One of the most significant financial reports for your business is going to be your profit and loss statement. The overall financial health of your business can be displayed in your profit and loss, it’s what banks will use in determining your eligibility for a loan, and it also plays a factor in determining your taxable income. As a business owner or self-employed professional, you are probably familiar with the basics of a profit and loss statement. We find that fully understanding its function and how it is formulated, is significant in helping small business owners with their tax planning; which in turn helps them save money on taxes and plan for their future.

Understanding the Profit and Loss Statement

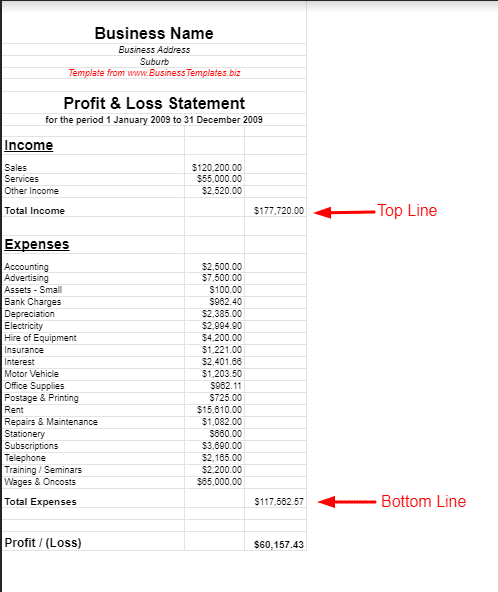

Profit and loss statements show business revenues and expenses for a given period of time. To calculate net income, deduct your business’s expenses from its gross revenues. The total will either be negative or positive, resulting in either profit or loss. These figures are important for financial planning, and you can use them as a basis for forecasting future revenues. This data can also help you create a budget, improve business performance, and cut costs.

What Does the P&L Statement Track?

A P&L statement tracks a company’s incoming revenues as well as their expenses and liabilities for a set period of time. It is instrumental in tracking businesses’ financial status and progress. You can organize these reports to whatever time frame fits your business. P&L statements commonly track performance by the month, quarter, and year.

Top Line Meaning

When running a profit and loss statement, you will need your gross revenues. Revenues include every dollar your business made, and it’s located on the top of the P&L statement. The top line is important because it can be an indicator of where your business is heading. An increase in your top line indicates that business is going well and there’s potential for growth.

Bottom Line Meaning

After you deduct business expenses from gross revenues, you have net income. Net income is located on the bottom of the P&L statement, so it’s commonly called the bottom line. As mentioned above, your bottom line total will either be a profit or a loss. The IRS uses this number to calculate taxable earnings. Lenders also use it to determine loan eligibility. In addition, your bottom line is important to help you evaluate your operating procedures.

Profit & Loss Template

Calculating your profit and loss is a relatively simple procedure. You will need to collect all of the important relevant information for the time period you are surveying. This includes gross revenue and expenses. You first need to calculate your gross revenues, which is your total sales and income for the given period. Next, you will need to account for all of your business-related expenses. These can include things like rent, insurance, equipment, office supplies, marketing expenses, meals, professional fees, travel, and utilities; basically the cost of doing business. Having a good accounting system in place can be really beneficial when it comes time to run your P&L.

Once you have all of the pertinent information, you subtract your business expenses from your gross income. You are left with your net income. If your net income is negative, you can deduct it as a loss on your taxes. The IRS will allow you to claim a loss on your business for 3 out of 5 tax years. Claiming losses can help reduce your tax liability.

Answers to Your Accounting Questions

Good accounting practices make it easier to manage your businesses and taxes. That puts more money in your pocket and helps your business grow. However, accounting isn’t a one-size-fits-all situation, so it’s important to understand your needs. A professional accountant can show you what your business needs to grow without overcomplicating things. Schedule a free one-on-one strategy session with a Shared Economy Tax pro today to learn how we can help. You can also sign up for our free newsletter using the form below.