the rest of their income. If they made one dollar more, they’d fall into the 22% tax bracket, but they would only pay the higher rate on the one additional dollar they learned.

Oftentimes, people misunderstand this key principle. Sometimes, you’ll hear people say, “I don’t want to take that raise because it will put me into a higher tax bracket.” This logic doesn’t make sense because the higher tax rate will only be imposed on the earnings that fall within the higher rate.

It’s always beneficial to earn more money, period. Never decline an offer to make more money over fears of a higher tax bill.

Instead, understand how the progressive tax system works and plan for taxes accordingly.

How Are Progressive Tax Rates Calculated?

Progressive tax rates are calculated according to brackets. These brackets are determined by the income level of the individual or household. The government regularly updates these brackets based on income and inflation trends. In the U.S., Congress sets these brackets through legislation, such as the Tax Cuts and Jobs Act of 2017.

Individuals

In 2023, the tax brackets for individuals in the United States are as follows:

- 10% for income up to $11,000

- 12% for income between $11,001 and $44,725

- 22% for income between $44,726 and $95,375

- 24% for income between $95,376 and $182,100

- 32% for income between $182,101 and $231,250

- 35% for income between $231,251 and $578,125

- 37% for income above $578,126

Joint Filers

In 2023, the tax brackets for married couples filing jointly in the United States are as follows:

- 10% for income up to $22,000

- 12% for income between $22,001 and $89,450

- 22% for income between $89,451 and $190,750

- 24% for income between $190,751 and $364,200

- 32% for income between $364,201 and $462,500

- 35% for income between $462,501 and $693,750

- 37% for income above $693,751

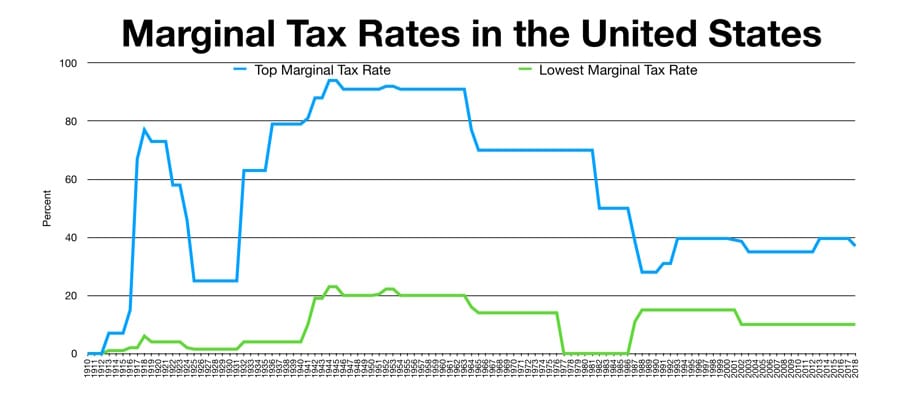

Historical Tax Rate Trends

Historically, tax rates in America have generally increased over the years. When the Income Tax Act was first passed in the early 20th century, the tax brackets were much lower than they are today. For example, the top marginal tax rate in 1913 was only 7%.

Throughout the 20th century, the top marginal tax rate was increased multiple times, reaching a high of 94% during World War II.

It’s difficult to predict if taxes will continue to increase in the future. While taxes have generally increased over time, there have also been periods of decrease, such as the Tax Cuts and Jobs Act of 2017, which lowered tax rates for many individuals.

Tax rates are often influenced by factors such as economic conditions, government spending, and political considerations and can be adjusted through legislation passed by Congress. It’s important to stay informed about changes in tax laws and regulations in order to plan for taxes accordingly.

Progressive Tax vs Flat Rate Tax: Which is Better?

A progressive tax system has advantages and disadvantages. For the sake of example, let’s compare progressive taxes to a flat-rate tax policy.

Supporters of progressive tax rates argue that they force better-off individuals to pay their “fair share” to fund government programs and services. America’s progressive tax system also offers deductions and credits to help small businesses and middle-class earners reduce their tax liability.

However, one can argue that a flat tax system offers greater simplicity and fairness. In flat tax countries, everyone pays the same tax rate, regardless of their income level. A flat rate makes taxes transparent and easier to understand. Calculating your tax bill is straightforward, and you don’t have to worry about tax brackets. Proponents of a flat tax system also say it stimulates economic growth and incentivizes investment.

Regardless of your opinion, America’s progressive tax code is here to stay for the foreseeable future.

Closing Thoughts on America’s Progressive Tax System

There are widespread misconceptions about income tax among U.S. citizens, but the tax system manageable if you take the time to understand it.

No matter what tax bracket you’re in, making more money is ALWAYS a good thing. Entering a new tax bracket will not impact any income that falls below your top-rate threshold.

Check out our articles on marginal tax rates vs effective tax rates more info on tax brackets and progressive taxes.

Get Help with Taxes Now

Shared Economy Tax specializes in tax & accounting services for small business and independent contractors. Our tax pros have decades of combined experience assisting up-and-coming businesses like yours, and we assist you with all of your tax and accounting needs. Set up a one-on-one strategy session now to see how much you can save with Shared Economy Tax.