When you own your own business or are self-employed, you have many more responsibilities regarding your bookkeeping and finances. It is important to keep accurate bookkeeping for your self-employment income and business expenses. This enables reliable forecasting, allows for strategic tax planning, makes preparing and filing your taxes a lot easier, and is instrumental in managing your personal finances. One challenge that many self-employed taxpayers face is proof of income, which is where a self-employment ledger comes into play. What is a self-employment ledger, you might ask? Read on to learn more.

What Is a Self-Employment Ledger?

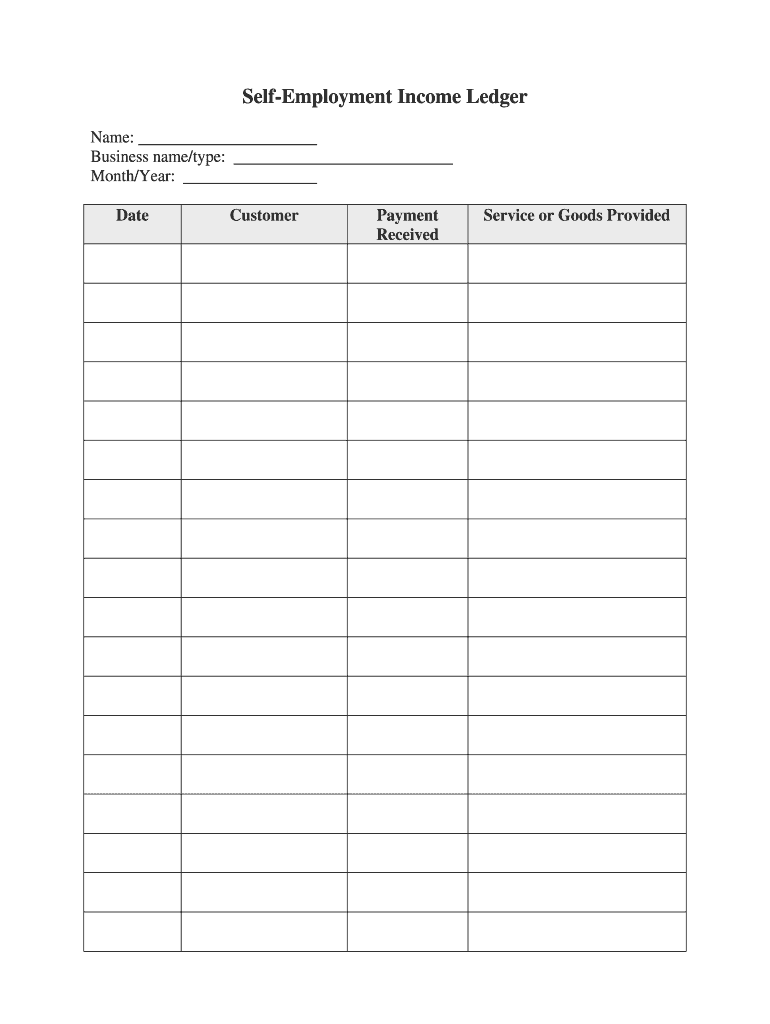

A self-employment ledger helps demonstrate self-employment income. There are a variety of reasons why you may need documented proof of self-employment income. For example, you will need to estimate your income and verify it to qualify for government healthcare subsidiaries. You can use a template to generate a self-employment ledger with accounting software. In addition, it can be a bit of a challenge for individuals who choose to work independently to prove income on a loan application. A self-employment ledger serves as a way to track and document your income. While this is not an official record like your tax return, it can corroborate your income.

How to Make a Self-Employment Ledger

When asked to support additional income verification, you may need to provide your self-employment ledger. A self-employment ledger is not complicated and essentially tracks all of your self-employment income and expenses. If you are applying for health insurance, there is no set format required. It simply needs to report your income accurately. You can use accounting software to generate a spreadsheet. You can also find a self-employment ledger template online.

Self Employment Ledger Examples

A self-employment ledger can be very straightforward. The most important thing to consider when creating a self-employment ledger is that it is accurate and up to date. It should be easy to decipher and supports your income history.

Good Self Employment Ledgers

As previously mentioned, the most important thing your ledger represents is accurate and supported records of your income. Keep in mind there isn’t just one format accepted. You can use a handwritten ledger, an excel spreadsheet, or accounting software to generate a ledger. As long as your income is accurate and clear, most institutions should accept it.

Bad Self Employment Ledgers

Inaccuracies and misrepresentations on your self-employment ledger can end up harming you in the long run. If the IRS cannot verify your income, they may deny your government healthcare subsidiaries. Banks may deny your loan application. Also, if you use your ledger for taxes, it is important to make sure you report accurate income to avoid the attention of the IRS. Inaccurate tax returns can result in an additional tax bill. In which case, you may receive tax penalties and interest charges.

When Do I Need a Self Employment Ledger?

Maintaining an updated self-employment ledger can help you better manage your finances and budget. Tracking your income is also important for forecasting and expanding your business. Banks will require you to submit proof of income when applying for a loan or securing additional capital and investors. A self-employment ledger provides potential lenders and investors with an idea of your estimated income. It is also an acceptable form of income verification for health insurance applications on the health exchange. This gives you all the more reason to stay up to date on your documentation.

Conclusion: The Self Employment Ledger

A self-employment ledger helps you track and monitor your self-employment income. As a self-employed individual, verifying your income can be more challenging since you don’t always have regular paystubs to document your income. Therefore, the burden of verifying your income falls solely on you. But you can use self-employment ledgers to verify income in a variety of scenarios. The main instance that requires self-employed individuals to verify their income is when you apply for healthcare on the health exchange. You can qualify for subsidiaries by using the self-employment ledger, which acts as sufficient documentation of your income.

Crunching numbers isn’t always the most desirable task. However, it is imperative from an accounting standpoint. It can help you plan your finances and secure the services you need to succeed. Many choose to outsource their bookkeeping and accounting tasks because they are daunting and time-consuming. Outsourcing helps ensure accurate financial records, which in turn improves accuracy in tax filing. An accounting and tax expert can help you save money on your taxes, develop a tax planning strategy, and claim all the available deductions when you file your taxes. To learn more, schedule a strategy session with one of the tax experts at Shared Economy today. For more tax tips, subscribe to our newsletter below.