If you overpay on your taxes, you’re eligible to receive a tax refund. Usually, refunds are the result of employers withholding too much money. However, self-employed individuals may receive a refund if they overpay on their estimated taxes. If you are one of the lucky taxpayers who gets a tax refund, here’s how you can track your tax refund status.

How Long Does It Take to Get My Tax Refund?

The IRS starts accepting tax returns in January, and you’ll typically get your refund sooner if you file earlier. However, you could wait longer for your paymentif you wait until the last minute to file.

Another big factor in determining your refund timetable is your filing method.

Filing Method

There are two main ways to file your taxes. Each can affect the amount of time it takes to receive your return.

Filing your taxes by mail simply takes longer. It takes approximately 6 to 8 weeks for the IRS to process a mailed tax return. If you mailed your form, you should wait at least 4 weeks before checking on your return.

E-Filers

You can get your refund much quicker if you e-file. The IRS processes e-filed taxes in as little as 48 hours, so you should receive your payment in about 21 days.

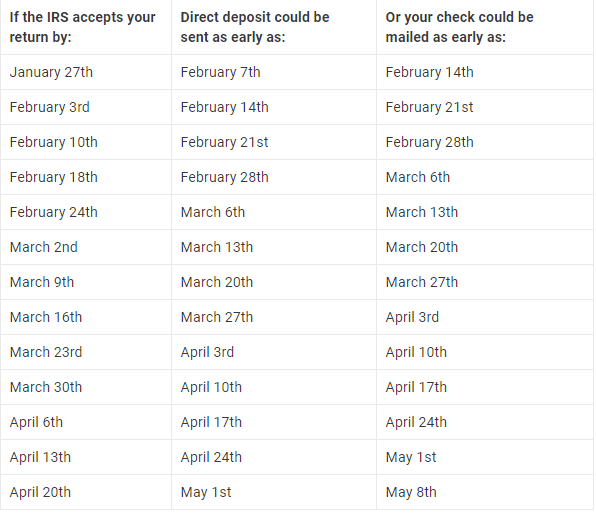

IRS Refund Schedule

Below is an approximate time-frame for your tax refund to arrive. Check payments will require additional time for shipping and processing.

Payments

Tax filers also have to choose a payment method. If the IRS owes you money, you need to tell them how to send it to you.

Check

If you choose to receive a check, you’ll have to wait for the check to process and send out. Then, you have to wait for delivery, which can take up to a week or two longer.

Direct Deposit

Direct deposit is the quickest way to receive your tax refund. Once your tax return is processed, the IRS will deposit the funds directly into your account. Choosing direct deposit should shave a few days off your wait time.

Tax Refund Tracker

Do you want your tax refund status right now? The IRS website has a feature that lets you instantly track your refund. Check out IRS.gov or click the image above to use the IRS’s “where’s my refund?” feature.

You have to submit your SSN, filing status, and total refund amount to verify your identity before you look up your return, so keep this information handy.

IRS Where’s My Refund will give you a good idea of when your refund will arrive. However, delivery takes a lot more time than an electronic fund transfer. If you opted for a paper check in the mail, it could take a few weeks to receive it.

Let Us Handle Your Taxes

Shared Economy Tax is an industry-leader in taxes for freelancers, Airbnb hosts, and other sharing economy participants. Get started now with a one-on-one consultation to see how much you can save.