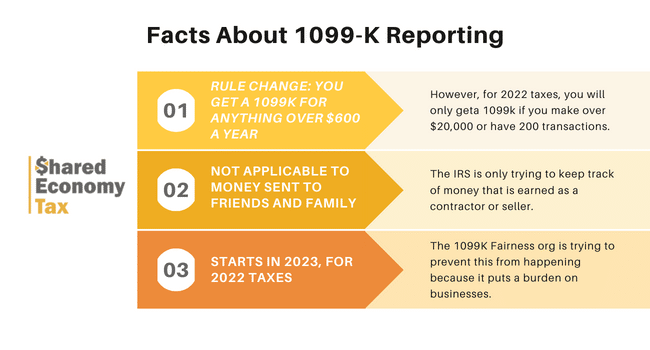

For 1099k 2022, third-party payment processors were scheduled to issue 1099-Ks if you received over $600 in payments. Form 1099-K reports the payments you receive from third-party processors such as Venmo or PayPal.

However, the IRS recently announced it would postpone the new rule by one year. Now, it’s set to take effect in 2023.

Here’s what you need to know about this major IRS rule change and the agency’s decision to postpone its implementation.

What’s in the News?

The Internal Revenue Service (IRS) announced in early January that it would delay this new rule. It would require third-party apps, such as Venmo, Amazon, Stripe, Paypal, Etsy, eBay, and others, to send 1099-K forms to anyone who makes over $600 on their platform.

A 1099-K form is an IRS tax form that reports income from electronic payments. It’s typically from businesses that accept payment through third-party payment processors. It shows the payments received by month through the platform, along with the recipient’s name, address, and tax ID.

Furthermore, the new rule was scheduled to take effect in tax year 2022, but the IRS has delayed its implementation until January 1, 2023. The IRS said it delayed the launch, so it could provide additional guidance and clarification. A substantial pushback from the payment processing industry likely contributed to the agency’s decision.

What is Currently in Place for 1099k 2022

Currently, businesses that process more than $20,000 in gross payment volume and have more than 200 transactions in a calendar year will receive a 1099-K form. This information goes to the IRS, and the business is responsible for including the income on their tax return. This applies to sole proprietorships, partnerships, and corporations.

Individuals receiving 1099-K forms are, according to the IRS, engaged in a trade or business and must report the income on their tax returns. The form shows the amount of income a person receives from electronic payments to the business, and it’s used to ensure that businesses accurately report their income to the IRS.

Note that even if you do not receive a 1099-K, you are still responsible for reporting all income on your tax return.

Why has the IRS changed its mind right before 2023?

The IRS has several reasons for delaying the implementation of the new $600 threshold. First, the new rule received a lot of negative feedback from various stakeholders. Many individuals worried they would suddenly have to pay tax on transfer payments among friends and family members.

“The IRS and Treasury heard a number of concerns regarding the timeline of implementation of these changes under the American Rescue Plan,” said Acting IRS Commissioner Doug O’Donnell.

Based on feedback from individuals and third-party payment processors, the agency said the rule will wait until 2023.

The launch of the 1099K Fairness org, which PayPal and other payment processors created, could have contributed to the delay of the new rule by the IRS. The organization’s mission is to advocate for changes to the 1099-K reporting rules. Additionally, they also provide education and resources to small business owners and other affected parties.

The 1099K Fairness org has been lobbying for a higher threshold for issuing 1099-K forms. They argue that the current threshold is too low and burdens small businesses. The organization has also been calling for more clarity and guidance from the IRS on the rules. Furthermore, this could be one of the reasons why the IRS has decided to delay the implementation of the rule.

What do I do if I get a 1099k?

If you receive a 1099-K form, you must report the income shown to the IRS on your tax return. Here are the steps you will need to take:

Review the 1099-K form: Carefully review the form to ensure that all the information is correct. If there are any errors, contact the form issuer to request a corrected version.

Report the income on your tax return: The income reported on the 1099-K form should be on your tax return. Specifically, the income should be on Schedule C (Profit or Loss from Business), Schedule E (Supplement Income and Loss), or Schedule F (Profit or Loss from Farming). If your business receives a 1099-K, the income should be on your business tax return.

Report your business expenses: You can also claim any business expenses that you incurred while earning the income reported on the 1099-K form. These expenses include the cost of goods sold, supplies, and business-related travel. To claim these expenses, you must keep accurate records and receipts.

Keep a copy of the 1099-K: Keep a copy of the 1099-K form and any other records and receipts that you used to report the income and expenses on your tax return. This will make it easier to respond to any questions the IRS may have.

Final Thoughts on 1099k 2022

The IRS has announced a delay in implementing a new rule requiring third-party apps like Venmo, Amazon, Stripe, Paypal, Etsy, eBay, and others, to send 1099-K forms to anyone who makes over $600 on their platform to their 1099k 2022.

However, the new rule should have taken effect on January 1, 2022, but is now starting on January 1, 2023. The delay will give businesses and payment processors more time to make necessary changes to their accounting and reporting systems.

This delay also allows advocacy groups and stakeholders to voice their opinions. Many have already criticized the new rule for being too burdensome on small businesses and for adding unnecessary complexity.

The delay is to help provide certainty for taxpayers and improve compliance with tax laws. Businesses should stay informed and ensure they understand the rule and their obligations when it comes into effect in 2023.

Remember that even if you do not receive a 1099-K, you must report all income on your tax return. Luckily, there will be no changes to your 1099k 2022.

If you’re not sure what to expect for 2023, we can help. Shared Economy Tax specializes in tax & accounting services for small businesses and independent contractor. Schedule a complimentary one-on-one strategy session with one of tax pros here to see how much you can save.