When you make a profitable investment, whether it’s in real estate, stocks, or other assets, one of the most important tax questions you might face is how to handle the capital gains when you sell. While capital gains taxes are an inevitable part of successful investing, there are strategies available to defer or minimize the taxes owed. In this post we explore some of the most effective strategies, including capital gains rollover, 1031 exchanges, and more.

What Are Capital Gains?

Capital gains are the profits you make from selling an asset for more than its purchase price. These gains can be realized from various assets, such as:

- Stocks: Market shares or privately held business equity.

- Bonds: Investments that can be sold in the open market.

- Real Estate: The sale of personal or investment properties.

- Precious Metals: Gold, silver, and other metals whose value appreciates over time.

- Crypto currencies: from Bitcoin to NFT’s, the IRS has a close eye on these types of assets and makes you disclose whether you purchased or sole them on your tax return.

- Collectibles: Coin or stamp collections, art, or other valuable items.

If the sale price of an asset exceeds its original purchase price, it generates a capital gain, which is taxable unless deferred under specific circumstances.

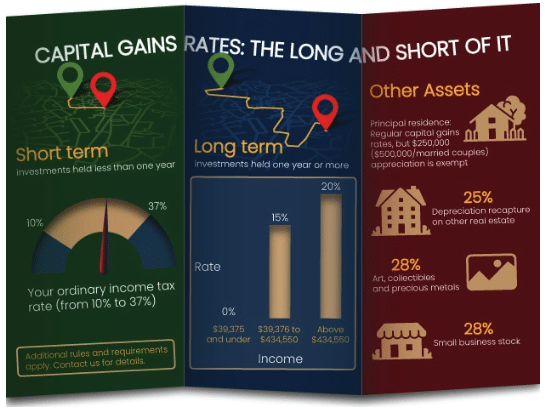

Long-Term vs. Short-Term Capital Gains

The IRS distinguishes between long-term and short-term capital gains, which are taxed at different rates. This is a critical component to the math. Often, there are huge savings for holding at least for 12 months.

- Long-Term Capital Gains: These gains are from assets held for more than one year and are taxed at favorable rates—0%, 15%, or 20%, depending on your overall income.

- Short-Term Capital Gains: These gains are from assets held for one year or less and are taxed at ordinary income tax rates, which can be as high as 37%.

From https://udcpas.com/2019/12/09/infographic-capital-gains-tax-can-take-a-bite-out-of-your-investments/

Key Components

To understand capital gains you also need to understand the below key terms:

- Basis: this is the tax term for what the asset cost you and will be subtracted from the sale price to determine gain.

- Sales Proceeds: this is essentially the total purchase price before any adjustments

- Date Acquired or Placed in Service: for stock, ownership begins upon acquisition; for rental properties, this begins on the first date it is available for rental (placed in service date)

- Cost of Sale: this is a critical part of reducing capital gains and includes attorney fees, closing costs, and any other costs associated with the sale.

How to Defer Capital Gains Taxes

Deferring capital gains taxes means delaying either the payment of taxes or the actual sale until a later date, allowing your investment to continue growing. There are a few primary methods to achieve this:

1031 Exchange: Deferring Taxes on Real Estate Investments

A 1031 exchange allows you to defer paying capital gains taxes on investment properties by reinvesting the proceeds from the sale into another “like-kind” property. Like-kind means its the same type of property. A commercial building sale needs to have a commercial building purchase. This is a highly effective strategy for real estate investors who want to preserve their capital gains without paying taxes in the year of the sale.

For 2025, the rules around 1031 exchanges remain largely the same as previous years. The key points are:

- Like-Kind Property: As previously discussed, you must exchange your property for one of the same type, such as one piece of rental property for another rental property. This doesn’t extend to personal property like primary residences, vehicles, or collectibles.

- Timeline: You must identify a replacement property within 45 days of the sale and complete the purchase within 180 days.

- Qualified Intermediary: You must work with a qualified intermediary to hold the proceeds from the sale to avoid triggering immediate tax liability. You cannot DIY this as qualified intermediaries handle escrow and compliance requirements to get 1031 treatment.

While this exchange defers taxes, it doesn’t eliminate them. When you eventually sell the replacement property, you’ll pay taxes unless you do another 1031 exchange. Therefore, a 1031 exchange is a tax deferral strategy, not a permanent tax avoidance strategy.

Pro tip: if you have a trust that transfers to your beneficiaries, 1031-ing is a dominant strategy. You avoid the capital gains taxes AND your beneficiaries receive a step up in basis upon transfer, meaning they can sell the property and only pay on the difference of the sale price and the market value at time of transfer.

Opportunity Zone Investments

In 2017, the Tax Cuts and Jobs Act introduced Opportunity Zones to incentivize investments in economically distressed communities. By reinvesting capital gains into a Qualified Opportunity Fund (QOF), you can defer taxes on the original gains until December 31, 2026. Moreover, if the investment is held for at least 10 years, any gains from the Opportunity Zone investment itself may be exempt from taxes.

To invest in Opportunity Zones:

- The investment must be made through a QOF, which is a fund that invests in properties or businesses in designated Opportunity Zones.

- You must reinvest the capital gains into a QOF within 180 days of the sale of your asset.

- The investment in the QOF must be held for at least 10 years for the gains to be permanently excluded from taxes.

While Opportunity Zone investments provide strong tax incentives, there are risks involved due to the limited availability of desirable properties or businesses in some zones.

Section 1202 Exclusions: Small Business Stock

Section 1202 of the Internal Revenue Code provides a tax exclusion for gains from the sale of stock in a qualified small business (QSB). The exclusion allows you to potentially exclude 100% of the gain from federal taxes, provided you meet certain requirements. This is a common strategy for startups and small businesses, not for real estate.

To qualify for the Section 1202 exclusion:

- The stock must be held for at least five years.

- The company issuing the stock must be a C corporation with gross assets of $50 million or less.

- The company cannot be engaged in certain prohibited industries, such as law or accounting.

For stocks purchased after September 27, 2010, the exclusion is 100%, but only for federal taxes (states may still tax the gains). This can be a great strategy for investors in small businesses that meet the IRS requirements.

Additional Strategies for Deferring Capital Gains

In addition to 1031 exchanges, Opportunity Zones, and Section 1202 exclusions, there are other strategies to consider:

Installment Sales

An installment sale allows you to spread out the recognition of capital gains over several years, rather than recognizing the entire gain in the year of sale. This strategy can be used for selling real estate or other assets, and taxes are paid only as you receive payments. This is covered under IRS Publication 537 and you need to work with a tax expert in this field, often a tax attorney prior to sale.

This option may be beneficial if you expect to be in a lower tax bracket in future years.

Primary Residence Exclusion

For homeowners, there’s a unique exclusion available on the sale of a primary residence. Under Section 121 of the IRS Code, you can exclude up to $250,000 of capital gains ($500,000 for married couples) from the sale of your primary residence, provided you meet the following criteria:

- You’ve owned the home for at least two years during the five-year period before the sale.

- The home has been your primary residence for at least two years during that time.

This exclusion doesn’t apply to second homes or rental properties. However, if you lived in the rental property in the last three years, you can still qualify.

Final Thoughts on Capital Gains Deferral Strategies

Deferring capital gains taxes is an effective strategy to allow your investment to grow without being immediately taxed allowing higher cash on cash return on investment. While 1031 exchanges and Opportunity Zones are two of the most popular methods, there are other strategies, like Section 1202 exclusions and installment sales, that can also help minimize your tax liability.

It’s essential to work with a tax professional when considering these options, as the rules can be complex, and missing a deadline or failing to meet the qualifications can result in unwanted tax liabilities.

At Shared Economy Tax, we can help you navigate the complexities of capital gains deferral strategies. Get started now with a one-on-one strategy session and learn how these tax-saving strategies can benefit your business and help you build wealth while minimizing your tax burden.