When you use your home as a short-term rental property, there are many tax breaks you can benefit from. These deductions and incentives allow you to effectively reduce your costs and build income. In this helpful guide, you’ll learn about six of the most useful short-term rental tax benefits available to you.

Short-Term Rentals & Taxes: An Overview

Owning a short-term rental property can significantly affect your tax obligations when you next file your taxes. For example, you have the ability to earn more income, which may increase the amount of taxes you owe. However, you also benefit from many available tax deductions. To save money, you’ll need to utilize the right tax planning strategies.

The Top-6 Short-Term Rental Tax Benefits

There are many short-term rental tax benefits that you can take advantage of. The following offers an in-depth look at six of the top benefits at your disposal, which include:

- Deduction of operating expenses

- Mortgage interest deductions

- Property depreciation

- Repairs and maintenance deductions

- Home office deductions

- Local tax benefits and incentives

Deduction of Operating Expenses

One of the top advantages of using your home as a short-term rental with Airbnb or a similar platform is that you can deduct your operating expenses.

Many ordinary and necessary expenses related to the operation of your short-term rental can be deducted from your annual tax return. These expenses include everything from utilities and property management services to cleaning fees.

If you have a professional cleaning company tend to the property once per week or month, these are considered deductible expenses. The same is true if you hire a third-party company to manage your rental property.

Mortgage Interest Deductions

If you’re currently paying for a mortgage on your short-term rental property, you should be able to deduct the mortgage interest you’ve paid from your annual taxes.

This is also possible with your personal property, which means that you continue having access to this benefit even if you use the property as a short-term rental.

By deducting your mortgage interest, you’ll effectively reduce your overall tax burden for the property in question. If you currently have private mortgage insurance (PMI) with your mortgage loan, you can deduct your monthly premiums as well.

Property Depreciation

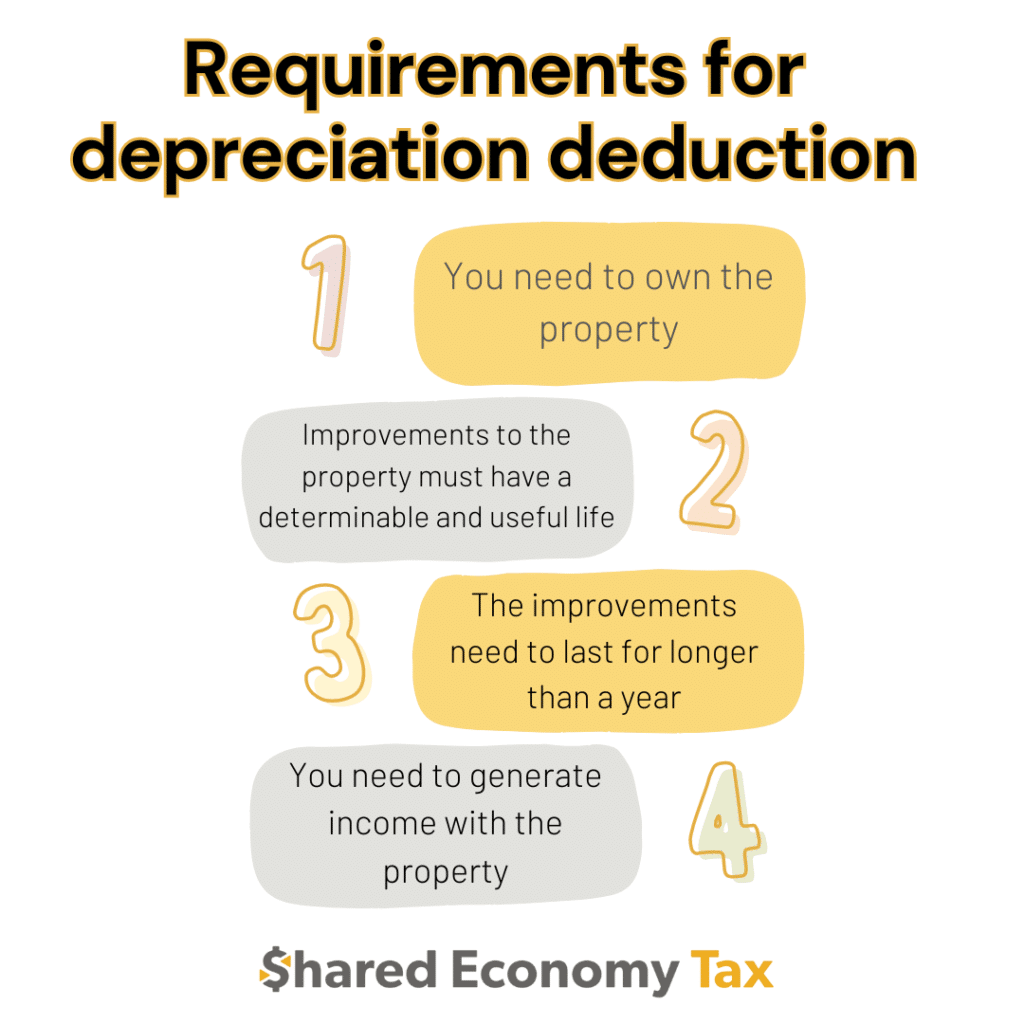

Short-term rental properties can benefit from depreciation deductions. These deductions give you the opportunity to spread the property’s cost over its useful life. There are four requirements you must meet if you wish to use the depreciation deduction, which are:

Depreciation spreads out over 27.5 years, which means that you can deduct depreciation on your next 28 tax returns.

Repairs and Maintenance Deductions

As a short-term rental property owner, you’ll invariably need to perform maintenance and repairs regularly. You should be able to deduct most of these expenses.

However, they must be deemed reasonable, necessary, and ordinary. Maintenance fees can add up to hundreds or thousands of dollars every year, which makes this one of the most beneficial tax breaks in this guide.

Home Office Deductions

If you operate your short-term rental business out of a home office, you might qualify for additional deductions as a result of using your personal residence for business purposes.

If you do anything to manage this business from your own home, you can deduct as much as 300 square feet of space in your home as an office. It’s possible to claim $5 per square foot, which gives you a max deduction of $1,500 per year.

Keep in mind that some of the equipment in your home office could be deducted as well if you use it for business reasons.

Local Tax Benefits and Incentives

Some counties and states offer their own tax incentives that might be available for short-term rental owners. These incentives can vary by location, which is why you should work with a tax professional to see if you have access to any local benefits.

Potential Downsides and Tax Complications

While there are many short-term rental tax benefits that you can list on your next tax return, there are also some potential downsides and tax complications to consider.

For example, short-term rental hosts must take income variability into account. If a tenant leaves your property, you must find other qualified tenants. This process can take days or weeks. During this time, you won’t be making any income on your rental property.

If you want to claim any tax deductions related to your short-term rental property, you must have meticulous record-keeping. If you don’t keep receipts of your expenses, you may find it impossible to claim deductions.

Keep in mind that some cities and locations across the country have strict guidelines about homeowners who offer short-term rentals. Make sure you thoroughly read the regulations in your area to ensure you can legally host an Airbnb or similar type of short-term rental.

An additional downside to renting out your property on a short-term basis is that you’ll likely need to perform regular maintenance, which can be costly. While these expenses can be claimed as a deduction on your tax return, you’ll still be tasked with paying these expenses before you file.

Closing Thoughts

Whether you’re an investor or a first-time homeowner, you have access to many short-term rental tax benefits, which include depreciation, home office deductions, and deductions pertaining to your operating expenses.

Shared Economy Tax specializes in cutting-edge tax strategies for Airbnb Hosts and short-term rental operators. Get started now with a one-on-one strategy session with our tax pros to see how much you can save.