To invest in real estate, you must have access to ample funding. The IRS assists investors by providing different forms of tax relief. You can effectively boost your cash flows and take advantage of accelerated depreciation with a cost segregation study. Here’s how to prepare for a cost seg study.

What Is CostSeg?

Cost segregation is a tool that allows you to deduct a property’s depreciation from your taxable income. Numerous types of properties are eligible for these studies, which include most residential homes.

Cost segregation can also be performed with many types of commercial real estate, which include office buildings, retail storefronts, and specialized facilities. The depreciation of the property can be sped up from the traditional 39-year timeline that commercial properties adhere to. In this scenario, you can deduct more from your taxes each year.

What Is a Cost Segregation Study?

Without a cost segregation study, real estate investors can depreciate residential properties over 27.5 years and commercial properties over 39 years. A cost seg study is the first step towards taking advantage of cost segregation on your tax return.

It’s a process that identifies assets in your building that can be depreciated faster. Components like carpeting, plumbing fixtures, fencing, and sidewalks can be part of a cost seg study. When an expert conducts this study, they’ll split every property element into different categories.

Benefits of Cost Segregation

There are many reasons why investors should use cost segregation, which include everything from considerable tax savings to accelerated depreciation.

Tax Savings Opportunities

Cost segregation can help you claim higher depreciation deductions every year, which should reduce your annual income taxes.

Accelerated Depreciation

The main advantage of a cost seg study is that it allows you to accelerate depreciation. Instead of depreciating the entire property over anywhere from 27.5 to 39 years, you can claim some deductions on components in just five to 15 years.

Enhanced Cash Flow

Cost seg studies allow you to increase your cash flow after paying taxes. By reducing your taxable income, you should have more money in your bank account that can be applied to the property’s cash flow.

Improved Financial Reporting

Obtaining a cost segregation study ensures that you comply with IRS regulations regarding the depreciation and classification of assets. If you correctly categorize these assets, you can avoid fines, penalties, and expensive audits.

Potential for Reducing Property Taxes

If you obtain an appraisal for the cost segregation study, you may be able to reduce your property taxes. When the appraised value is lower, you won’t pay as much in property taxes.

Preparing for CostSeg Success

By preparing for your cost segregation study, you should be able to complete the process without any delays or roadblocks.

Timing Your Study for Maximum Benefit

The optimal timing for conducting a cost segregation study is right after you purchase, construct, or renovate an investment property. If you can get this study done during the same year that you make these investments, you should be able to maximize your tax savings. Otherwise, you’ll need to obtain a look-back study and claim a catch-up deduction.

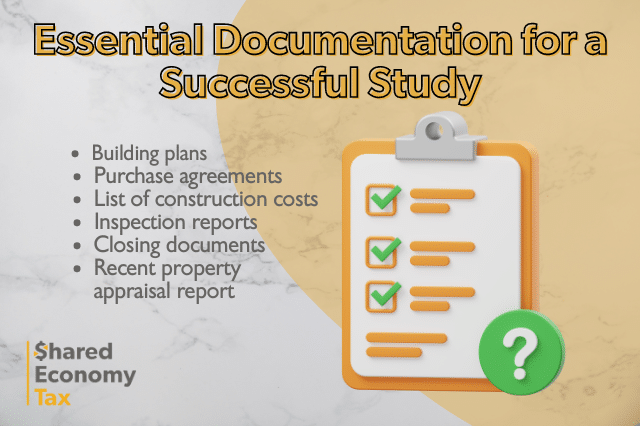

Essential Documentation for a Successful Study

Make sure you have the right documentation for a successful study. The experts who perform this study need to identify the value of the building and its components. You must maintain detailed records to support the study’s findings. The documents you should have on hand include the following:

Selecting a Qualified Cost Segregation Specialist

You can’t perform a cost segregation study on your own. To ensure the study is completed correctly, you need to choose the right professional for the job. When hiring a tax professional, the key credentials and experience they should have include the following:

- Certified public accountant (CPA) or enrolled agent (EA) certification

- Preparer tax identification number

- At least a few years of experience performing cost segregation studies

Ask them for references from past customers. You should also inquire about their experience with performing cost segregation studies. Not every tax professional knows how to conduct one. Make sure you get proof of their license or certification as well.

Preliminary Assessment: Estimating Potential Savings

Before you request a cost segregation study, you can do a preliminary assessment that allows you to estimate the financial impact. There are many tools and software solutions that can help you with this initial evaluation. For example, KBKG offers a cost segregation savings calculator that estimates the amount you can save with a study. All you need to do is enter some basic information about your property.

Breaking Down Property Components

Cost segregation studies analyze different components of a property, which include land improvements, structural components, and personal property. The traditional depreciation timeline can be accelerated into five, seven, or 15-year intervals. Even though the structure will continue to depreciate over 27.5 years. Keep in mind that land improvements include everything from a new fence to an upgraded walkway. Appliances often depreciate in seven years.

Site Visit Preparation

Certified tax professionals will visit the site of your investment property to perform the study. Before they get there, consider cleaning up the place. The expert will examine all components in your property to estimate their values and assess specific tax classifications. Work closely with them to facilitate an efficient and thorough assessment. Point out any improvements you’ve made to the property.

Navigating the Final Report

The tax expert who performs the cost segregation study should help you review and interpret it. Once they place your assets into different tax classifications, you can determine how quickly these items depreciate.

To integrate the study’s results into your tax filings, make sure you have your return on hand when you discuss the report with the expert. If you’re changing your accounting method because of the cost segregation process, you must file Form 3115 with the IRS.

How Long Does the CostSeg Study Process Take?

When a tax professional performs a cost seg study, they must separate every aspect of your investment property into a specific classification, which takes time. The entire study can take one to two months to complete. The exact timeline depends on the size of your investment property, the type of building you own, and the amount of paperwork you provide.

Closing Thoughts on Cost Seg Study Preparation

Cost segregation studies are highly effective because of their ability to accelerate depreciation in an investment property. However, this process can take longer than a month to complete. To make sure it goes as smoothly as possible, prepare the necessary documentation and hire a reputable tax professional.

These studies offer long-term tax planning benefits by allowing you to improve your cash flows and reduce your taxable income every year. When hiring qualified professionals, be proactive. Work closely with them to ensure you understand every step of the process.

Here you can view our latest webinar about cost segregation studies. If you’re ready to upgrade to a tax firm that understands your business, my team would love to connect with you. Get started now by signing up for a one-on-one strategy session with a Shared Economy Tax pro to see how much we can help you save.