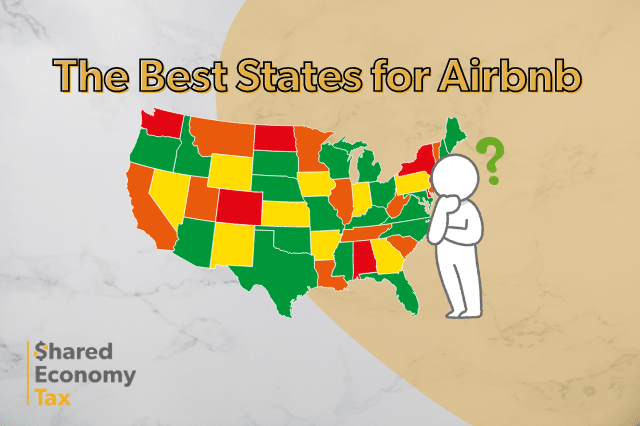

Choosing the right location to launch or expand your Airbnb business is crucial for success. Factors like short-term rental regulations, taxes, housing markets, and local occupancy rates play pivotal roles in determining profitability. In this article, we’ll explore what to consider when choosing a state for Airbnb and highlight the top three states poised for success in 2025.

What to Consider When Choosing a State for Airbnb

Here are a few key points to consider when evaluating a state for a potential Airbnb purchase.

Short-Term Rental Regulations

The legal landscape for short-term rentals varies greatly across states and even within cities. States like New York and California have strict regulations, including limits on the number of nights a property can be rented out or requirements for hosts to register their properties with local authorities. On the other hand, states like Florida have more lenient rules that encourage Airbnb investments.

However, it’s essential to be aware of any upcoming legislative efforts. Some states are contemplating new rules that could impact Airbnb hosts, such as increasing taxes or imposing stricter limits on rentals. Investors should stay informed about the current legal framework and any pending legislation before committing to a property in a specific state.

State and Local Taxes

Taxation is another key factor in determining whether a state is favorable for Airbnb investments. Many states impose additional taxes on short-term rentals, including occupancy taxes, transient lodging taxes, and local sales taxes. For example, states like Colorado and Arizona have relatively low taxes on Airbnb properties, making them more attractive to investors.

Hosts should also consider local tax implications, as some cities may have their own set of taxes on short-term rentals in addition to state taxes. Being aware of the total tax burden can help investors accurately assess their potential return on investment.

Real Estate Market

The health of the real estate market plays a major role in determining whether a state is suitable for Airbnb investment. States with booming real estate markets, such as Texas and Florida, are more likely to offer lucrative Airbnb opportunities. In these states, property values are appreciating, and rental demand is increasing, making it easier for hosts to charge competitive rates and secure bookings year-round.

Conversely, states with slower real estate markets or declining property values may not be as favorable for Airbnb investments. It’s important to analyze the real estate trends in any state you’re considering to ensure your property will appreciate in value and remain in demand.

Occupancy Rate

Occupancy rate is a critical metric for Airbnb hosts. A high occupancy rate means that properties are being rented out frequently, translating into more consistent income for hosts. When analyzing occupancy rates, it’s essential to focus on the city or town where you plan to invest rather than just the statewide rate. Cities like Miami or Austin have much higher occupancy rates than rural or less popular destinations within their states.

Consider factors like local tourism, business travel, and seasonal demand when evaluating occupancy rates. Areas with year-round tourism or business travel will typically have higher occupancy rates, making them more attractive for Airbnb investments.

The Top-3 States for Airbnb in 2025

Based on feedback from our clients, industry colleagues, and market research, these are the three best states for aspiring Airbnb hosts to consider.

Florida

Florida continues to be a top destination for Airbnb investments due to its favorable regulations, high tourism rates, and booming real estate market. With cities like Miami, Orlando, and Tampa attracting millions of visitors each year, hosts can expect high occupancy rates and strong demand.

Florida’s tax policies are also relatively friendly to short-term rental owners, and the state’s thriving tourism industry ensures consistent bookings, especially in coastal cities and near theme parks like Disney World.

Texas

Texas has emerged as a hotspot for Airbnb investors thanks to its lenient short-term rental regulations and rapidly growing real estate market. Cities like Austin, Dallas, and Houston are popular destinations for both leisure and business travelers, resulting in high occupancy rates.

In addition, Texas does not have a state income tax, which is a significant benefit for Airbnb hosts looking to maximize their profits. With a strong economy and an increasing number of tourists, Texas offers excellent growth potential for short-term rental investors.

Arizona

Arizona is another state that has become a popular choice for Airbnb investments. Cities like Phoenix and Scottsdale attract visitors year-round due to their warm weather, golf resorts, and outdoor activities. Arizona has relatively low taxes on Airbnb properties compared to other states, and the real estate market is steadily growing.

The state’s lenient short-term rental laws make it easy for hosts to get started without facing too many regulatory hurdles. As tourism continues to flourish, Arizona remains a top pick for Airbnb investors.

Rising Stars

These up-and-coming markets have become more popular for Airbnb hosts in recent years, and they’re on our radar as potential contenders for the top-3 spots.

Nevada

Nevada is rapidly becoming a favorite for Airbnb investors, thanks to its business-friendly environment and growing tourist attractions. Cities like Las Vegas and Reno draw millions of visitors each year, with many seeking short-term accommodations for events, conventions, and entertainment.

Nevada’s relatively low taxes and lenient short-term rental regulations make it an attractive option for hosts looking to maximize profits. Additionally, the state’s real estate market has remained strong, with new developments catering to tourists and short-term rental needs. As the state continues to attract both domestic and international tourists, Nevada remains an excellent choice for Airbnb investment in 2025.

Tennessee

Tennessee stands out as another strong contender for Airbnb investments in 2025. Nashville, in particular, has seen a surge in tourism, with travelers flocking for its vibrant music scene, festivals, and Southern hospitality. The state boasts relatively low taxes on short-term rentals and a welcoming regulatory environment for Airbnb hosts.

Tennessee’s real estate market is also on the rise, with increasing demand for both short-term rental properties and vacation homes. With the continued growth of Nashville and other tourist destinations like Gatlinburg and Pigeon Forge, Tennessee offers an excellent opportunity for investors seeking consistent rental income and a growing market.

Closing Thoughts on The Best States for Airbnb

Choosing the right state for your Airbnb investment is a crucial decision that can significantly impact your profitability. While states like Florida, Texas, and Arizona stand out for their favorable short-term rental regulations, low taxes, and strong real estate markets, it’s essential to conduct thorough research before making a final decision.

Stay informed about any changes to short-term rental laws, consider the state and local tax implications, and analyze occupancy rates in your chosen location. By doing so, you can set yourself up for success in the competitive short-term rental market.

Shared Economy Tax specializes in strategic tax services for Airbnb hosts and real estate investors. Our team of veteran tax pros can help grow your business by maximizing your tax savings. Get started now with a one-on-one strategy session with one of our tax pros to see how much you can save.