With the onset of the internet more and more working individuals have the opportunity to work from home. As a freelancer, you have unlimited potential to earn money and fulfill your dreams because you have the freedom, the operative word, to create your own schedule. You can work as much as you like, take your work abroad, and more. For many, the freelance lifestyle is very appealing because of the flexibility it offers while still paying the bills. However, with this flexibility comes financial responsibility, meaning paying taxes, and not everyone can afford a freelance tax expert. Especially since if you’ve only had a job before, your employer has paid your taxes on your behalf. As a freelancer, that is not the case. Even if you are just a part-time freelancer, there could be tax ramifications. Here are some tax tips from our freelance tax experts.

Help With Independent Contractor Taxes

As we mentioned above, the freelancer lifestyle draws a lot of mass appeal for individuals who want a flexible career. In addition, there are many employed workers looking to make extra income on the side. Working freelance allows then to work around their existing work schedule, and earn some extra income. Regardless of the reason, any income earned, be it full time or part-time, needs to be reported to the IRS.

With more and more individuals turning to freelance work, it is important to educate freelancers on the various tax laws that will affect them. Inaccuracies or failure to pay additional taxes on the income you earn could result in costly penalties. A freelance tax expert is the best place to get some much-needed tax advice if you are just entering the freelance world, or even if you have been there for a while. Knowledge is power, especially when it comes to the tax code.

Taxes For Freelancers and Independent Contractors

Having a good system in place for accounting is one of the number one tax tips from freelance tax experts. Keep track as you go. This allows you to stay organized, which is crucial for accounts receivable, accounts payable, and filing taxes. A systematic approach to accounting will help your business succeed. Plus, you’ll have important insights into the financial health of your business. Here are some accounting tips from freelance tax experts:

- Use the right software for your accounting. Quickbooks Online and Xero are some of the top programs in the world. Both are reliable, effective, and affordable. For those starting out, we recommend Wave Accounting a free program that also allows invoicing.

- Keep track of all expenses. Save receipts and snap pictures of receipts. File them as you go. Business expenses can often lead to business deductions.

- Be aware of deductions. When you are a freelancer or self employed, tax deductions can help reduce your taxable income, therefore reducing the amount you owe. Some common tax deductions for freelancers include home office deduction, marketing deduction, office expenses, business travel, and more.

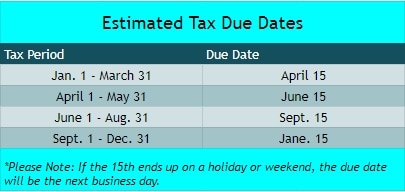

- Pay estimated taxes. As a freelancer or self-employed individual, you don’t have an employer withholding taxes, and since the IRS still wants their piece of the pie, you are responsible for remitting estimated taxes quarterly. You can calculate this based on the prior year’s tax return, payments are due: April 15, June 15, Sept. 15, and Jan 15 however, if the 15th falls on a weekend or holiday, the due date is moved to the next available business day.

- Don’t forget about self-employment taxes. These taxes make up the employee and employer portion of Social Security and Medicare taxes and they amount to about 15.3% of your income.

- Set up a tax saving account. You should already have a separate account for your business, however, setting up a tax saving account can be helpful. Set aside a certain percentage of your income for future tax payments. This makes the process of remitting taxes easier and less stressful.

- Contribute to your retirement. Making contributions to your IRS or Roth IRA not only benefits your future, but it also has tax benefits.

Remember To Pay Taxes On Income & Hiring A Pro Can Save You Time & Money

As a freelance tax expert, we always recommend working with a tax professional. It saves you a lot of time because you don’t have to research all the tax laws yourself. The tax code can be a complicated thing, and it varies from state to state and city to city. Working with a freelance tax expert is the best way to ensure all of your ducks are in a row. In addition, a freelance tax expert can help with calculating estimated taxes, and help ensure that quarterly payments are made on time.

When it comes to taxes, you don’t want to overlook any deductions, or credits that may be available to you. A freelance tax expert knows which deductions and credits are applicable to your business and can help you plan for those deductions to help you save. Get your taxes prepared and filed accurately on time by hiring a freelance tax expert. To talk to a freelance tax expert now, contact Shared Economy Tax today.

Related Articles

Airbnb, HomeAway, & VRBO Ultimate Tax Planning Guide & Checklist