Expense tracking is important for a multitude of reasons. These records provide a clear picture of your business’s financial health. More importantly, you can use an accurate expense record to defend yourself in the event of an audit. If you’re not doing it, you should start. An expense tracking ledger an extremely valuable resource for any business owner. Take these simple steps to get started.

Calculating Annual Income

Whether you’re paid hourly, weekly, or receive a fixed salary for the year, knowing how much you’ve earned and how much tax you owe is the best way to anticipate requirements.

For those who are paid an hourly wage, estimate your weekly earnings by multiplying the amount you are paid an hour by the number of hours you are working each week.

Next, multiply the total amount by 52, which will give you your gross annual income, and then divide it by 12. This will give you your monthly average income, which is helpful for calculating quarterly income by multiplying that number by three.

If the number of hours you work each week varies, do your best to estimate the average number of hours worked on a weekly basis. You also need to include commissions and bonuses.

If you receive non-hourly income, we recommend taking an average weekly amount (average of at least 6 weeks) and multiplying that number by 4.5 to calculate average monthly earnings. To annualize that number, simply multiply your average monthly earnings by 12.

Track Deductible Expenses

IRS code says deductions should be ordinary and necessary. Ordinary means that other similar businesses are also deducting those expenses. Necessary means that the expense helps you in your business. You just need to make sure to record these four critical things: date, vendor, amount, and business purpose.

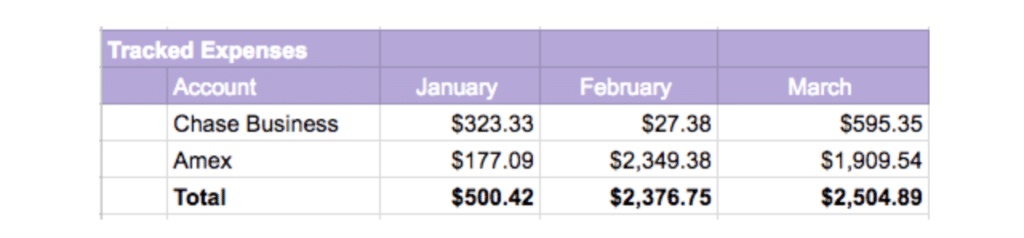

One of the most basic ways to track your expenses is by doing it through a monthly spreadsheet in Excel or Google Sheets. This includes small, minor purchases such as a cup of coffee, water, and things like batteries or other minor supplies. You should record every expense on your tracker. This example shows you how to track your expenses. Click here to see a longer list of deductions for sharing economy 1099 workers.

Expense Tracking Sample Entry

If you have credit cards you should also be making a separate spreadsheet for said purchases. Make one sheet to track cash or debit card purchases and another for credit card buys. You can create a separate tab on the same spreadsheet but be sure to track them separately. Combine both totals in the summary section of the expenses tab.

So far we have talked about direct expenses. You should also be including indirect expenses, like rent and utilities. If you have a home-based business, you can write off a portion of these expenses. The same goes for vehicles, in certain cases. There’s no set percentage rate for calculating these allocations. However, the rate is generally based on an allocation factor. See our home office guide for more details. Basically, you apply the percentage to your indirect expense totals to calculate the business portion for deductions. Track these totals accurately because the IRS is paying attention.

For vehicles, track every business-mile you drive. Airbnb and Turo hosts should also track the days that they rent their property. If you work from home, measure the square footage of your office so you know what’s deductible. If you’re unsure about what’s deductible, talk to a tax professional to make sure your expenses qualify.

Expenses for Sharing Economy Businesses

Rideshare Business Expenses

For a rideshare business, you have the option to take a deduction for the business use of your car via the actual expenses method or the standard mileage deduction. If you opt to use the actual expenses method, make sure to save your receipts and create detailed logs with the costs of gasoline, oil, repairs and maintenance, insurance, auto loan interest, and lease payments. For the standard mileage deduction, you will need to keep track of the number of miles that you drove for business with mileage logs. If you use your vehicle for both personal and business use, keep in mind that you are only permitted to report the expenses related to driving for business.

Homeshare Business Expenses

For Airbnb hosts, there are many expenses that you should keep track of. These expenses include mortgage interest, property tax, insurance, operating expenses, cleaning fees, maintenance, and repairs. You can also deduct the guest-service or host-service fees that are charged by the homeshare company. Make sure that you keep records regarding the rental days and the days that you personally used the property so that you can properly separate your personal and business expenses.

Safeguard Your Expense Records

It is important to keep your expense documents because they support the entries in your books and on your tax return. In the event of an IRS audit, the IRS will want to see the documents that show the amount paid with a description that shows the amount was for a business expense.

Documents for expenses that you should retain include the following:

- Canceled checks or other documents that identify payee, amount, and proof of payment/ETF

- Cash register tapes

- Account statements

- Credit card receipts and statements

- Invoices Petty cash slips for small cash payments

Even if you’re never audited by the IRS, you need to have a receipt to claim a deduction. If you do not have the correct documentation in place, you will need to contact the appropriate financial institutions to help you reconstruct your expense records by sending you copies of checks, statements, and receipts. In the event of a natural disaster, the IRS may grant a reprieve. However, it is still your responsibility to obtain the proper records.

Save Your Expense Records

Generally, you must keep your records that support an item on your tax return until the period of limitations for that tax return runs out. The IRS outlines the specific guidelines for income tax returns here. In most cases, you are required to keep records for a minimum of 3-7 years.

To ensure that you have the documents that you need, saving your records electronically on your smartphone, computer or in the cloud is a good option. Scan or take high-quality photos of paper documents. Update and check your records regularly for accuracy. By taking the necessary steps to secure your records, you can make sure that you take all of the deductions that you are entitled to and that you will have the information available to back up your claims if the IRS launches an inquiry into your tax filings.

Expense Tracking Spreadsheets

Tailor the spreadsheet to track your expenses on a monthly basis. It should also track by month, quarter, and year. Generally, you should save about 30% of your net income.

You don’t have to make one yourself. There are plenty of free templates floating around the internet. This Google Sheets expense tracker is a great example.

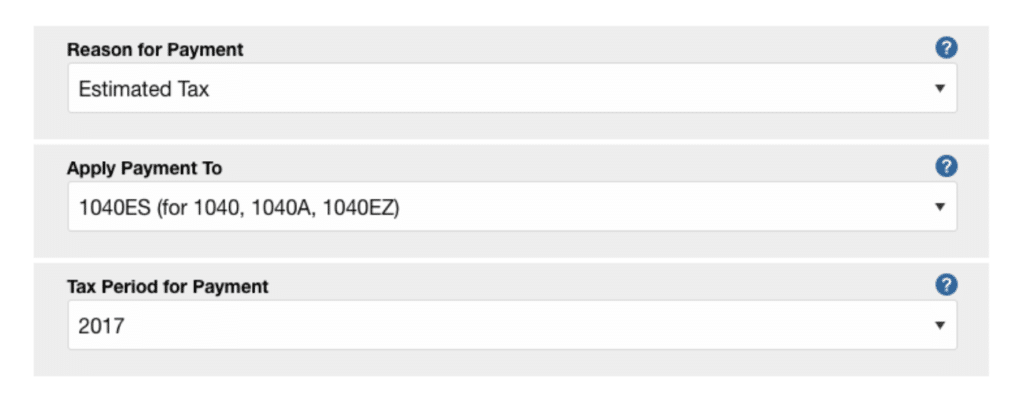

Paying your Estimated Quarterly Taxes

Penalties for Late and Unpaid Payments

You could face penalties for underpayment or late payment.

The IRS assesses penalties when you file your annual tax return. To avoid costly fines, pay at least 90% of your tax liability.

Why Track Expenses?

Tracking your expenses is one of the most important aspects of running a business as a freelancer. Freelancer income comes from multiple sources, and there are also a lot of business expenses to track. If you want to stay on top of your business, you need to stay organized.

How to Track Expenses: The Right Way

1. Track sales and 1099’s separately.

The first step to tracking your expenses is to make sure that you have a clear picture of your income. We recommend that you track your sales and 1099’s separately. It will help you catch discrepancies between 1099 totals and actual payments. Ultimately, the IRS will rely on 1099, so take it up with the client if you see any differences.

Secondly, you should never rely on 1099’s for tracking and reporting your income. Always report your sales and reconcile them with your bank account. It will give you have an accurate picture of your earnings. Accurate tracking allows you to easily track your business’s financial performance throughout the year.

2. Set up a separate bank account for your business.

You need a business bank account so you can separate business expenses from personal expenses. In fact, the IRS may actually disallow deductions that you want to take by considering them personal expenses. That is because you are generally not permitted to deduct personal, living or family expenses. Avoid problems by using a separate business bank account for business purchases.

You should also set up a business entity for legal liability reasons. Organizing your business as an LLC or corporation allows you to protect your personal assets from legal action. If someone sues your business, they can’t go after your personal assets.

3. Scan receipts for all purchases over $50.

When it comes to keeping tracking of the receipts and invoices from your business expenses, it’s a good rule of thumb to scan receipts for purchases over $50. While the IRS doesn’t usually require proof of small purchases, in the event of an audit, you’ll need to have receipts for larger purchases that you’ve claimed as a part of a deduction.

4. Issue 1099’s to contractors you hire and pay more than $600.

If you hire and pay contractors more than $600 in a single calendar year, you’ll need to issue 1099’s to each one. Make sure that these are issued to each contractor by Jan 31st of the following year. The deadline for filing electronically with the IRS is also January 31st.

5. Review your bookkeeping with your accountant before the end of the year.

To help you get organized for tax time, review your bookkeeping with your accountant before the year ends. Don’t wait until you have to file in order to go over your business records. By discussing your financial records in advance, you can ensure that you’ve tracked everything accurately so that your accountant can easily prepare your taxes when the time comes.

6. Calculate your tax liability before the end of the year.

Finally, it’s also important that you calculate your tax liability before the end of the year. This will help you determine if you should spend more in business expenses in order to increase your deductions for the year. This may help you save more money at tax time in comparison to just paying the tax.

Maximize Your Deductions

Make sure you get the most money back that you can by running down your expenses with a certified tax advisor. Shared Economy Tax specializes in small to mid-sized businesses, so they know all the tricks to help you maximize your deductions. Get started today with a free one-on-one consultation with a certified tax professional, or sign up for our free newsletter using the form below.