Are you new to the world of NFTs? If so, you may wonder about the tax implications of owning and using these digital assets. This blog post will overview how NFT taxes work, including some common tax scenarios. By understanding the basics of NFT taxation, you can better prepare for filing your taxes this year.

What is an NFT?

One of the most important aspects of blockchains is that they provide a way to store and transfer data securely. This data can be anything from financial transactions to digital art. However, one type of data is particularly well suited for blockchain technology: non-fungible tokens or NFTs.

NFTs are unique digital assets that another identical asset cannot replace. This makes them very well suited for activities such as digital art, where provenance and authenticity are important. You can also use NFTs for things like gaming items, which can be traded or sold on secondary markets. Because you store NFTs on the blockchain, they are very secure and impossible to tamper with.

There are a few different ways to create NFTs, but the most common method is to use the ERC-721 standard. This standard provides a way to create NFTs that are compatible with the Ethereum blockchain.

After its creation, you can buy, sell or trade an NFT just like any other cryptocurrency. So far, the use of NFTs has been largely in niche applications. However, as the technology matures, we will likely see more and more uses for NFTs in the future.

NFT Tax Challenges for Investors

There are several tax challenges for NFT investors.

Any time a new technology comes into play, investors move into uncharted waters. Unfortunately, in this case, the tax laws have not caught up with NFTs. As a result, the rules surrounding NFT investments are changing, including new reporting requirements for exchanges and tax treatment of various transactions.

Additionally, state laws do not necessarily align with federal regulations. Over time, there will likely be convergence between state and federal laws, but it takes time for legislatures to vote on new laws.

Ultimately, the taxpayer is responsible for compliance with tax laws and cannot outsource that responsibility to tax preparers or exchanges. Therefore, taxpayers invested in NFTs must monitor all law changes to remain compliant.

Taxes for NFT and Crypto Creators

Purchasing an NFT is only a taxable event if you buy the NFT using cryptocurrency. In this case, the use of crypto for the purchase would be considered a sale of the crypto, and you would be subject to capital gains tax on any gain you realize from the sale.

For investors, the sale of an NFT would trigger a capital gain or loss depending on whether the sale is for more or less than the purchase price. For example, if you hold the NFT for less than a year, then the sales would result in a short-term capital gain or loss. However, if you hold the NFT for a year or more, then the sale would create a long-term capital gain or loss.

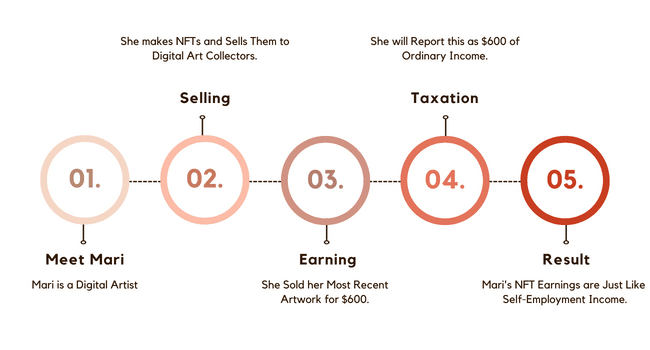

For creators of NFTs, the rules are different. The sale of a newly minted NFT creates self-employment income and would report on Schedule C for a sole proprietor or a business return if the creator has established a business. Most NFT creators operate as sole proprietors, meaning their earnings (less the associated business expenses) would be subject to income tax and self-employment taxes.

If you are considering investing in NFTs, you should hold the asset for at least a year to minimize the impact of capital gains taxes. If some of your assets have lost value, you could sell some of the NFTs with losses to offset the capital gains. Then, at the end of the year, you only pay tax on your net capital gains.

State vs Federal NFT Taxes

While NFTs are a fairly new phenomenon, the IRS already has guidance on how to treat them for tax purposes. In general, you treat NFTs like other property for federal tax purposes. This means that any gains from the sale of an NFT are subject to capital gains tax.

However, states have their own rules regarding taxes, and some have already announced how they will treat NFTs. So far, federal and state authorities seem to be taking a similar approach to the taxation of NFTs. However, this could change as the use of NFTs becomes more widespread.

State Sales Taxes on Crypto and NFTs

Washington and Pennsylvania are the only states that have addressed whether the sale of NFTs is subject to sales tax. Both states have deemed the sale of NFTs subject to sales tax. Other states will likely solidify their stance on NFT sales in the next few years.

Over 30 states have imposed sales tax on the sale of digital products, although, as noted above, only two states have specifically addressed NFTs. Therefore, if we categorize NFTs as digital products, then they are subject to sales tax. Note that crypto is considered an asset (like a stock), so the sale of crypto would not be subject to sales tax.

Property Taxes as Applied to Crypto and NFTs

As the digital economy continues to grow, there are increasing calls for crypto and NFTs to be subject to property taxes. After all, these assets have real value, and consumers can buy, sell, and trade them just like any other piece of property.

Imposing taxes on crypto and NFTs would level the playing field between digital and traditional economies.

However, there are several challenges that need addressing before property taxes fully apply to crypto and NFTs. For one thing, it is still unclear how these assets should be classified for tax purposes. Furthermore, there are concerns that taxing crypto and NFTs could stifle innovation in the digital economy. Additionally, local tax authorities currently handle property taxes. That means it is unclear which location would have a claim to the tax on digital property.

Final Thoughts on NFT Taxes

Though the IRS has issued guidance on the taxation of NFTs, many states still need to outline their treatment of NFTs for income, sales, and property tax purposes. Therefore, investors need to monitor the news and stay abreast of the changing regulatory landscape to ensure they are in compliance with applicable laws.

The NFT tax landscape is constantly changing because it’s so new, but Shared Economy Tax has answers to your most challenging tax questions regarding NFTs. Contact our tax pros for a complimentary one-on-one strategy session.