With home sales slowing down, lenders are looking for ways to increase the number of mortgages lenders issue. One of the latest marketing ploys is a “buy now, refinance later for free” mortgage. It promises that borrowers can take advantage of lower interest rates in the future. But are these mortgages good for real estate investors or Airbnb hosts?

What is a “Buy Now Refinance Later” Mortgage?

The concept of a “buy now, refinance later” mortgage is not new. In the past, during periods of high-interest rates, lenders used these products. The promise was that high loan payments were short-term and borrowers could lower the payments in the future.

The loans mimic some of the pitfalls of mortgages with 3-, 5-, or 7-year ARMs (adjustable rate mortgages) that were popular before the housing bubble burst in 2008. During this period, lenders pushed loans with fixed rates for a short period. This meant that many borrowers were caught off guard when the rates reset. As a result, many borrowers planned to refinance once the lock period expired, but when the housing bubble burst, they needed more equity in their homes than they had to refinance.

Today’s buy now refinance later mortgages are locking in high fixed rates on 15- or 30-year mortgages while hoping to lower their payments later. Borrowers assume they can withstand high payments for a few years while waiting for interest rates to decrease.

Buy Now Refinance Later: Definition

A “buy now, refinance later” mortgage is one in which the lender agrees to a mortgage at today’s interest rate but provides the option to refinance in the future either for free or at a reduced cost. The idea is that borrowers have high payments for a short time and can take advantage of reduced rates in the future.

Several lenders are experimenting with these deals, and each has its own set of rules. Most require borrowers to wait at least six months before refinancing.

Pros and Cons

Let’s look at the pros and cons of buying a house with a “buy now, refinance later” mortgage.

Pros

Lenders entering into a “buy now, refinance later” mortgage deal may give the borrower a lower interest rate payment.

Because the mortgage includes free or reduced refinance costs, borrowers won’t need to have as much cash on hand (or any) to refinance in the future. Since refinance fees can often run 1-2% of the loan amount, this savings can be significant.

“Buy now, refinance later” mortgages allow borrowers to move with the market and take advantage of future rate decreases to lower their monthly payments.

Cons

“Buy now, refinance later” mortgage may have higher initial fees as lenders factor into the initial price the future fee waivers.

These types of mortgages may inspire borrowers to take out larger loans than they otherwise would. Why? Because if they knew they were stuck with the high-interest rate for the entire life of the loan they might not want to make the purchase.

There can also be difficulty in refinancing since the borrowers will still need to meet the criteria to take out a new loan. Also, the home will need to have enough equity to meet the lender’s loan-to-value requirements.

What Are the Tax Implications?

Mortgage interest on a primary residence is deductible for the first $750,000 of mortgage debt. For larger loans, the interest paid on any amount over $750,000 is not deductible. Rental properties and Airbnbs are not subject to this limitation.

Refinancing to a lower interest rate can reduce the deduction on your tax return and increase your taxes. Note that points paid on refinancing can not be deducted immediately. They must be amortized over the life of the loan.

What are the Greatest “Buy Now, Refinance Later” Risks?

While “buy now, refinance later” mortgages look good on paper, they offer no guarantee. Many people are hopeful that interest rates will not stay at the current level for long, but who knows if interest rates will decrease in the foreseeable future.

Depending on the timing of future interest rate decreases, a borrower may have paid off a significant portion of their loan before interest rates decrease.

There is also the risk that housing values will decrease. Then you will not be able to refinance because you need more equity in your home.

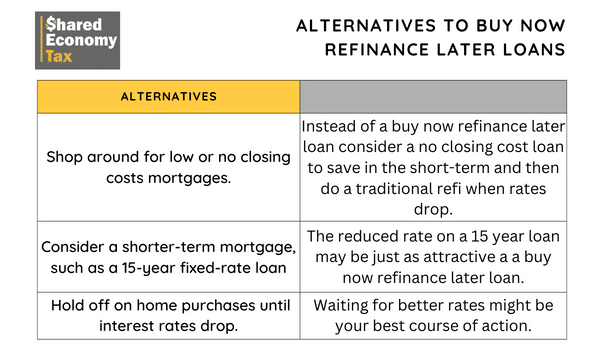

What are Some Alternatives for Borrowers Trying to Get Lower Rates?

There are several alternatives for borrowers who want to avoid the potential risks and costs associated with “buy now, refinance later” mortgages. One option is to shop around for lenders offering low or no closing costs, which can help reduce upfront costs and make the loan more affordable in the long run. Another option is to consider a shorter-term mortgage, such as a 15-year fixed-rate loan. The 15-year fixed-rate loan typically offers a lower interest rate than a 30-year fixed-rate loan.

Borrowers may also consider holding off on home purchases until interest rates drop. This ensures they can afford the home purchase.

Closing Thoughts on Buy Now Refinance Later

For real estate investors and Airbnb hosts, “buy now, refinance later” mortgages may be an excellent option. Why? These mortgages allow borrowers to acquire a property and generate income quickly. However, it’s not without risks.

For other borrowers, it may be worth considering other alternatives. Alternatives such as shopping around for low or no closing costs, improving their credit score, or delaying their home purchase may be attractive.

As interest rates continue to rise, the popularity of buy now, refinance later mortgages may decline. This is because borrowers may become more cautious about taking on additional debt. Furthermore, borrowers may also lose hope that interest rates will quickly drop down to lower levels in the near future. Overall, it’s crucial for borrowers to carefully consider their options. They should also consult with a qualified financial advisor or mortgage broker before deciding on a mortgage.

Calculating the right mortgage strategy can be a tricky task. But don’t worry – Shared Economy Tax has an in-house team of professionals to crunch the numbers, so you won’t have to! Click here for your free, personalized consultation and start uncovering if “buy now refinance later” or no closing cost loans are best suited for your needs.