The IRS typically affords tax breaks to taxpayers with qualifying dependents to compensate for their additional costs. The most prevalent type of dependent is children, but qualifying relatives often include adults and other individuals in your household. However, your claimed dependents must pass the qualifying relative test to count. This guide covers the latest IRS qualifying relative rules for 2021 and explains how you can apply them to your taxes.

What Is the Qualifying Relative Test?

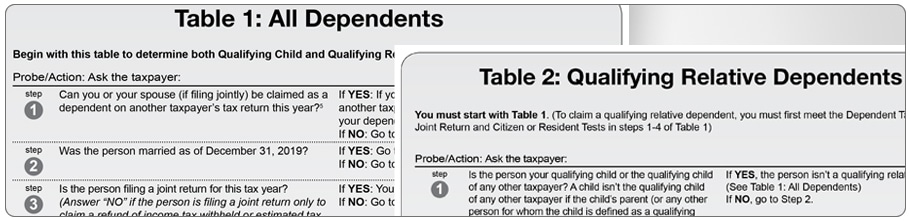

The IRS Qualifying Relative Test primarily uses three factors to qualify a potential dependent. Here’s a brief overview of the criteria:

- What sort of link does this person have to the taxpayer?

- What is the size of the relative’s income?

- And how much money does the taxpayer supply toward the relative’s support?

These qualifying relative rules allow potential certain savings for certain non-relative children and other household members. Heads of households could reap significant tax benefits from maximizing these tax breaks.

Is a Qualifying Relative the Same as a Dependent?

Yes, and no. You can claim a qualifying on your tax return as a dependent. However, the reverse isn’t always true because a dependent doesn’t necessarily meet the criteria for a qualifying relative. A qualifying relative is a very specific term for a narrow class of dependent household members. Typically, a qualifying relative is an older person with diminished capacities and earning power.

The IRS qualifying relative definition says, “a dependent is a person other than the taxpayer or spouse who entitles the taxpayer to claim a dependency exemption. Each dependency exemption decreases income subject to tax by the exemption amount.”

IRS Qualifying Relative Rules 2021

Believe it or not, most qualifying relatives aren’t children. Children are typically qualified under a different set of standards. However, an adult child living with parents can qualify if their income is low enough, the parental support is high enough, and the children meet age restrictions. Non-students older than 19 and students older than 24 don’t qualify under the IRS criteria.

Qualifying relatives can be direct descendants, children, step-children, foster children. It can also apply to grandchildren, great-grandchildren, and so on. In-laws, siblings, half-siblings, and step-siblings can also qualify. Spouses may never be listed as qualifying relatives.

Tenure of residency can also affect the qualifying relative test. A claimed dependent must live with the taxpayer throughout the prior year and rely on them for more than half of their financial support. However, the dependent’s gross income must fall under $4,300 to qualify as a qualifying relative. Taxpayers can still claim qualifying dependents that don’t live with them, but the potential dependents must meet the specified financial criteria.

Finally, you can also claim a dependent for any qualifying relatives that die during the year. This rule also applies to children born during the year who remain in the home until December 31st.

Can Qualifying Relatives Reduce Your Tax Bill?

Since 2018, the IRS recognizes Child Tax Credits of $2,000 for each qualifying child. The government also awards $500 for each qualifying relative under its Credit for Other Dependents (ODC) worksheet. Under the ODC guidelines, taking care of two aging parents could earn you $1,000 toward your adjusted gross income (AGI).

Keeping with this example, taxpayers can also deduct daycare and medical expenses associated with the welfare of their parents. Filing with qualifying relatives may also boost earned income credits, depending on your income. Together, these credits can significantly lower your AGI. Lowering your AGI reduces your overall taxable income and subsequently reduces your year-end tax bill.

More Ways to Lower Your Tax Bill

Hopefully, these qualifying relative rules will lead you to additional tax savings. Here are a few other strategies for reducing your year-end tax bill:

- Opening a health savings account (HSA): This tax-advantaged account covers medical expenses from before you reach your insurance deductible. Only certain insurance plans allow HSA accounts, so check with your insurance provider to learn more.

- Building your retirement: Contributing funds to IRAs, 401(k)’s, and other tax-advantaged retirement accounts can reduce your adjusted gross income for the year.

- Start your side hustle: You can deduct business expenses from your side hustle on your main tax return.

- Combine business trips and vacations: You can deduct a portion of your travel costs in some instances.

- Tax credits for college students: You can earn up an annual credit of up to $2,000 if your child is in college.

These are just a few examples of excellent tax deductions for self-employed workers and small business owners. Explore our site for more money-saving tax tips, or sign up for our monthly newsletter using the form at the end of this article.

Get Expert Tax Help Now

If you’re looking for creative ways to lower your tax bill, you landed in the right spot. Shared Economy Tax specializes in tax prep services for independent contractors and small businesses. Our talented tax pros can help you squeeze every last drop of deductions out of your tax return. Click here to sign up for your complimentary one-on-one consultation now.