Most people realize that a ROTH IRA is a good investment that allows retirement funds to grow tax-free. You can withdraw these funds tax-free in retirement. But what most people don’t realize that you can also start a ROTH IRA for kids.

What Is a ROTH IRA for Children?

A ROTH IRA for children works the same way as a ROTH IRA for adults. The child can put post-tax funds into the ROTH IRA, and the funds grow tax-free throughout the child’s life.

There is no minimum age to start a ROTH IRA, but the contribution is limited to a person’s earned income for the year. So teens have the opportunity to fund a ROTH IRA based on summer or after-school jobs, giving them a leg up on retirement.

Can an adult open a Roth IRA for a child?

Adults can open a ROTH IRA for a child. In fact, a minor cannot open a ROTH IRA account without an adult custodian. The adult does not need to be a parent, which allows other family members or friends to start a ROTH IRA for a child.

The contribution limits for a ROTH IRA are $6,000 or the child’s earned income. Earned income includes all income from employment, including wages, tips, and self-employment earnings. Self-employment can consist of earnings that are generally not subject to reporting, such as babysitting income or yard work.

Withdraw Rules for Investment Accounts for Minors

Just like ROTH contributions for adults, contributions to a ROTH IRA for a minor are not tax-deductible. Most children are taxed at a 0% rate even if they hold part-time employment. Because of this, your post-tax dollar contributions to a minor’s ROTH IRA are usually tax-free.

A minor can withdraw the contributions to their ROTH IRA at any time without paying taxes on the withdrawal. However, the same is not true for the earnings on the contribution.

Early withdrawals on the earnings in a ROTH IRA may be subject to a penalty of 10%. However, the child can avoid the early withdrawal penalty if the withdrawal is used for a first-time home purchase, higher education expenses, adoption expenses, or if the child becomes permanently disabled.

Roth IRA for Minors: Tax Considerations

There are several important tax considerations if you’re considering opening a ROTH IRA for your children.

You must transfer the funds held in a custodial ROTH IRA into a standard ROTH IRA once the child reaches age 18. That means you will no longer have control over the assets.

Roth IRAs provide long-term tax-free growth whether you take disbursements at 25 or 64, making them a flexible option. However, the accessibility of the funds may be detrimental to retirement planning if the child accesses the funds before retirement. After the Roth IRA is funded for five years, the child can take out up to $10,000 to buy a first home, tax, and penalty-free.

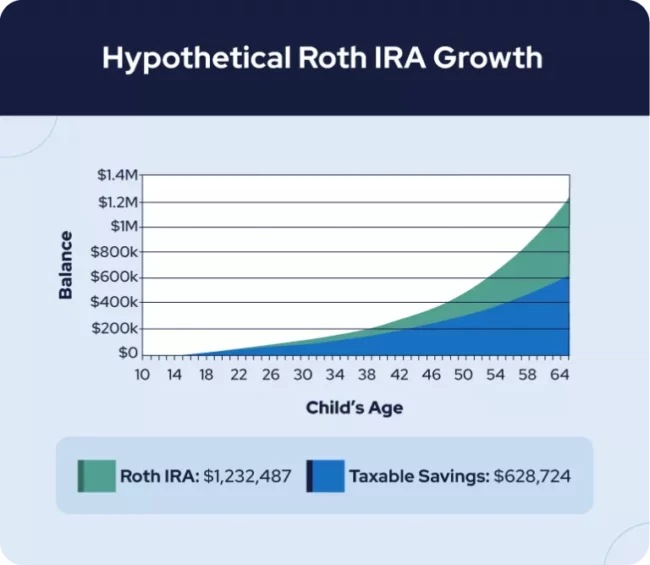

Roth IRAs are especially valuable when a child has a long time until retirement. Once your child reaches retirement age, the “kid” may take qualified distributions tax-free.

As we noted before, kids tend to have low income and will be contributing funds paid at low-income tax rates to the ROTH IRA. For example, if a child earns $6,000 from a part-time job during the summer, they will not pay any federal income tax on the earnings. The $6,000 can then be contributed to a ROTH IRA after essentially paying 0% taxes on the contribution. When the child withdraws their funds after their full retirement age, they will not pay taxes on the withdrawal.

Pros and Cons of a Roth IRA Minor

There are several non-tax considerations to consider when opening a ROTH IRA for a child.

Benefits of Opening a ROTH IRA for a Child

Opening a ROTH IRA is an easy way to make a purposeful gift to a child. Anyone can make a gift as long as the total gifts do not exceed the maximum ROTH IRA contribution for the year or the child’s earned income (whichever is less).

You will establish the beginning of a solid retirement fund by giving the funds a headstart on compounding. For example, if you invest $6,000 for a child and they leave it untouched for 50 years while earning a 6% return, the $6,000 will grow to $110,000.

The adult controls a minor’s ROTH IRA until the child reaches adulthood. The adult has the authority to make investment decisions and distributions if necessary for the benefit of the child.

Disadvantages of Opening a ROTH IRA for a Child

Some colleges will consider a ROTH IRA an asset to the child when making financial aid offers. This could make the child ineligible for financial aid. However, funds owned by the parents have less effect on a school’s offer of financial assistance.

Final Thoughts on Taxes on Investment Accounts for Kids

Starting a ROTH IRA for your child can give them a leg-up on retirement while allowing them to access tax-free funds for certain expenses. In addition, if your child has a long-time before retirement, the after-tax contributions will have considerable time to compound before the child reaches retirement age. If you’re still unsure if a ROTH IRA is the right move for your kids, you should consult a tax planning expert such as the pros at Shared Economy Tax, who have helped countless parents decide whether a ROTH IRA is suitable for their children.