Starting an investment account for a child can give them a head-start in life, but when choosing the right account type, you need to consider your goals and the child’s financial situation. One of the most flexible types of accounts is a UTMA account. Let’s look at UTMA account rules and the rules for the other investment accounts for minors.

What Is a UTMA Account and What Are UTMA Account Rules?

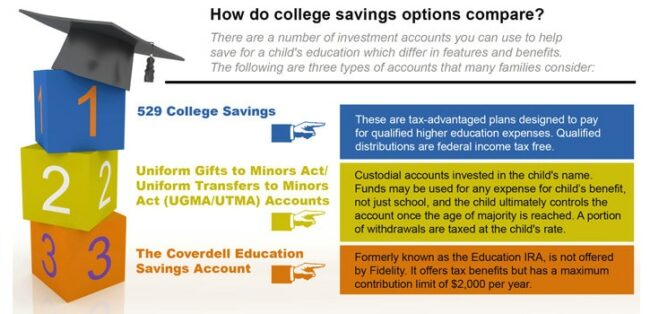

An account set up by an adult to benefit a child is a Uniform Transfer to Minors Act (UTMA) or Uniform Gift to Minors Act (UGMA) account.

The money or assets in the account are the legal property of the child, but the custodian manages the account until the child reaches the age of majority. UTMA and UGMA accounts fill a wide variety of purposes, including saving for college, investing, or even paying for medical expenses.

Because the money in the account belongs to the child, the account is useful for just about anything that benefits the child. However, it’s important to note that any money the account earns is taxable income for the child. As such, it’s essential to consult with a tax professional before making investments with a UTMA or UGMA account.

Other Types of Investment Accounts for Minors

Before funding a UTMA or UGMA account, you should consider your goals in transferring funds to the minor. Then, depending on your motivation, there may be better options.

A Roth IRA for Kids

A Roth IRA is an excellent way for minors to save for retirement. Contributions are after-tax dollars, which means that withdrawals are tax-free in retirement.

There are a few things to keep in mind when opening a Roth IRA for a minor:

- A parent or guardian must open the account.

- The minor must have earned income from a job to contribute themselves.

- There is a contribution limit each year, which is currently $6,000, although the limit is subject to change each year. However, even small contributions can add up over time, and a Roth IRA is an excellent way to help your child prepare for a comfortable retirement.

A Custodial 529 Account

A 529 savings plan is a tax-advantaged investment account that encourages saving for future college expenses. States, state agencies, or educational institutions generally sponsor 529 programs, and then investment companies manage them.

529 plan contributions accrue in a portfolio of mutual funds or exchange-traded funds. The earnings on these investments are not subject to federal income tax and, in some cases, may also be exempt from state income tax.

Withdrawals from a 529 plan can pay for qualified higher education expenses, such as tuition, fees, books, and room and board. Furthermore, 529 plans are unique because they offer flexibility and tax benefits. For example, many plans allow account holders to change the account’s beneficiary without incurring taxes or penalties. This makes 529 plans an ideal way to save for college expenses for multiple family members.

Coverdell Education Savings Account (ESA)

A Coverdell ESA is a savings account that, when used, covers the costs of a beneficiary’s qualified education expenses. In addition, the account holder can make after-tax contributions to the account, and the money will grow tax-free.

The account’s distributions also remain tax-free as long as the funds cover qualified education expenses. Coverdell ESAs are available to beneficiaries under 18, and the account must be closed before the beneficiary reaches age 30. There are annual contribution limits for Coverdell ESAs.

Contributions to a Coverdell ESA can continue until the beneficiary reaches age 18. However, if the beneficiary does not use all the funds by age 30, the remaining balance will be taxed as income and may also be subject to a 10% penalty. Therefore, it is essential to carefully consider whether a Coverdell ESA is right for you before opening an account.

Contribution Rules for Investment Accounts for Minors

Each type of account for children has a specific annual contribution limit and rules regarding how the funds work.

UTMA Account Rules

UTMA account rules aren’t all that complex. Contributions to a UTMA account are not tax-deductible to the contributor. There is no specific limit on the contribution amount. However, you must report it to the IRS when making contributions over $16,000.

On a UTMA account, you can withdraw and can be made at any time for any reason without penalties. However, the income on the account is taxable to the child and may be taxed at the parent’s tax rate if the child’s unearned income exceeds $1,200 for the year.

A UTMA account can hold any type of assets, including real estate or partnership interests.

UGMA

UGMA follows the same rules as a UTMA. The difference between the two accounts is the type of assets that the account can hold. A UGMA can only hold financial products such as stocks, bonds, life insurance policies, and mutual funds.

Custodial Accounts

Contributions to custodial accounts are not tax-deductible, and you must report these contributions as gifts if they exceed the annual gift tax limit of $16,000.

Withdrawals from a custodial account can occur anytime, but must benefit the minor. However, the definition of “benefit” is loosely defined and allows a lot of leeway.

Roth IRA for Kids

Contributions to a ROTH IRA are made with after-tax dollars, so the contributions are not tax-deductible. There is an annual limit of $6,000 or the minor’s earned income, whichever is lower. You may withdraw at any time. However, the earnings on the withdrawals may be subject to a 10% penalty if the funds are withdrawn before retirement age and not used for a qualified expense, such as a first-time home purchase or higher education.

Custodial 529 Accounts

There is no limit on the number of contributions to a 529 plan, although contributions exceeding the annual gift limit must be reported on a gift tax return. The contributions are not deductible for federal tax purposes, although some states allow a deduction.

Withdrawals not used for education expenses are subject to penalties on the amount withdrawn. But, equally important, any unspent amount at the end of a child’s education can transfer to another beneficiary without penalty.

Coverdell Education Savings Accounts (ESA)

Coverdell Education Savings Accounts have an annual contribution limit of $2,000. Distributions from the account are tax-free if used for qualified higher education expenses. However, you must report the amount withdrawn on your tax return. Withdrawals not used for education expenses do have penalties.

Final Thoughts on Investment Accounts for Children

Gifting any amount to a child can give them a leg-up on their future savings and investment goals. In addition, you can make a small contribution in early life and watch it grow into a substantial nest egg.

Each investment account for children comes with its own set of tax considerations. We only scratched the surface of UTMA account rules in this post, but our talented tax pros can answer all your toughest questions.

Get started now with a one-on-one strategy session with a Shared Economy Tax pro to discuss the best options for you. We can help you find an account that meets your goals and maximizes your contribution’s impact.