There’s been a lot of talk in the news recently about Congress raising taxes on the wealthy. Regardless of what the final legislation looks like, high earners can expect some increase in taxes. If you fall into this category, you should take steps now to start implementing some tax-saving strategies. In this vein, our clients regularly ask us about setting up offshore trusts. As such, we’ll explain why people ask us how to save big on taxes with offshore trusts – and why that doesn’t work.

Specifically, we’ll cover the following topics:

- What is an Offshore Trust?

- Offshore Trust Tax Strategies

- Best Types of Offshore Trusts

- How to Set Up an Offshore Trust

- Compliance Considerations

- Are Offshore Trusts for Tax Savings Worth It?

- More Tax Strategies for High Earners

What is an Offshore Trust?

Let’s break down everything you need to know about offshore trusts

Definition

Before discussing offshore trusts, we must define trusts, in general. According to the IRS, a trust is a relationship in which one person holds title to a property, subject to an obligation to keep or use the property for the benefit of another. As this definition suggests, a trust has three parties:

Grantor: This individual holds some property and would like to move it into the protection of a third party for the benefit of someone else. To do this, the grantor transfers property into a separate legal entity known as a trust, which is managed by the trustee.

Trustee: This individual, acting in a fiduciary capacity, receives title to the grantor’s property. The trustee manages this property in accordance with the terms of the trust.

Beneficiary: Lastly, every trust must have a designated beneficiary. This is the individual who receives part or all of the assets from the trust, depending on its terms.

For example, wealthy parents (the grantors) may establish a trust for their young children to protect assets until adulthood. In this scenario, the trustee would manage the property in the trust and eventually distribute them to the children (the beneficiaries) in accordance with the trust’s terms.

An offshore trust functions in the same fashion – with one major difference. Most domestic (i.e. American) trusts exist at the state level. People establish offshore trusts, on the other hand, in some jurisdictions outside of the United States.

Potential Tax Benefits

The primary benefit of an offshore trust is asset protection. Say, for instance, you receive a civil judgment against you in US courts. If you hold assets in the United States, that judgment would also allow creditors to pursue your US assets. An offshore trust, though, avoids this situation. When you move your assets into an offshore trust, you place them outside the legal jurisdiction of US state and federal civil courts.

NOTE: An offshore trust will not protect you from a US bankruptcy judgment!

Unfortunately, many people – mistakenly – view offshore trusts as a means to reduce their US taxable income. However, this is a common misconception. Offshore, or foreign, trusts should not be used as a tax-saving strategy.

Rather, the IRS treats most offshore trusts as a special type known as a grantor trust. With these trusts, the grantor retains some element of control over the property in the trust. As a result, the IRS disregards the trust entity, and the grantor must pay taxes on all trust income. Or, in IRS terms, a U.S. person who is treated as the owner of a foreign trust under the grantor trust rules (IRC sections 671-679) is taxed on the income of that trust.

Alternatively, an individual may form a non-grantor offshore trust. In these types of trusts, the grantor has no control over the property held by the trustee. Consequently, the grantor does not need to pay taxes on the income earned by the property within the trust. But, the grantor will most likely have to pay capital gains taxes on the transfer of any property into a non-grantor trust.

While a grantor may avoid paying taxes on a non-grantor offshore trust, the beneficiary will not. According to the IRS, a U.S. beneficiary of a foreign non-grantor trust will report its share of foreign trust income.

Offshore Trust Tax Strategies

However, due to the popular misconception of offshore trusts as tax-saving vehicles, many sham offshore trust tax strategies exist. In a publication focused on these underhanded strategies, the IRS explains:

A specialized industry of offshore scheme promoters has developed to assist U.S. taxpayers in circumventing the current payment of income tax through the use of foreign trusts and other offshore entities. The promoters of offshore schemes often advance technical arguments which purport to show that their scheme is legal or compliant with the Internal Revenue Code. These arguments are used to induce their clients to enter into an abusive scheme, which usually involves concealing the true ownership and control of assets and income.

To be clear, most of these abusive strategies are illegal. As a rule of thumb, a trust formed solely to minimize your tax liability will be disregarded by the IRS. And, in some situations, abusing offshore trusts will also qualify as tax evasion, exposing taxpayers to civil and criminal liability.

Best Types of Offshore Trusts

Unfortunately, offshore trusts do not provide the tax savings suggested by popular culture. But, there are some good reasons to create one. As discussed above, an offshore trust’s primary benefit is asset protection. If you believe you will be subject to a US civil judgment, moving your assets into an offshore trust can potentially protect them from this judgment.

How to Set Up an Offshore Trust

In practice, you’ll establish an offshore trust with the assistance of a law firm specializing in these types of trusts. These firms will provide you with (or act as) an offshore trustee. You will then provide the legal title of your assets to this trustee. To establish an offshore trust, you’ll typically pay an initial set-up fee followed by subsequent annual management fees.

Compliance Considerations

To crackdown on tax evasion via offshore trusts, the IRS has imposed significant reporting requirements. According to the IRS:

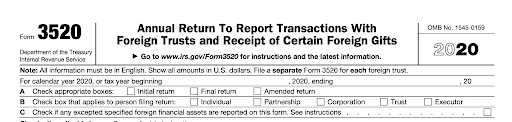

In addition to tax consequences, there are a number of reporting rules that can apply to a U.S. person who enters into transactions with a foreign trust or is treated as an owner of a foreign trust under the grantor trust rules of Internal Revenue Code (IRC) sections 671-679, including information reporting on Forms 3520 and 3520-A; on Form 8938, Statement of Specified Foreign Financial Assets; and on FinCEN Form 114, Report of Foreign Bank and Financial Accounts (FBAR).

These forms are extremely complicated and time-consuming. Most people will need to hire CPAs with extensive offshore trust reporting experience to complete these requirements.

Are Offshore Trusts for Tax Savings Worth It?

For tax savings, no, offshore trusts are not worth it. In many situations, US taxpayers are actually worse off from both tax and reporting standpoints when they establish offshore trusts.

More Tax Strategies for High Earners

With that said, plenty of outstanding tax savings strategies do exist for high earners. And, we’d love to help! At Shared Economy Tax, we live and breathe tax savings for wealthy individuals, so contact us to set up a tax planning strategy session.