Transportation expenses can be among the biggest expenses for employees and business owners. The IRS allows you to take either the actual expenses for your travel costs or a standard mileage rate. Knowing which one to take can mean significant tax savings. We’ll look at the current standard mileage rates, their use, and the alternative option.

What is the Standard Mileage Reimbursement?

The standard mileage rate simplifies the deduction for vehicle expenses. Taxpayers can simply multiply the number of business miles driven by the standard rate to calculate their deduction.

If you choose to deduct actual costs instead of using the standard rate, you must track your expenses individually. When a vehicle is used for both business and personal purposes, those expenses must be allocated based on the percentage of business use.

Eligible expenses include gas, maintenance, insurance, repairs, and vehicle depreciation.

Your choice of deduction method in the first year the vehicle is placed in service is important. If you use the standard mileage rate in the first year, you may switch to the actual expense method in a later year. However, if you start with the actual expense method — particularly if you claim accelerated depreciation, Section 179, or bonus depreciation — you generally cannot switch to the standard mileage rate later. In other words, beginning with actual expenses can limit your flexibility in future years.

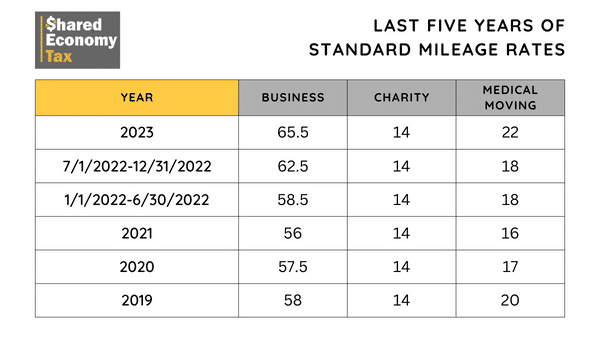

The IRS sets the standard mileage rate ahead of each calendar year based on national data regarding vehicle operating costs. While the rate is typically announced once per year, the IRS has occasionally issued midyear adjustments during extraordinary circumstances. The most recent example occurred in 2022, when the agency implemented a rare midyear increase in response to sharply rising fuel prices following Russia’s invasion of Ukraine.

Should I Use the Standard Mileage Method?

There is no universal answer. Choosing between the standard mileage method and the actual expense method depends on your vehicle, your business use percentage, and your long-term tax strategy.

One of the primary advantages of the standard mileage method is simplicity. You only need to track your business miles throughout the year and apply the IRS rate when calculating your deduction. This significantly reduces the administrative burden compared to tracking every fuel, maintenance, insurance, and repair expense.

In some cases, the standard mileage rate may also produce a larger deduction — particularly if you drive a fuel-efficient vehicle, have modest insurance and repair costs, or operate in an area with lower operating expenses.

The standard mileage method is often well-suited for vehicles used for both personal and business purposes. Because the deduction is calculated strictly based on business miles driven, allocation between business and personal use is straightforward.

However, the actual expense method may generate a larger deduction for certain vehicles — especially newer or higher-value vehicles where depreciation is significant in the early years. Depreciation can meaningfully increase deductions under the actual method.

Bonus depreciation is still available, although it has been phasing down in recent years. In addition, vehicles with a gross vehicle weight rating (GVWR) over 6,000 pounds may qualify for substantial first-year deductions under Section 179, subject to annual limits and business-use requirements. In these situations, the actual expense method often produces a larger upfront deduction.

Keep in mind that the method you choose in the first year the vehicle is placed in service can affect your flexibility in future years. Starting with the standard mileage method generally preserves the ability to switch later, whereas certain depreciation elections under the actual method may limit that option.

Because depreciation rules, Section 179 limits, and bonus percentages change over time, it’s wise to consult a tax professional before making a final decision.

Ultimately, the most reliable way to determine which method benefits you most is to run the numbers both ways and compare the results. Before making any major changes, consult with a tax professional to avoid unforeseen complications.

What Was the Standard Mileage Rate In 2025?

For tax year 2025, the IRS set the standard mileage rate for business use at 70 cents per mile.

Unlike 2022, the IRS did not issue a midyear adjustment. Taxpayers may apply the 70-cent rate to all qualifying business miles driven between January 1 and December 31, 2025.

As always, this rate applies to business mileage for self-employed individuals and for employees deducting unreimbursed business expenses where permitted. Separate rates apply to medical, moving (for qualifying active-duty military members), and charitable mileage.

What Is the Standard Mileage Rate for 2026?

For tax year 2026, the IRS increased the business standard mileage rate to 72.5 cents per mile.

This rate applies to all qualifying business miles driven beginning January 1, 2026. As of now, no midyear adjustment has been announced.

Keep in mind that the business mileage rate is distinct from other mileage categories. For 2026:

- Medical and qualifying moving mileage is 20.5 cents per mile

- Charitable mileage remains 14 cents per mile (set by statute)

Taxpayers should always confirm they are using the correct rate for their specific situation before calculating deductions.

How to Claim the Standard Mileage Deduction

Claiming the standard mileage deduction requires proper documentation.

First, you must maintain a contemporaneous mileage log. Your log should include the date of each trip, the business purpose, and the number of miles driven. The more detailed and consistent your records are, the easier it will be to substantiate the deduction in the event of an IRS audit.

While mileage was traditionally tracked in a paper notebook, many business owners now use mobile apps that automatically log and categorize business trips. Digital tracking can reduce errors and simplify recordkeeping.

Self-employed individuals typically claim the standard mileage deduction on Schedule C as part of their business expenses. (Certain employees and other qualifying taxpayers may use Form 2106, but unreimbursed employee business expenses are generally not deductible under current federal law.)

Only qualifying business miles may be deducted. Commuting from your home to your primary place of work is not considered business mileage and should be excluded. However, if your home qualifies as your principal place of business, travel from your home office to another work location may count as deductible business mileage. Driving between multiple job sites or client locations during the day is also generally deductible.

Because the rules surrounding business use, commuting, and home offices can be nuanced, consulting a tax professional can help ensure you are claiming only eligible miles and maintaining proper documentation.

Closing Thoughts on Standard Mileage Deductions

Vehicle expenses can represent a meaningful deduction for many business owners. Taking advantage of the standard mileage rate can simplify recordkeeping while still providing substantial tax savings — provided you maintain accurate logs and apply the correct rate for the year.

Tax laws and IRS guidance evolve over time. Working with a knowledgeable tax professional can help you choose the right deduction method, comply with documentation requirements, and maximize the benefit available to your business.

If you’re ready to step up your tax strategy and start maximizing deduction, you need to talk with the tax pros at Shared Economy Tax. We focused on serving small businesses, self employed individuals, and real estate investors. Click here to set up a complimentary 1-on-1 strategy session with our team to see how much you can save.