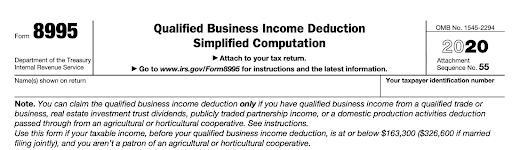

Many business owners have heard of IRS Form 8995. But what does this do for small businesses? And how can you use IRS Form 8995 to save your business money?

The 2017 Tax Cuts and Jobs Act (TCJA) made some major changes to the tax code. In particular, this legislation reduced the corporate tax rate from 35% to 21%. When initially proposed, this reduction seemed unfair to small businesses since they are not corporations. After all, reducing the corporate tax rate doesn’t help sole proprietors, partnerships, and other businesses organized as pass-through entities.

To fix this, the final TCJA included the Qualified Business Income Tax (QBIT) deduction. This allows eligible pass-through entities to deduct up to 20% of their qualified business income when they file taxes. To take advantage of this, taxpayers simply file IRS Form 8995 with their personal tax returns.

We’ll use the rest of this article to explain both the QBIT deduction and as a guide for IRS Form 8995. Specifically, we’ll cover the following topics:

- What is Form 8995?

- Can I Use Form 8995 for My Business?

- How Do I Calculate a Pass-through Deduction?

- What’s a Loss Carryforward?

- Final Thoughts

What is Form 8995?

In order to understand Form 8995, business owners should first understand the Qualified Business Income Tax (QBIT) deduction. As mentioned before, Congress decided to allow pass-through entities to reduce their tax liability to provide non-corporate owners equal treatment. In other words, since Congress reduced the corporate income tax, they also wanted to help out businesses that organize as pass-through entities (e.g., sole proprietorships and partnerships).

To accomplish this equitable treatment, Congress authorized the QBIT deduction via the Tax Cuts and Jobs Act of 2017. According to this rule, businesses organized as pass-through entities could reduce their eligible taxable income by 20%. And, according to the IRS:

…the deduction is available, regardless of whether taxpayers itemize deductions on Schedule A or take the standard deduction.

Let’s say, for example, you are the sole proprietor of an e-commerce business. In this instance, you have $100,000 in qualified business income (QBI) in a given year. According to the QBIT deduction, you can reduce that taxable income by 20%. In other words, rather than pay taxes on $100,000, your taxable business income would only be $80,000.

Now, the next question is, how do I claim this 20% deduction? The IRS created two forms for pass-through businesses to use to report their QBIT and claim the associated deduction: Form 8995 and Form 8995a. Depending on your situation, business owners must choose between these forms to claim your QBIT deduction. More precisely, you should pick a form depending on the following information. According to the IRS:

Form 8995-A must be used if taxable income is over the [minimum income] threshold or if you or any of your trades or businesses are patrons of a specified cooperative. Alternatively, Form 8995 may be used in all other cases…

… Form 8995 or 8995-A, as applicable, must be attached to any return claiming a qualified business income deduction beginning in 2019.

As with most tax issues, the IRS uses fairly complex calculations and requirements to the QBIT deduction. If unsure what form you should use, or if you qualify for the deduction, feel free to contact us for assistance.

Can I Use Form 8995 for My Business?

It depends. The TCJA tailored the QBIT deduction to assist as many pass-through entities as possible. You can review your situation based on the following two business components :

- QBI Component: This component of the deduction equals 20 percent of QBI from a domestic business operated as a sole proprietorship or through a partnership, S corporation, trust or estate. The QBI Component is subject to limitations, depending on the taxpayer’s taxable income, that may include the type of trade or business, the amount of W-2 wages paid by the qualified trade or business and the unadjusted basis immediately after acquisition (UBIA) of qualified property held by the trade or business.

- Real estate investment trust / publicly traded partnership (REIT/PTP) Component: This component of the deduction equals 20 percent of qualified REIT dividends and qualified PTP income. This component is not limited by W-2 wages or the UBIA of qualified property. Depending on the taxpayer’s taxable income, the amount of PTP income that qualifies may be limited depending on the PTP’s trade or business.

As a result, business owners must first ask themselves if they fall into either of the above categories? Most small business owners fall into the first category of companies organized as pass-through entities.

If your business meets this requirement, you next need to confirm that you meet income requirements. However, if your personal taxable income exceeds a certain threshold, you will not qualify for the QBIT deduction.

How Do I Calculate a Pass-through Deduction?

To calculate your pass-through deduction, you first need to calculate your actual Qualified Business Income (QBI). The IRS defines QBI as:

[…] The net amount of qualified items of income, gain, deduction and loss from any qualified trade or business, including income from partnerships, S corporations, sole proprietorships, and certain trusts. Generally this includes, but is not limited to, the deductible part of self-employment tax, self-employed health insurance, and deductions for contributions to qualified retirement plans (e.g. SEP, SIMPLE and qualified plan deductions).

Next, business owners that fall beneath the income threshold can simply multiply their QBI by 20% to calculate their pass-through deduction. The IRS has also outlined numerous items that do not qualify as QBI to ensure pass-through businesses do not abuse this deduction. While this is not an all-inclusive list, you should not include the following items in your QBI calculation:

- Items that are not properly includable in taxable income

- Investment items such as capital gains or losses or dividends

- Interest income not properly allocable to a trade or business

- Wage income

- Income that is not effectively connected with the conduct of business within the United States

- Commodities transactions or foreign currency gains or losses

- Certain dividends and payments in lieu of dividends

- Income, loss, or deductions from notional principal contracts

- Annuities, unless received in connection with the trade or business

- Amounts received as reasonable compensation from an S corporation

- Amounts received as guaranteed payments from a partnership

- Payments received by a partner for services other than in a capacity as a partner

- Qualified REIT dividends

- PTP income

What’s a Loss Carryforward?

In the real world, small businesses don’t always make money. And plenty of companies incur losses any given year. This begs the question, how do these losses affect QBIT deductions?

Once again, it depends. More precisely, how the IRS treats losses depends on whether or not you own any other pass-through businesses.

If someone owns multiple eligible businesses:

… (the) taxpayer must net their QBI, including losses, from multiple trades or businesses (including aggregated trades or businesses). So, qualified business losses from one business will offset QBI from other trades or businesses (including aggregated trades or businesses) in proportion to the net income of the trades or businesses with QBI.

On the other hand, what if you don’t have another business against which you can net losses? In this situation:

… the carried forward negative QBI will be treated as negative QBI from a separate trade or business for [the] purpose of determining the QBI Component in the next taxable year.

Simply put, a loss doesn’t really go away. Rather, the IRS allows businesses to carry forward QBI losses to subsequent years.

Final Thoughts

The Qualified Business Income Tax deduction can save small business owners a ton of money. But, filling out IRS Form 8995 can also be extremely complicated. Don’t let the challenge of filling out this form dissuade you from taking advantage of these incredible tax savings.

At Tax Hack, we live and breathe taxes for small businesses. So contact us today to set up a QBIT deduction planning strategy session!