Filing taxes can be a headache for any small business. But, corporations, in particular, face a unique set of challenges. Sole proprietors file a Schedule C with their personal tax returns. Businesses organized as a corporation must file a completely separate, corporate tax return – a far more complicated task. We want to make sure you file this return correctly and on time. As such, we’ll use this article to explain what you need to know about the October corporate tax deadline.

Specifically, we’ll cover the following topics:

- When is the Corporate Tax Deadline?

- What Forms Do I Need to File Corporate Taxes?

- Business Entities That Must File by the Corporate Tax Deadline

- How to File Your Corporate Tax Return

- What are the Penalties for Missing the Corporate Tax Deadline?

- Corporate Tax Filing Tips

- Get Help with Your Corporate Tax Return

When is the Corporate Tax Deadline?

Most taxpayers know about individual tax day: April 15th. But, if you haven’t filed taxes on behalf of a corporation before, you may not be familiar with the corporate tax return requirements. Fortunately, most corporations must also file their tax returns by April 15th. However, a few important exceptions exist.

To understand these corporate tax deadline exceptions, we need to first explain some definitions. The IRS breaks down corporations into two distinct types:

C Corporations

When you think of a large American company (e.g. Apple, Microsoft, Facebook, etc.), you’re likely thinking about a C Corporation. Most major companies organize as separate legal and taxable entities, and the IRS considers them C Corporations.

The IRS outlines the process of forming this business structure as follows: In forming a corporation, prospective shareholders exchange money, property, or both, for the corporation’s capital stock. Furthermore, for federal income tax purposes, a C corporation is recognized as a separate taxpaying entity. A corporation conducts business, realizes net income or loss, pays taxes, and distributes profits to shareholders.

As a result of this separate nature, C Corporations face a double tax. The IRS explains, the profit of a corporation is taxed to the corporation when earned, and then is taxed to the shareholders when distributed as dividends.Â

C Corporations must file their corporate tax returns by April 15th. But, similar to individuals, corporations can request a filing extension. C Corporations that request an extension must file their corporate tax returns by October 15th.

S Corporations

The tax code also allows for another type of corporation. Named after Subchapter S of the Internal Revenue Code, S Corporations (S Corps, for short) function as separate entities – just like C Corporations. But, S Corporations are not taxed as separate entities. Rather, according to the IRS, these corporations elect to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. Shareholders of S corporations report the flow-through of income and losses on their personal tax returns and are assessed tax at their individual income tax rates.Â

Instead of paying a corporate tax, S Corporations pass everything through to their shareholders’ individual tax returns. As a result, S Corporations must file their taxes before individual due dates. The standard S Corporation tax deadline is March 15th. This is meant to provide individual filers a month to take information from a corporate tax return and apply it to their 1040s. For the same reason, S Corporations that request an extension must file their taxes by September 15th.

What Forms Do I Need to File Corporate Taxes?

The forms you need to file for corporate taxes depend on the type of corporation.

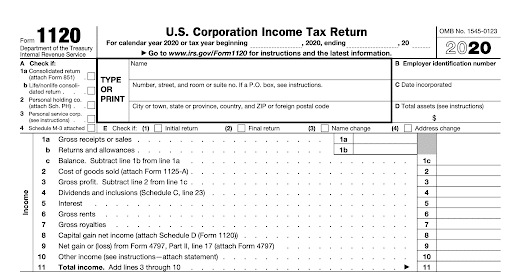

C Corporations need to file IRS Form 1120, US Corporation Income Tax Return. This form concludes with the amount of corporate income tax that must be paid. This corporate-level tax is paid by the corporation itself – not the individual shareholders.

S Corporations must file IRS Form 1120S, Income Tax Return for an S Corporation. Unlike ith Form 1120, the S Corp form does not include a corporate-level income tax. Rather, this form includes a Schedule K-1. And, the S Corporation files a copy of this schedule with the IRS to report your share of the corporation’s income, deductions, credits, etc. In that way, the taxable results of the S Corporation get passed through to shareholders’ individual tax returns.

Business Entities That Must File by the Corporate Tax Deadline

All businesses organized as a C Corporations must file by the corporate tax deadline, with one exception. A C Corporation can elect S Corporation tax treatment. If it does so, it must follow the S Corp deadlines. To make this S Corp election, a corporation must meet the following requirements:

- Be a domestic corporation

- Have only allowable shareholders

- May be individuals, certain trusts, and estates and

- May not be partnerships, corporations, or non-resident alien shareholders

- Have no more than 100 shareholders

- Have only one class of stock

Additionally, certain other legal entities can elect S Corporation tax treatment. In particular, LLCs and eligible domestic (American) partnerships can elect this status.

How to File Your Corporate Tax Return

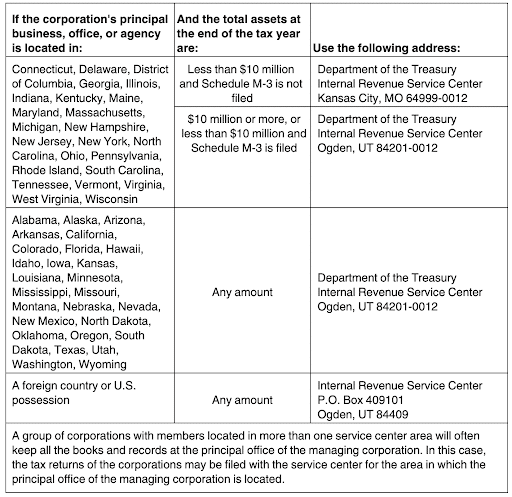

After you or a tax professional prepares your corporate tax return, you have two options for filling it. If you want to mail in a hard copy of the return to the IRS, you must adhere to the guidelines in this table:

Alternatively, eligible corporations can file their corporate tax returns via the IRS e-file program. This option minimizes the likelihood of delays, as it provides near-instantaneous feedback that your form has been successfully filed.

What are the Penalties for Missing the Corporate Tax Deadline?

If you miss a corporate tax deadline, the IRS will assess a failure-to-file penalty. For C Corporations, this penalty equals 5% of any unpaid tax for every month the return is late – up to a maximum of 25%.

Due to its pass-through nature, S Corporations have a different failure-to-file penalty. According to the IRS, the penalty is $195 for each person who was a partner or shareholder at any time during the year, for each month or part of a month following the return due date that the information remains missing, for up to 12 months.Â

Corporate Tax Filing Tips

Stay organized! As with your individual tax returns, the most important tip for successfully filing your corporate tax return is to stay organized. This means closely tracking the above filing deadlines, maintaining a thorough accounting system, and storing all documentation necessary for preparing your return.

Get Help with Your Corporate Tax Return

Unfortunately, though, even the most organized individuals can be overwhelmed with the corporate tax filing process. That’s why we’re here to help! At Shared Economy Tax, we live and breathe corporate tax returns, so contact us to set up a tax planning session today.